January 2026 | ![]() 21 min read

21 min read

David Chan, Portfolio Manager – MLC Private Equity

Alicia Chen, Assistant Portfolio Manager – MLC Private Equity

As can be surmised from this note’s title, we are unabashedly pro private equity

co-investments. Before digging into why co-investments are the jewel in the private equity (PE) crown, as we claim, a little background on their emergence and trends are in order.

Co-investments really came to light in the wake of the Global Financial Crisis as private equity managers/General Partners (GPs) found it difficult to raise capital for private equity (PE) funds from investors spooked by the events of the time.1

Their solution was to turn to co-investments by inviting especially trusted clients/Limited Partners (LPs) to invest with them directly into individual companies, rather than indirectly into companies via traditional PE funds.2

The chance to invest directly in hand-picked deals and companies, differs from traditional private equity (PE) funds where investors commit capital without knowing, beforehand, the identity of companies that will be acquired.

For LPs, co-investments represent a more targeted allocation of their capital enabling them to have direct access to privately held companies on which they can gain deeper insights than when investing through funds.

Moreover, co-investments enable LPs to gain a better understanding of a GP’s sourcing capability and operational skill, thereby providing valuable intelligence for the future relationship between the parties.

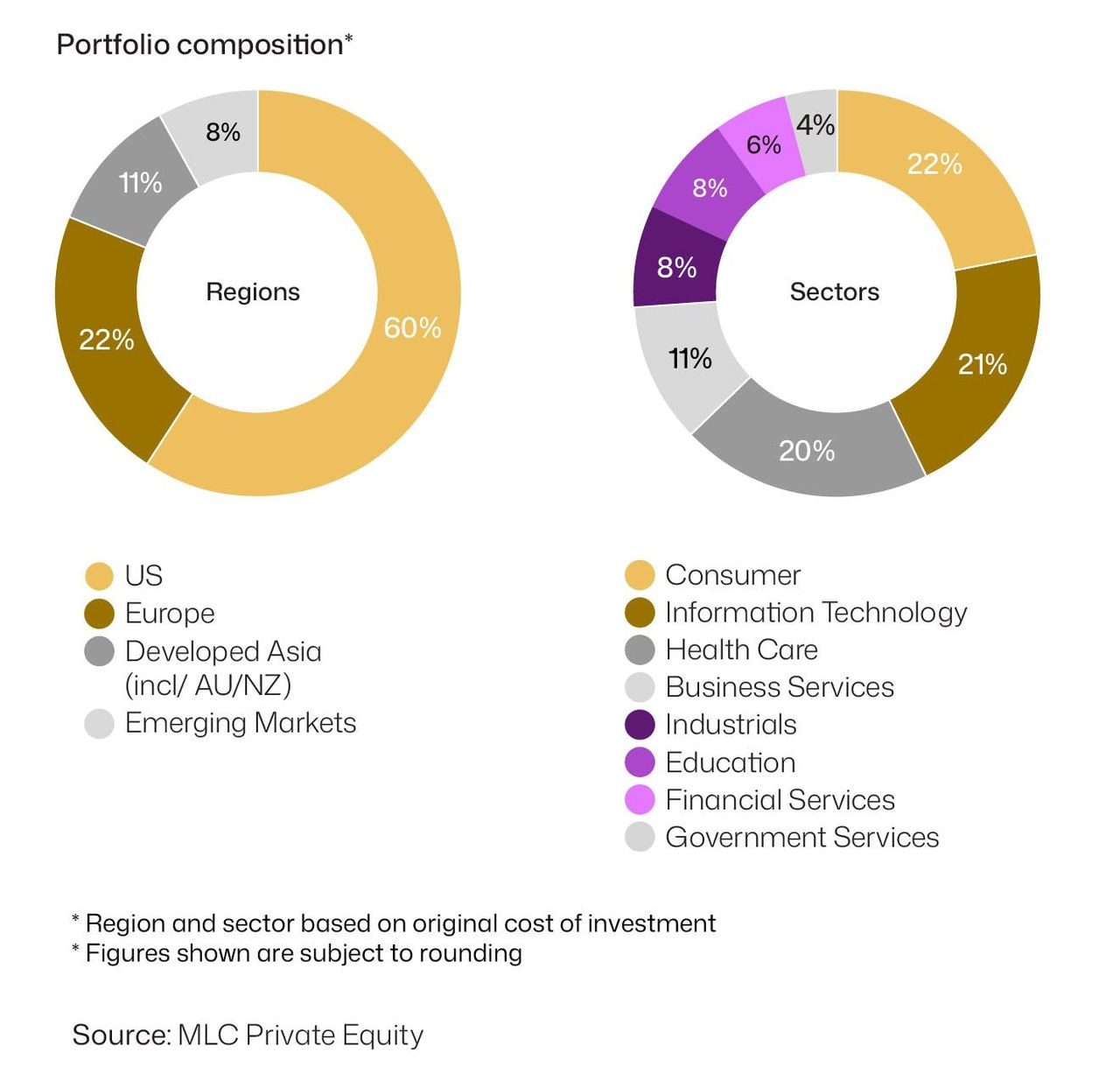

Diversification is a feature of strong co-investment programs with investee companies spanning multiple GPs, countries, industries, and vintages.

For GPs, co-investing offers a way of investing in attractive businesses which may be too large for their private equity fund to invest in wholly due to single firm concentration limits. It also allows them to work closely with LPs and build relationships ahead of future fundraisings.

Recent co-investment trends

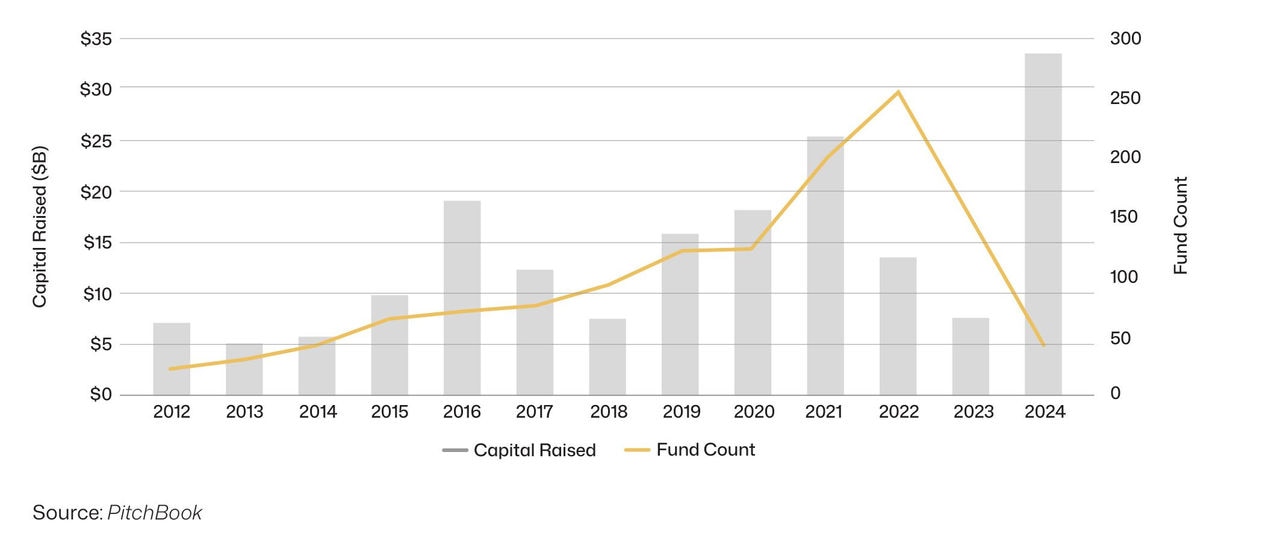

Until 2022, capital raised for co-investments was on an upward but uneven trajectory. This trend was interrupted by the lingering effects of COVID-related disruptions, followed by macroeconomic headwinds — most notably the inflation surge over 2022–2023 and subsequent central bank interest rate hikes (Chart 1).

Chart 1: Until 2022, capital raised for co-investments was on an upward but uneven trajectory

Global capital raised across co-investments (US$ billions)

Source: Pitchbook

2024 saw a big uplift in fund raising as capital for co-investments hit a record US$33.2 billion, even as the number of deals fell sharply to just 40, the lowest since 2013.3 This appears to stem from mega PE funds becoming so large that they found it more difficult to offer co-investments to their LPs.4

That said, in the mid-market space, which is the focus of our PE fund as well as co-investment program, co-investments continued “to be a critical and assumed market norm”.5

We believe co-investments will continue to be central to how PE capital is deployed, relationships are enriched, and investment value is created.

There’s certainly ample room for co-investment expansion with an estimate revealing that nearly two-thirds of LPs have no co-investment exposure and this way of participating in PE has the highest proportion of LP under-allocation.6

Finally, with expectations of greater pent-up transaction activity expected to hit the market, and as liquidity strengthens and mergers and acquisitions activity picks ups, we think co-investment participation will rise too, creating the opportunity for investors to deploy more capital to this part of the PE realm.7

Lower fees, higher potential returns for investors

In our view, fee structures linked to co-investments offer an additional incentive for investors to explore this approach to private equity.

Co-investments often come without management fees or carried interest (fees on profits), which helps minimise overall costs and can improve net returns — provided underlying investments perform as expected.8 This cost efficiency can translate into stronger risk-adjusted outcomes for the asset class and gives investors a practical way to enhance the overall performance of their private equity allocations.9

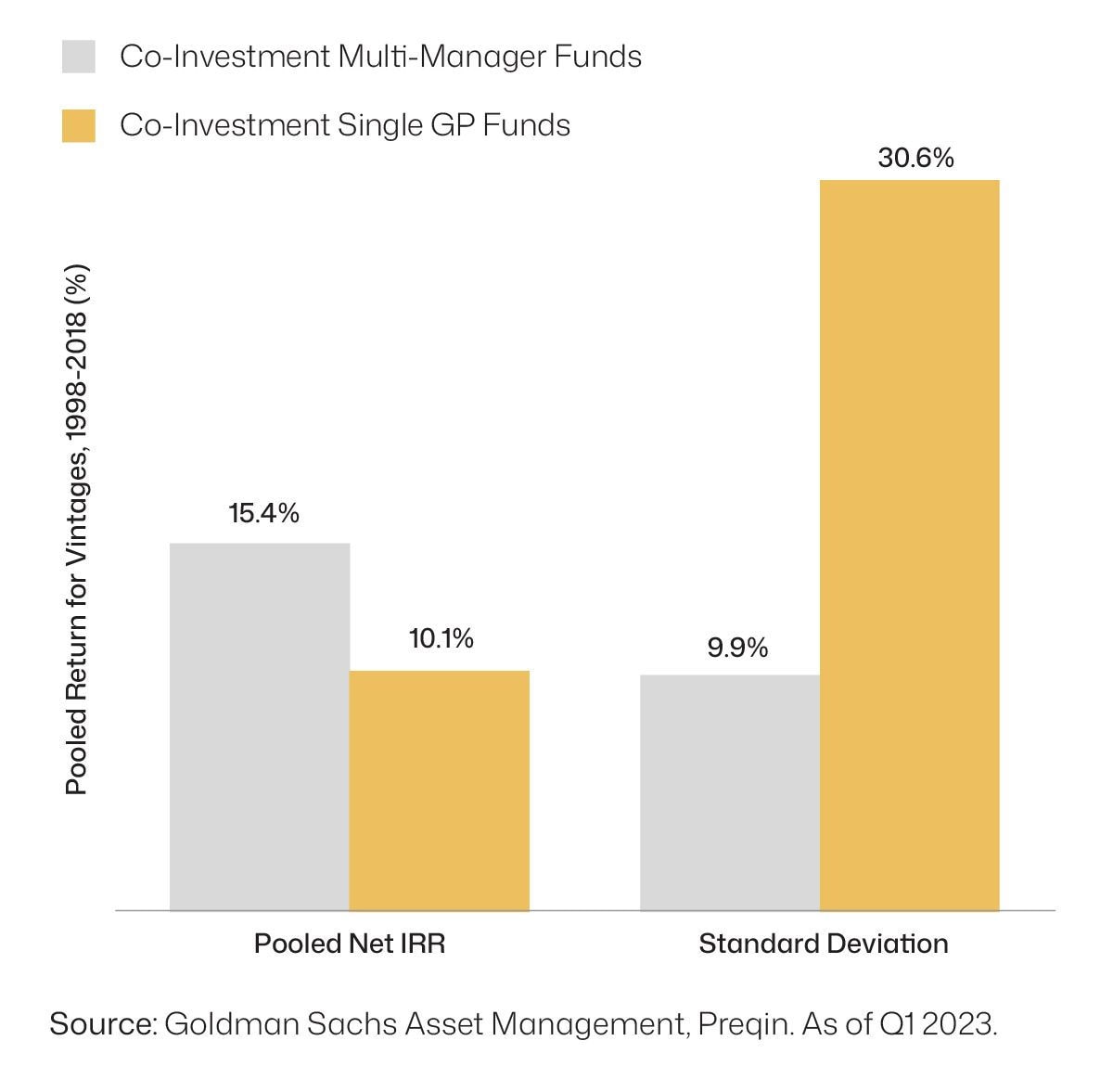

Research indicates that multi-manager co-investment funds tend to outperform traditional private equity funds thanks to diversification.10

Unlike single-GP co-investment funds, which are concentrated around one manager’s deals, multi-manager funds can select opportunities from a broad range of general partners. We think this approach helps spread exposure across different geographies, sectors, and company sizes, reducing concentration risk and enhancing portfolio resilience.11

On this basis, multi-manager co-investment funds, in aggregate, have generated superior returns with significantly less variance than single-GP co-investment funds (Chart 2).

Chart 2: Multi-manager co-investment funds have generated superior performance to single GP co-investment funds...

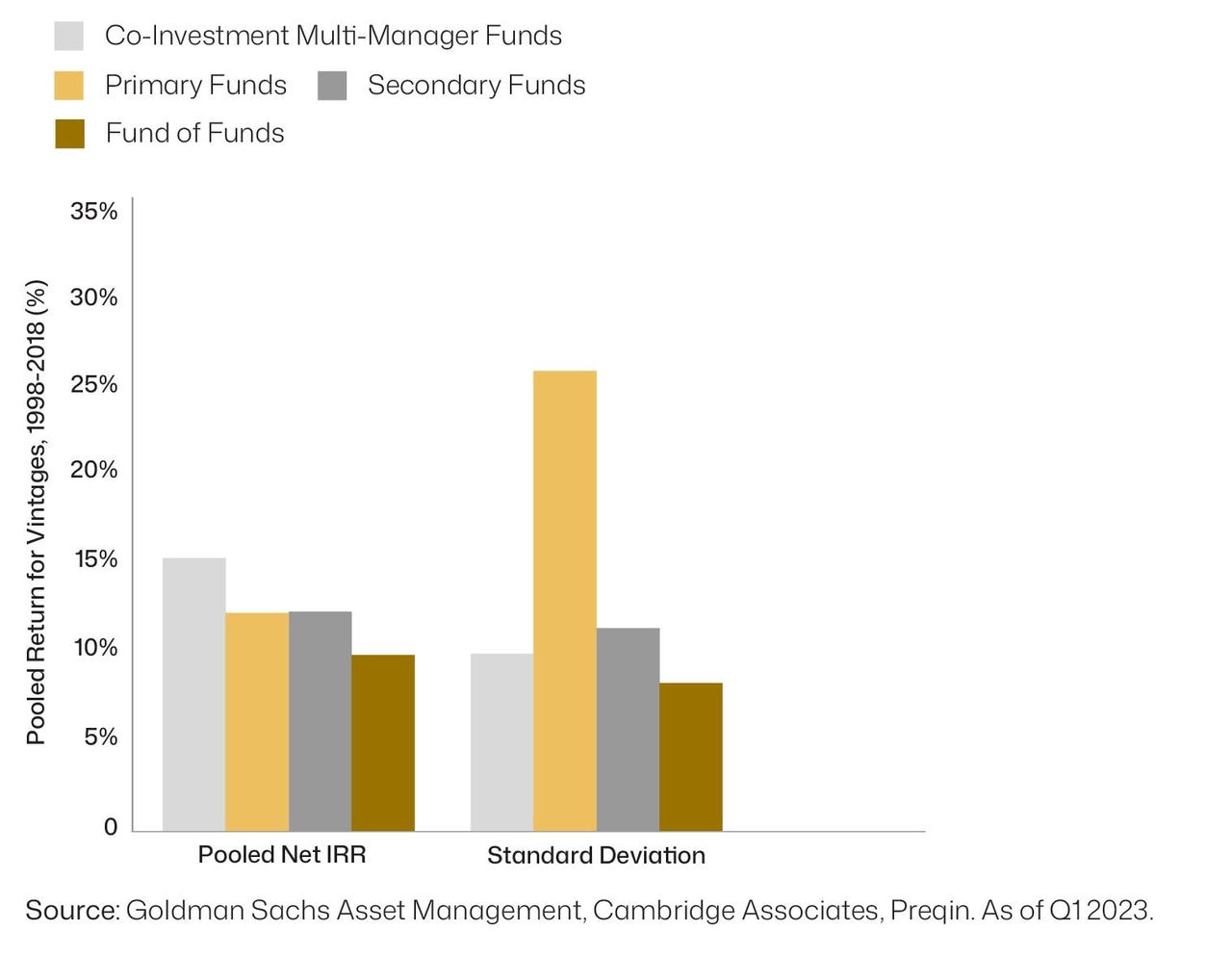

Moreover, compared to primary, secondary, and fund-of-funds private equity strategies, multi-manager co-investment funds, in aggregate, also outperformed for the 20 vintage years from 1998 to 2018, with much lower dispersion in returns (Chart 3).

We think this underscores the significance of relationships between investors and a select group of outstanding private equity managers.

Chart 3: ...and have done so with lower dispersion than other types of PE funds

It’s easy to be beguiled by co-investments’ performance as displayed in charts 2 and 3 but the reality is that performance can vary based on deal selection, industry and business conditions. That is why we strongly believe detailed due diligence should be undertaken before investors commit capital to any co-investment opportunities.

Minimising the J-curve impact

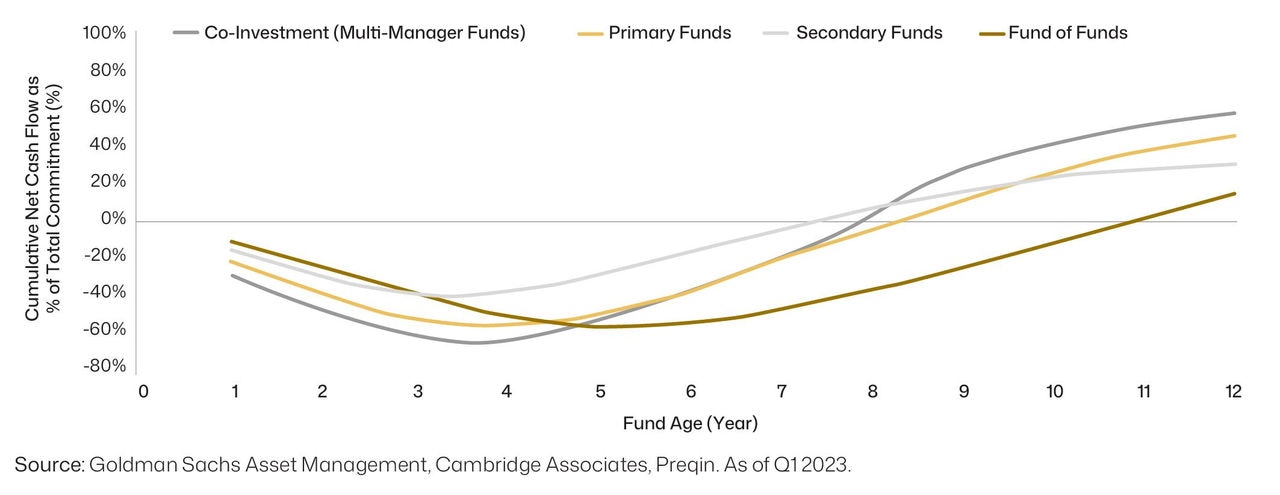

We would argue that another desirable feature of co-investments is their attractive J-curve characteristics – the J-curve being the tendency of PE funds to post negligible returns in their early years and stronger returns in later years as investments mature and value is realised.

Fallow returns in a PE fund’s formative years result from investment costs, management fees, and an investment portfolio dominated by investee companies at the beginning of transformation journeys.

By contrast, co-investments generally accelerate capital deployment, and this coupled with typically lower than PE fund fees help to lessen the J-curve affect.12

Although co-investments experience the deepest initial drawdowns among multi-manager private fund strategies, their cumulative net cash flows quickly converge with primary funds and reach breakeven sooner (Chart 4).

Chart 4: Co-investment funds have attractive J-curve characteristics

Our co-investment experience

MLC has been a private equity investor since 1997 and a private equity co-investor since 2007. From the get-go, ours has been a global investment program recognising that the opportunity set beyond Australia was immensely greater than one focused on the local market.

Since then, we have built enduring relationships with what we regard as some of the most renowned PE managers, many of whom have shut their doors to new investors, so successful have they been. We are privileged to still be able to invest with this manager suite, and they enjoy working with us.

Relationships and access are key to success in private equity investing because there are large differences between long-term returns delivered by strong-performing PE managers, compared to their lower-performing industry peers. In other words, manager selection is pivotal in private equity.

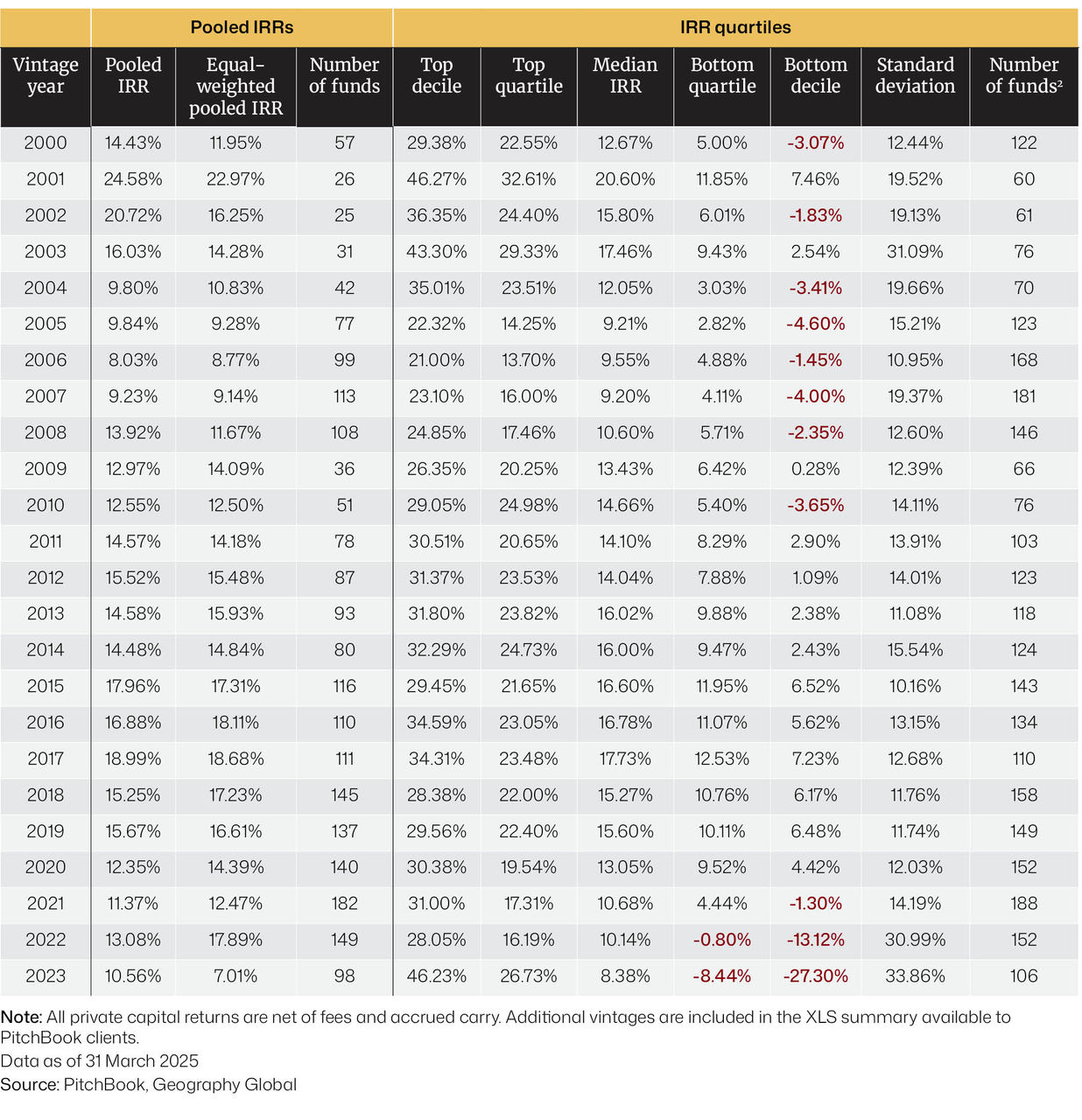

Indeed, return differences between managers in the top quartile of performance compared to the bottom quartile of performance expanded during the inflation outburst over 2022-2023 (Chart 5).

In 2023, there was a greater than 36% net internal rate of return (IRR) difference between the top quartile (26.73% return) and bottom quartile (-8.44% return) PE managers (Chart 5), which we believe underscores the importance of manager selection.

Chart 5: Return differences between top and bottom quartile PE managers widened over 2022 and 2023

Global PE: IRRs by vintage

In our view, benign business conditions can mask skill differences between capable and less capable managers. Low-interest rate environments, for instance, enable such things as easier valuation uplift which tends to benefit all assets, irrespective of ‘quality’.

However, in our opinion, the 2022-2023 period exposed variances with skill and specialisation enabling better credentialed managers to significantly outperform less able counterparts.

We observed, those we regard as more capable GPs, navigating the period by leaning on better due diligence, tried and tested operational playbooks, and networks for add-on acquisitions, turning adversity into outperformance.

By contrast, what we regard as less capable GPs, typically less specialised, lacked these tools and thus struggled in a challenging cycle.

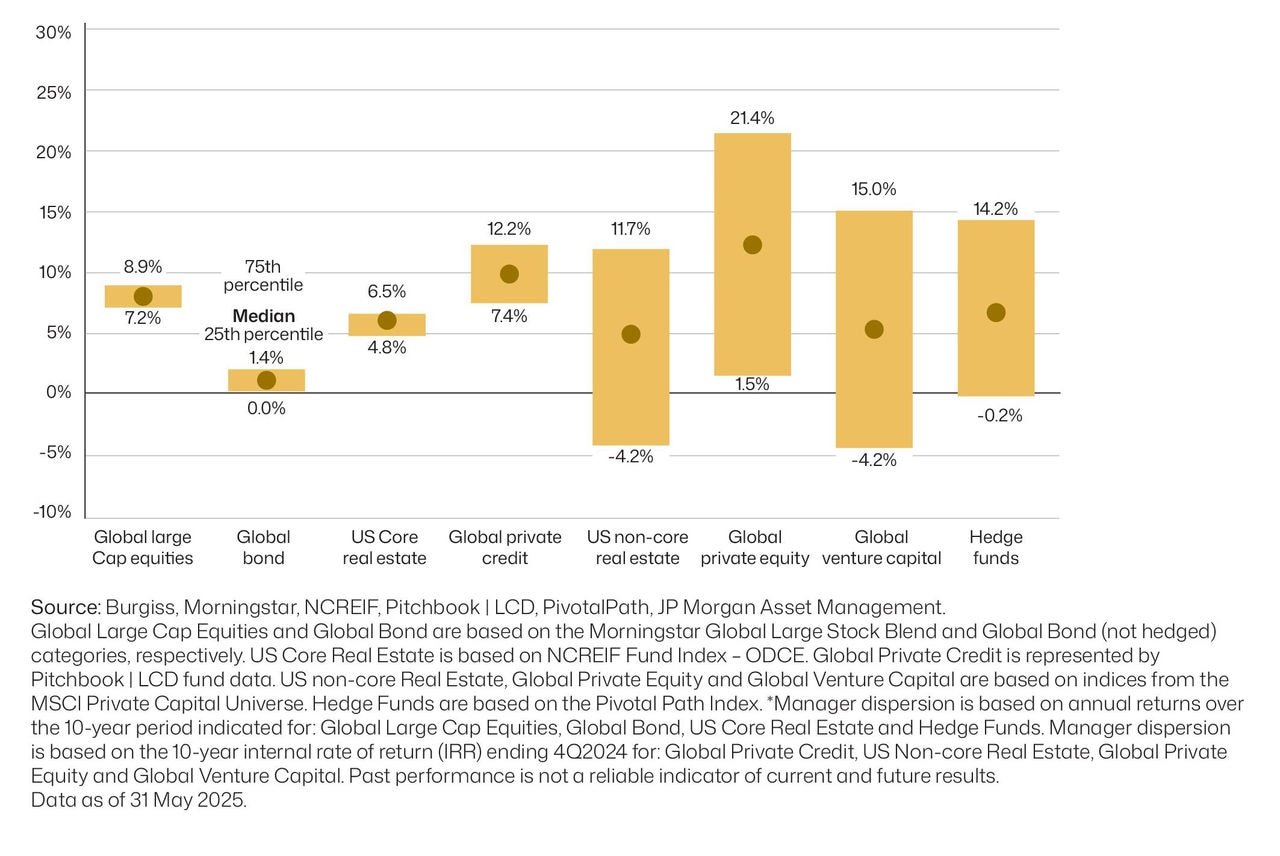

Just as not all companies are equally good, neither are all private equity managers equally skilled. Another way of unpacking the dispersion issue is to delve into the return dispersion of managers of share market investments versus private equity managers.

Just as not all companies are equal, not all PE managers are equally capable with JP Morgan data revealing an almost 20-percentage-point performance differential between the top-performing private equity managers and the bottom-performing managers in Chart 6, a dispersion almost 12 times wider than in listed global large cap equities.

We believe this places an usually high onus on the importance of deep relationships with the world’s most capable PE managers and being connected within the industry. The PE landscape is relationship-driven, and top performers are often inaccessible to newcomers, preferring established partners.

Chart 6: PE managers’ dispersion of returns far exceeds public equity managers’ performance dispersion

Median, top quartile, bottom quartile performance dispersion of private and public investment managers (based on returns 1Q 2015 – 1Q 2025)*

Relationships built over many years and through shared experiences in multiple, successful programs bind strong performing private equity managers and their preferred investors and drives long-term investment success. That’s certainly been our experience.

Staying committed through thick and thin, and backing great people

One of the reasons for the strength of these relationships is that we have stood by our investment program and general partners through thick and thin.

We have been an all-seasons investor, rather than a fair-weather one, exemplified by the continuation of our program through the Global Financial Crisis, COVID, and the more recent period of high inflation.

Furthermore, in contrast with investors who may have pulled back from private equity because of over-allocations to the asset class or were deterred by rising interest rates, which have a downward impact on asset values, we continued with our PE commitments.

PE managers appreciate that we are a source of patient capital willing and able to invest through varying market cycles.

Our co-investments share the same characteristics as PE funds we invest into.

We prefer partnering with industry sector specialists, for example, in financial technology, healthcare or business-to-business software as, according to analysis by Bain Capital in their Global Private Equity Report 2022,13 increasing use of specialists drives successful deals.

While most of our manager relationships are long-standing, we are prepared to selectively back new managers, especially those who come out of well-known firms with strong track records, who we generally already know.

From our perspective, leaving a recognised PE manager to set up a new shop shows drive and ambition.

Those qualities coupled with principals who risk their capital by ploughing their money into newly founded PE firms, impress us. Said differently, we like managers with ‘skin in the game.’

To be clear, we do not commit our clients’ funds simply on managers’ drive, ambition and alignment on risks and incentives. As always, we carry out intensive due diligence on any opportunity that comes to market that could potentially be of interest to us, whether from a new or established manager.

That said, we steer clear of managers who are unprepared to have ‘skin in the game.’

We are broadly agnostic about the industries we invest in and scour the opportunity set on a case-by-case basis.

Nevertheless, both our PE fund program and co-investments do show an overweighting to three intriguing structural themes:

- Healthcare

- Consumer-related industries, and

- Technology, especially financial technology, and business-to-business software

We believe these thematics will benefit from long-term structural trends which will play out over time, matching the multi-year investment horizons associated with private equity whether via PE funds or co-investments.

In these industries, we generally back co-investments provided by specialist healthcare, consumer or technology private equity managers who ‘know what good looks like’, given their deep industry expertise and sector knowledge.

We like the specialist private equity model in healthcare, consumer, and technology as we often see specialist PE funds winning deals over generalist funds, impressing founders with their rolodex of industry experts, track records of delivering successful returns in similar businesses, and ability to implement proven playbooks of tried and tested value creation initiatives.

Diversification is a feature of our program too as our clients’ capital is spread across high-conviction managers, multiple vintages, companies, industries, sectors, and regions (Chart 7).

Chart 7: Regional and sector diversification is apparent

MLC Private Equity Co-Investment Fund III portfolio composition*

In listed equity terms, we are ‘benchmark agnostic.’ We do not feel compelled to invest in any industries, companies, countries, or regions just because doing so may be in step with an industry benchmark.

The upshot is that our co-investments have offered clients access to rarity, that is, benefits that accrue from relationships with some of the world’s most capable PE managers who have chosen to partner with us to invest directly in hand-picked individual companies.

The mid-size company opportunity

Our one area of preference is company size: the co-investments we invest lean towards are mid-size companies. In our view, there are more operational efficiencies to be achieved in the mid-size company arena over a 3-7 year holding period, than among larger companies where transformation can take longer to realise, or where operations are already highly efficient and growth prospects may be limited.

Because of these inefficiencies, it is possible to have a greater impact on companies towards the smaller end of the spectrum through transformation and growth programs.

From our experience, transformed mid-size companies often become so attractive to bigger companies or other PE managers that they get bought at attractive prices, giving investors an ideal way of realising value.

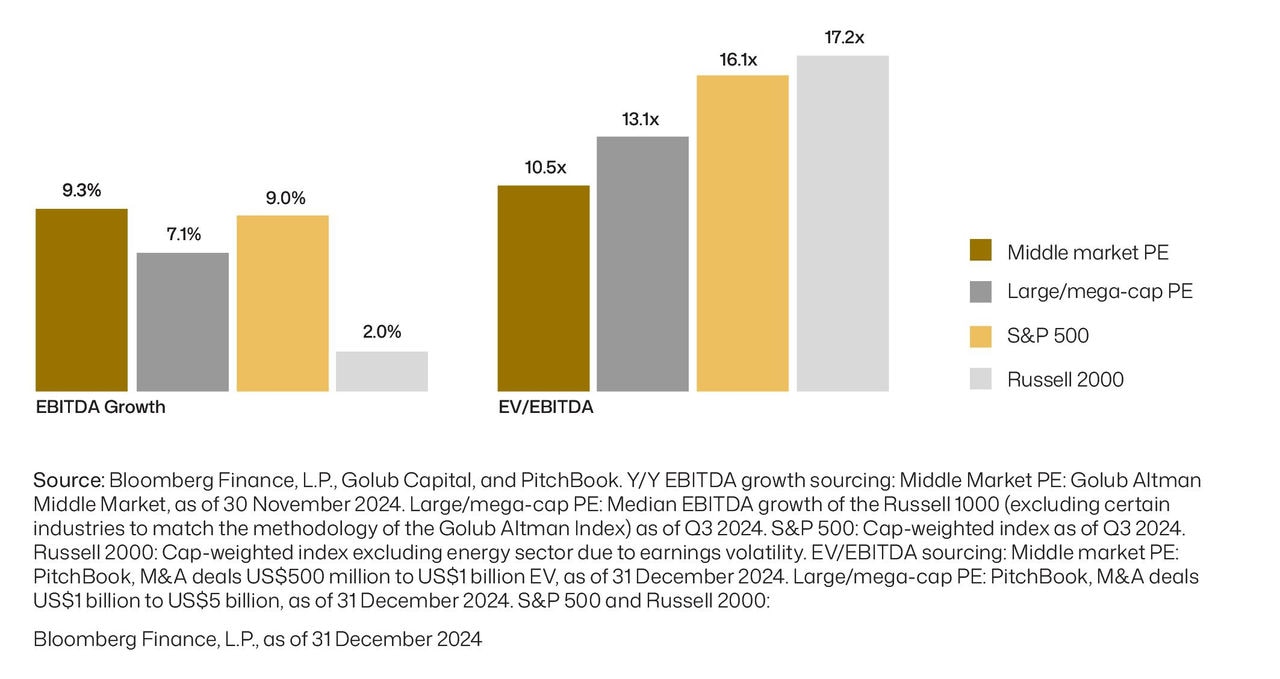

Digging deeper and being more specific – one of the attractions of the mid-size company realm is the valuations they offer compared to their larger counterparts.

In the United States, for instance, mid-sized companies’ valuation advantage can be found in their purchase multiples with middle-market companies’ purchase multiples being 10.4 times versus 12.4 –12.9 times for large-market companies.14

In our view, this pricing gap gives PE managers room to improve performance and sell at potentially higher valuations.

At the same time, lower purchase multiples imply that middle-market buyouts require less leverage to achieve their target returns. In fact, the average middle market transaction typically uses 32% less leverage compared to large company related transactions.15

This suggests, to us, that middle-market companies provide better value and lower risk.

Moreover, middle companies grow faster than large ones. On average, US middle-market companies under private equity ownership have achieved 9.3% annual Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) growth compared to 7.1% for large companies owned by private equity managers.16

Private middle market firms’ earnings growth also beats earnings growth delivered by large-cap listed US companies (as measured by the S&P 500 index) and small cap firms (as measured by Russell 2000 index, Chart 8).17

Desirably, mid-size companies’ strong earnings profile is coupled with attractive valuations with PE-owned US mid-size firms’ valuations being at discount to large US PE-owned companies’ valuations, as well as the valuations of companies that make up the S&P 500 Index and Russell 2000 index (Chart 8).

We think this owes to the flexibility, entrepreneurial leadership, and untapped efficiencies that private equity firms can help unlock in the mid-market space.

Chart 8: PE-owned mid-size US companies have exhibited higher earnings growth and lower valuations than their larger counterparts

Earnings growth and valuations across private and public equity markets

Furthermore, mid-cap advocates would argue that these firms provide more room for growth with accretive bolt-on acquisitions, and more value creation opportunities. Lower mid-market companies also tend to have less debt on the balance sheet and as a result are nimbler and better positioned to adapt to market disruptions.18

The mid-market also benefits from an abundance of potential targets compared to listed markets. In the United States, around 200,000 privately owned mid-size companies with revenues between US $10 million and $US1 billion have been a driving force in the domestic economy for decades.19 This group represents around one-third of US private sector gross domestic product (GDP) and employs around 48 million people.20

We would argue that there are often more value-creation levers available to private equity investors in smaller companies. Think of the ability to drive margin improvement through operational management, supply chain management, IT implementation, data science, better enterprise reporting and acquisitions integration.21

By the time firms have reached large company status, they are closer to the ceiling in all arenas, in our view. They have reached levels of maturity where revenue growth is slower. There is less low hanging fruit to target.

This means there is greater reliance on the final value-creation lever available to private equity firms – capital markets. Mega firms tend to rely much more on financial engineering and higher levels of debt, which proved to be a source of some become more challenging in today’s macroeconomic environment22 with higher interest rates. All up, we believe the mid-market segment represents a source of potentially strong long-term returns.

A one-team approach so we benefit from a breadth of insights

We think the combination of our team structure and culture is a source of competitive advantage.

MLC is a decisive ‘yes’ or ‘no’ co-investment decision maker. Indecision and prevarication are anathema in co-investing. Execution speed is valued and private equity managers appreciate our capacity to arrive at thought-through conclusions in a timely fashion.

Our nine-person team of PE investment professionals, divided between the United States and Australia, has, on balance, more senior PE investment professionals compared to those in the earlier stages of their private equity careers. We utilise the decades of experience of our senior team members in assessing and critiquing co-investment opportunities.

A number of our team come from direct private equity investing backgrounds (that is, they have been private equity managers themselves) and therefore are attuned to the nuances of what can make or break a private equity deal, including the importance of good governance, workplace leadership and culture in driving value.

‘Workplace diversity’ is a much-used term these days. We are proud to be able to say that every member of our private equity team is valued and nurtured.

One third of our most senior team members are female.

Ours is a group drawn from many cultural and national backgrounds, heritages, ages, and life experiences. We know that we are better investors because we are able to channel this richness towards the common goal of delivering financial wellbeing for our clients.

Intensive focus on risk-management

Investment success comes not just from owning good assets. Risk-management is equally important.

Without intensive and constant focus on downside management, a co-investment program could be undone by failures in one part of the program overwhelming positive returns elsewhere.

As is often said when it comes to investing: if you lose half your money, you need to double your return just to get back to where you were.

That is why, as part of our investment process, we model investee companies against severe ‘what if’ downside scenarios.

What if high interest rates return, or go even higher? What if inflation persists? What if there is a recession? What if the company’s most material contract isn’t renewed? What if the worst-case scenario the private equity manager contemplates occurs? What if even worse eventuates?

We make sure all our investments have a margin of safety so they can be resilient should the operating environment sour.

Cash flow is particularly important in this regard. In its absence, companies cannot survive, let alone fulfil basic obligations like paying lenders, suppliers, and employees on time.

That is why we analyse prospective investee companies for their cash flow durability. We do not

co-invest in venture capital businesses which are loss making. We co-invest in cashflow positive private equity opportunities which we feel can be resilient in a downturn but retain significant upside if managed as well as the private equity firm intends.

A note on illiquidity

As PE and PE co-investment enthusiasts, we are more than happy to speak about what we regard as the good things associated with the asset class all day long. That said, PE and PE co-investments have distinctive risks that investors should bear in mind, the foremost being illiquidity.

Private equity co-investments can lock in investors’ capital for 5-10 years, and over this period investors are unable to access their capital. Moreover, given the absence of a vast active market for the underlying investments (in contrast with share markets), it is difficult to estimate when investments may be realised and at what valuations.

Given this illiquidity and uncertainty, investors demand higher long-term returns from the asset class than those generally associated with listed shares, by way of comparison.

However, as discussed earlier in this paper, not all PE investments meet higher performance expectations, and as such, it is important to partner with high-performing PE managers who have demonstrated track records of acting in investors’ best interests. PE is a sophisticated asset class and it is more likely to be rewarding to invest alongside managers who have a long history in the sector and with evidence of long-term, sustainable value creation.

Co-investment track record

We launched the first of our four co-investment funds in 2013, with the most recent co-investment fund launched in 2024.

MLC Private Equity Co-investment Fund I (Fund 1), commenced on 15 November 2013, concluded on 20 May 2025. Over its life, Fund 1 delivered a net IRR of 18.4%, coupled with a gross Multiple of Invested Capital (MOIC) of 2.7x over the same period.23

MLC Private Equity Co-investment Fund III, launched in November 2020, is just entering the harvesting phase with one realised investment so far. MLC Private Equity Co-investment Fund IV, launched in December 2024, has only just commenced its investment phase.

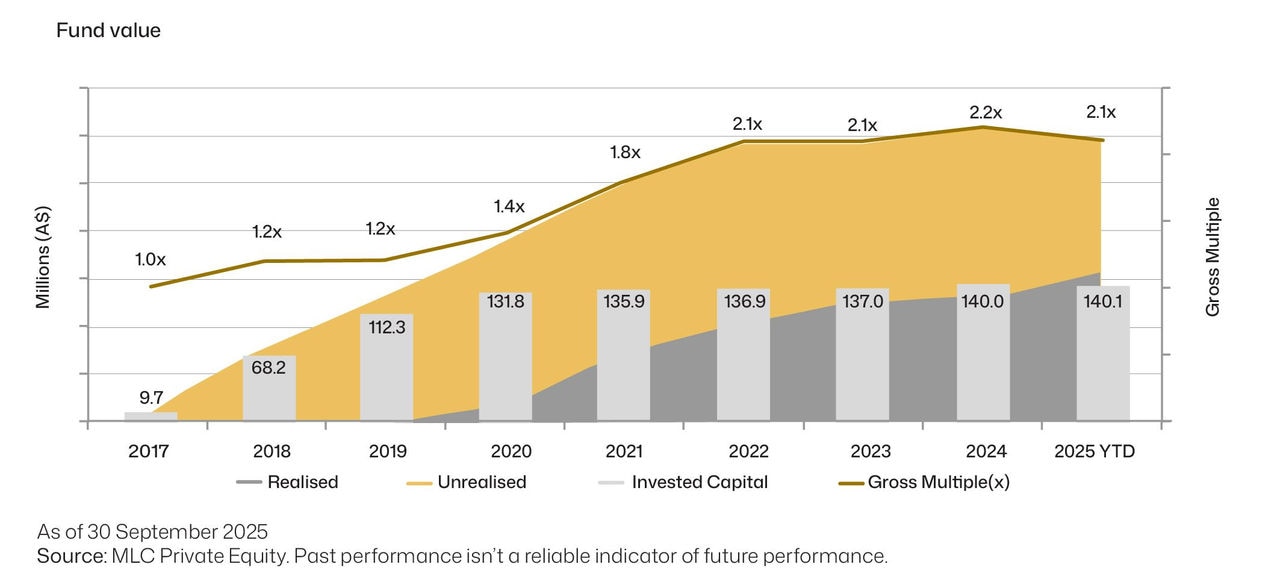

MLC Private Equity Co-investment Fund II (Fund 11), launched on 16 May 2017, has a since inception to 30 September 2025 IRR of 13.3%, with a gross Multiple of Invested Capital (MOIC) of 2.1x over the same period (Chart 9).

As of 30 September 2025, Fund 11 was invested in 13 companies and realised investments in 8 other companies while being diversified across regions and sectors.24

Chart 9: MLC Private Equity Co-investment Fund 11

Long-term track record

We believe all of this helps to place us in a desirable position to continue sourcing more quality co-investments.

References

1 The advantages of co-investments, Russ Steenberg, Jeroen Cornel, BlackRock Private Equity Partners, February 2019

2 Ibid

3 https://www.infrastructureinvestor.com/teaming-up-are-co-investments-here-to-stay/

4 Ibid

5 Ibid

6 Goldman Sachs Asset Management, The case for co-investments, Q4 2023

7 https://www.chronograph.pe/macroeconomic-trends-shaping-the-co-investment-landscape/

8 Goldman Sachs Asset Management, The case for co-investments, Q4 2023

9 Ibid

10 Ibid

11 Ibid

12 Flattening the J-curve: Private equity strategies to improve investment outcomes, Darren Spencer, March 14, 2022, https://russellinvestments.com/us/blog/flattening-j-curve-private-equity-strategies

13 The 2022 Global Private Equity Report: Market Overview. https://www.bain.com/insights/the-2022-global-private-equity-report-market-overview-podcast/

14 https://www.areswms.com.au/livewire-why-is-the-u-s-middle-market-important/

15 Ibid

16 Middle market private equity: Growth at a reasonable price

17 Ibid. Also note that returns are gross/absolute and not necessarily representative of investor outcomes.

18 Ibid

19 https://www.futurestandard.com/insights/chart-of-the-week/private-equity-middle-market

20 Ibid

21 Ibid

22 Ibid

23 Source: MLC Private Equity. Past performance is not a reliable indicator of future performance.

24 Source: MLC Private Equity

Important information

The financial products or strategies described in this article are available for investment by Australian residents only (and some New Zealand residents), and any financial product advice is intended for Australian residents only and not for residents of any other jurisdiction.

This communication has been prepared for licensed financial advisers and Wholesale Clients as defined in section 761G of the Corporations Act 2001 (Cth) only, and must not be distributed to retail investors under any circumstances. This communication was prepared by MLC Asset Management Pty Limited , ABN AFSL(“MLC” or “we”), a part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group). The capital value, payment of income and performance of any financial product referred to in this communication or marketed in connection with this communication are not guaranteed. An investment in any financial product is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested. Neither MLC, nor any other Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication or marketed in connection with this communication.

The information included in this communication is general in nature. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Actual returns may vary from any target return described and there is a risk that the investment may achieve lower than expected returns.

Any opinions expressed constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.