April 2025 | ![]() 10 min read | Download PDF

10 min read | Download PDF

Gareth Abley, Co-head of Alternatives

Jehan Sukhla, Co-head of Alternatives

ILS series: issue 1

For investment professionals, the quest for assets capable of magnifying portfolio diversification is one of the most impactful and challenging endeavours. We have spent more than 17 years of our careers focused on identifying these investment unicorns.

A primary motivation stems from our knowledge that while equity markets are likely to deliver over the long-term, there can be prolonged periods when they do not. So, finding strategies capable of making money due to having fundamentally different return drivers can be hugely valuable to investors.

Such opportunities are rare. Many more liquid alternative strategies — such as hedge funds and alternative risk premium strategies — can suffer from misaligned incentive structures, hidden beta, and ephemeral alpha characteristics.

Conversely, private market assets, such as unlisted infrastructure and real estate, private credit and private equity, can have characteristics different from their public counterparts and so can provide potentially more attractive returns if well executed.

That said, a large part of the statistical ‘diversification benefit’ of these private assets is in practice driven by their infrequent valuation cycles relative to their public equivalents. However, if there was a global recession, rising interest rates, and lower valuation multiples, it is likely that many of these private assets would suffer alongside public assets.

One of the rare asset classes that can provide the trifecta of:

- Attractive liquidity (akin to more liquid alternatives) at ~1-year intervals

- Uncorrelated return drivers, and

- Attractive returns – particularly given current wide credit spreads

…are insurance linked securities (ILS).

Attractive time to invest

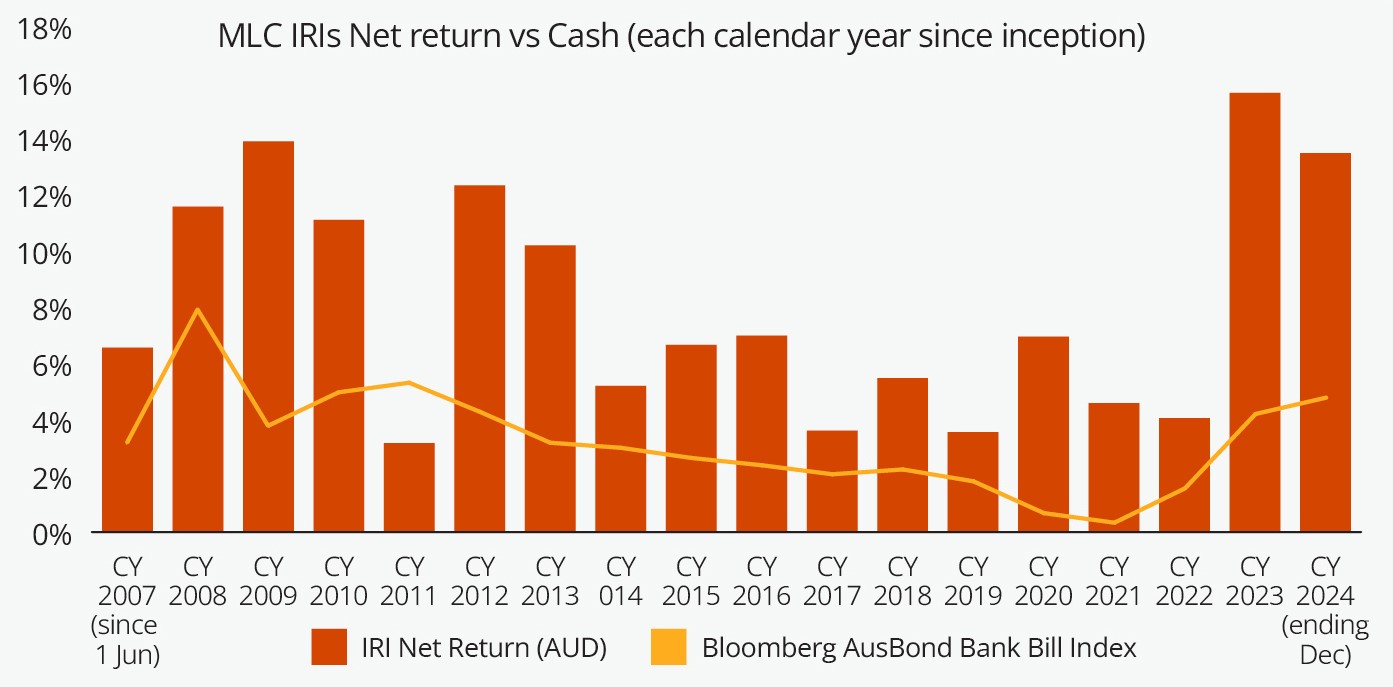

In Chart 1 we illustrate, using MLC’s proprietary portfolio, that it’s been possible to deliver very attractive and consistent returns over the last 17 years.

Chart 1: MLC Insurance Related Investments (IRIs) performance

Source: Bloomberg, MLCAM

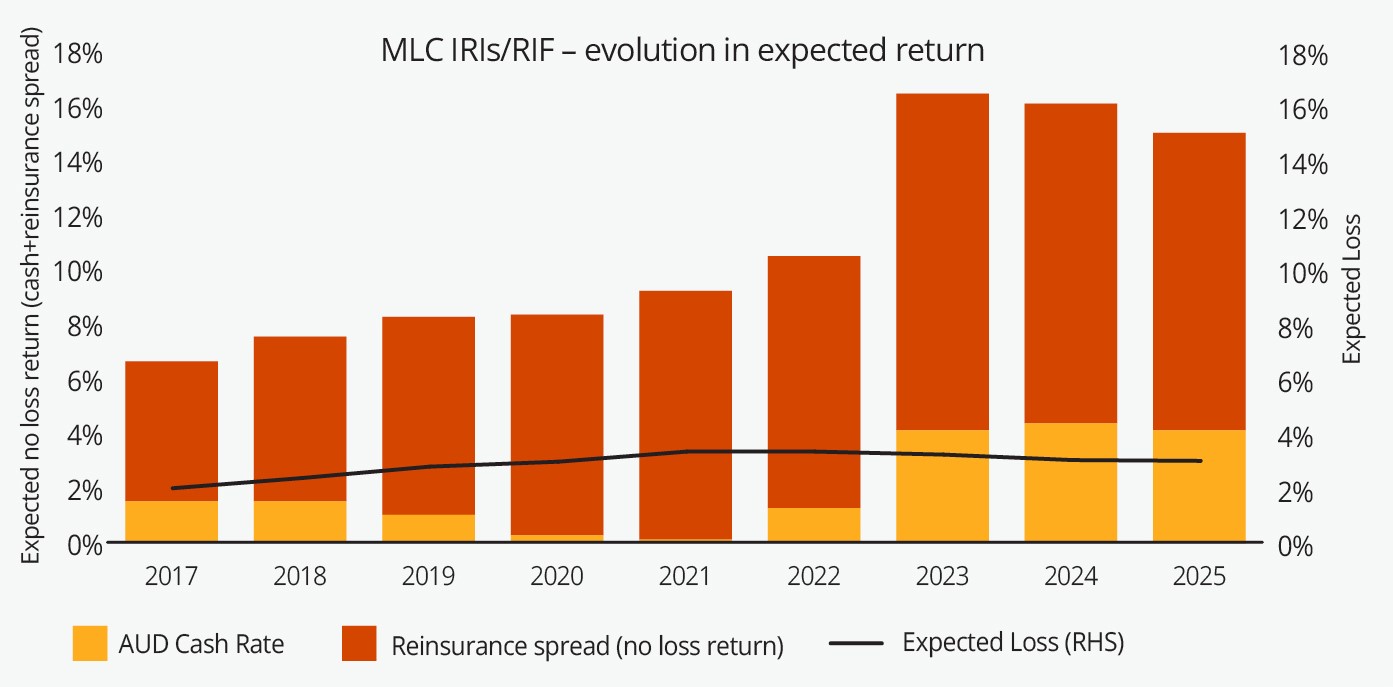

Perhaps even more importantly, Chart 2 illustrates why now is potentially an excellent time to consider an investment in the asset class.

Chart 2: MLC IRIs expected returns through time

Source: MLCAM

Chart 2 shows the expected no loss return on our proprietary portfolio at the beginning of 2025 is 15%, with the reinsurance spread above cash being more than double 2017 levels. The return net of expected losses of 3% is 12%, which we view as very attractive for a diversifying peril asset.

Diversification benefits in multi-asset portfolios

We think Insurance Linked Securities (ILS) will appeal to institutional investors seeking diversification from equity-dominated portfolios because ILS returns are driven by natural peril events, not economic cycles or monetary policy, resulting in negligible correlation with traditional assets (MLC’s ILS portfolio has had a 0.0 beta to equities since inception in 2007).

This lack of correlation makes intuitive sense on two levels.

Firstly, ILS income streams derive from insurance risks linked to natural catastrophes like US Gulf Coast hurricanes, Japanese earthquakes, and California wildfires, none of which bear any relationship with public market return patterns or economic conditions.

Secondly, there is additional diversification within the asset class i.e. a hurricane in the United States and an earthquake in Japan are unrelated.

Returns are contingent on loss avoidance, introducing a tail-risk profile distinct from conventional investments. This trade-off supports a risk premium that complements, rather than competes with equities.

Components of return

In an environment of increasing macro and geo-political uncertainty, and scope for material moves in inflation, interest rates, and therefore bond portfolios subject to duration risk – it's also worth noting that ILS are floating rate instruments.

The return — whether accessed via a public catastrophe (cat) bond or a private reinsurance contract — consists of two components.

Firstly, the collateral invested to pay potential claims is invested in cash markets (e.g. money market funds or T-Bills). Secondly, the investment also earns a coupon (in the case of cat bonds) or reinsurance premium (in the case of private reinsurance) above this cash rate.

What drives the risk-premium?

When examining any alternative asset to assess the likely persistence of returns, it’s critical to understand its drivers. Is it reliant on manager skill, like some hedge funds? Or is it a risk premium? Or a combination?

If it’s a risk premium — what drives it, what causes it to vary, and is it big enough to compensate investors for the risks?

At its core, insurance is humanity’s way of pooling risk. You pay an insurance premium so that when your roof caves in, you can survive financially. Insurers collect those premiums, manage the cash, and pay claims when disaster strikes.

They’re able to benefit from actuarially modelling the probabilities, insuring a large number of properties, and so having tolerable certainty of losses in the normal course of business.

However, large-scale catastrophes — hurricanes, earthquakes, or floods — can overwhelm insurers’ capital reserves. Insurers turn to reinsurance, essentially insurance for insurers, to spread that risk further.

Reinsurers take a cut of the premiums to absorb the big hits, ensuring insurers don’t go belly-up. Essentially, there is a logic for the homeowner and the insurer to ‘overpay’ (probabilistically speaking) for the security of insurance — which creates an attractive risk premium for reinsurers to harvest for bearing this tail risk.

One of the challenges for reinsurers is that they can end up with significant concentration risk to parts of the world that a) are densely populated, b) have expensive real estate, and c) are subject to material natural catastrophe risks. Florida (hurricanes) and California (earthquakes) are two prime examples of these ‘peak peril’ regions.

This is where ILS play an important role in sharing in these reinsurance risks — peak peril risks in particular. Through instruments like catastrophe bonds (cat bonds) or private reinsurance contracts, investors provide capital to underwrite specific perils, earning returns if predefined loss triggers are not met, or forfeiting principal if they are.

This mechanism diversifies risk-bearing beyond traditional insurance balance sheets, solving the problem of capacity constraints in an industry facing escalating exposures.

The Insurance Gap

One of the reasons the industry is important — and we believe a social good — is the ‘insurance gap’. Globally, only about 40% of economic losses from natural disasters are insured, according to Swiss Re.1 That’s the insurance gap — the chasm between what’s lost and what’s covered.

In 2024, according to Aon, total economic losses from natural disasters were US$368bn (14% above the 21st century average).2 Only US$145 billion was covered by insurance — meaning the insurance gap was US$223 billion.3

Developing nations suffer most, where penetration is often below 10%. Why?

Insurance is expensive, and insurers can’t always stomach the megaton risks of a warming world. ILS inject additional capital into the system, helping to fund coverage and act as a supportive lever to make protection more accessible.

Beyond financial returns, ILSs offer tangible societal value. When triggered, payouts fund rapid recovery — rebuilding infrastructure, supporting businesses, and stabilising communities post-disaster.

Climate change concerns leading to higher premiums

Climate change amplifies the relevance of ILS. Rising global temperatures have intensified the frequency and severity of natural catastrophes, with insured losses from weather-related events averaging US$110 billion annually since 2017.4

Some key points worth noting about climate change and ILS:

- Insurers and reinsurers are heavily incentivised to assess the latest climate science and ensure that risk is adequately priced.

- They are also motivated to encourage, partly through price signals, more robust building quality and building in more climate resilient locations.

- Reinsurance contracts are annual instruments, which means they can be repriced incrementally to reflect the changing perceptions of climate change risks.

- Certain perils e.g. earthquake being the most obvious, are not climate impacted.

- There are independent modelling firms, staffed by highly qualified climate scientists, who are integral to the industry’s assessment of the risks of natural catastrophes (of which climate change is one of many inputs).

Our view is that one of the risks, if not the most important risk in the asset class, is ‘model risk.’ This is the probabilistic assessment of the likely loss under myriad events that could occur —taking into account (for example) the tracking of hurricanes, windspeed, property values, severity of damage and the like.

While this is a hugely resourced scientific effort, incorporating sophisticated independent vendor modelling, which is then often reviewed and overlaid with various adjustments by specialist ILS managers... it is ultimately something of a ‘best estimate.’

Nobody truly knows whether the probabilistic loss estimate of a ‘1 in a 100’ year hurricane is accurate. The key, from our perspective, is to ensure a) that the work has been done in assessing the risk as best as possible, with appropriate conservatism, and b) most importantly – that there is enough of a risk premium to compensate us for the risk of the model being miscalibrated.

Key considerations for people considering ILS

We think this is an incredibly interesting asset class for a number of reasons. One of which is that many capital market investors may approach it from the lens of ‘this looks more like beta than alpha’. We’d agree with this perspective.

However, what makes this asset class different to equities is that unlike the S&P 500, for instance, there is no investible ILS index providing easy and cheap access.

There are myriad variables that can make a huge difference to performance:

- Remote vs non-remote risk: Exposure can be accessed for ‘remote’, lower probability events, or higher (no loss) returning ‘non-remote’ exposures.

- Peak vs non-peak perils: Peak perils tend to pay more per unit of risk, but non-peak perils can add diversification – and be capital efficient if accessed via non-recourse leverage.

- Public vs private instruments: Cat bonds are publicly traded, liquid and now represent a US$50 billion market,5 whereas the private reinsurance market is much larger and includes quota shares (non-recourse leveraged exposure to a reinsurer’s balance sheet) as well as collateralised reinsurance.

- Reinsurance vs retrocession: Retrocession is reinsurance of a reinsurer (compared with reinsurance of an insurer) and can pay a higher return as compensation for the greater risk and opacity.

- Per occurrence vs aggregate contracts: Per occurrence contracts can trigger losses if a single event incurs losses above the attachment point. Aggregate contracts are triggered if cumulative losses from multiple events (or a large enough single event) compound above the attachment point.

- Cedant quality and diversification: Which insurance counterparties (cedants) and how many are in the portfolio will also be very influential.

- Alignment: With the ILS manager and the underlying reinsurers and insurers.

What this all means is that the way you design your exposure makes a huge difference to returns.

Another distinctive characteristic of the asset class is that risk is driven by infrequent and unpredictable catastrophe events.

This means that a reinsurer or ILS manager may be skilled in choosing to write a particular risk or counterparty, but if they happen to do so in the year when that low probability event hits that contract... their performance will be hit i.e. they will have been ‘wrong for the right reasons.’ In other words, while skill matters, luck can dominate skill in this asset class.

If you pull all of this together, it’s easy to understand that even though many investors are after the attractive asset class ‘beta,’ manager dispersion has been very material, and implementation choices matter a lot. That's why we emphasise a multi-manager approach to the asset class that appropriately calibrates these portfolio design choices.

Looking ahead: optimising ILS exposure

ILS present a compelling case for institutional portfolios — low correlation, attractive risk-adjusted returns, and positive societal impact. Yet, to capture these returns reliably is not simple and requires a deep understanding of the underlying nuances.

MLC has had 17 years of consecutive positive returns in the asset class, and in our next article we’ll share our thoughts on what we think some of the key issues are.

1 sigma 01/2024: Natural catastrophes in 2023, https://www.swissre.com/institute/research/sigma-research/sigma-2024-01.html

2 Climate risk cover key to economic resilience – report, 23 January 2025, https://www.cirmagazine.com/cir/c2025012303.php

3 Ibid

4 Natural disasters in 2024. Munich Re NatCatSERVICE, https://www.munichre.com/content/dam/munichre/mrwebsitespressreleases/MunichRe-NatCAT-Stats2024-Full-Year-Factsheet.pdf/_jcr_content/renditions/original./MunichRe-NatCAT-Stats2024-Full-Year-Factsheet.pdf

5 Record cat bond issuance of $17.7bn in 2024 takes outstanding market near $50bn: Report, Steve Evans, 2 January 2025, https://www.artemis.bm/news/record-cat-bond-issuance-of-17-7bn-in-2024-takes-outstanding-market-near-50bn-report/#:~:text=As%20our%20report%20also%20details,from%20the%20end%20of%202023

Important information

This communication is issued by MLC Investments Limited ABN 30 002 641 661 AFSL 230705 (MLCI), in its capacity as responsible entity and trustee of the various funds issued by it. It is intended for financial advisers and wholesale clients only, and must not be distributed to ‘retail clients’ as defined in the Corporations Act 2001 (Cth). MLCI is part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information and commentary provided in this communication is of a general nature only and does not relate to any specific fund or product issued by an Insignia Financial Group entity. The information does not take into account any particular investor’s personal circumstances and reliance should not be placed by anyone on the information in this communication as the basis for making any investment decision. Before acting on the information, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available from the applicable Insignia Financial Group website or by calling us, before deciding to acquire or hold an interest in a financial product issued by an entity within the Insignia Financial Group.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Actual returns may vary from any target return described and there is a risk that the investment may achieve lower than expected returns.

No company in the Insignia Financial Group guarantees the repayment of capital or the performance of an investment, unless expressly stated in a PDS. Any investment is subject to investment risk, including possibly delays in repayment and loss of income and principal invested.

Any opinions expressed constitute our judgement at the time of issue and are subject to change without notice. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability or in respect of other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This communication is directed to and prepared for Australian residents only.