January 2026,  10 min read

10 min read

David Chan, Portfolio Manager – MLC Private Equity

Alicia Chen, Assistant Portfolio Manager – MLC Private Equity

Small-to-medium enterprises (SMEs) tend to stir positive emotions. They conjure up images of the underdog or fledgling challenging big players in established industries. In Australia, IGA versus Coles and Woolworths comes to mind.

There are also SMEs who are innovators who introduce game-changing products and services. Think about companies like Facebook and AirBnB, to name some. They are giants now but started life as ideas in the heads of their founders.

Big companies don’t start out big. They usually start small. Some progress all the way to become large established companies. Some, sadly, go out of business altogether.

Our private equity (PE) team has been active in the mid-size part of the SME space for many years and we’re enthusiasts about the potential benefits of PE investing in this sector because the sector has helped deliver strong long-term returns for our clients.

Our private equity portfolios look for firms globally of around A$200 million – A$2 billion in size in sectors like technology, healthcare, and business-to-business industrial services. We make investments in profitable, cashflow generative companies with proven records of revenue and cashflow growth and forecast to continue or accelerate on such trends.

The mid-size market opportunity

There are multiple reasons why we think mid-size companies are attractive, from our perspective as private equity investors. For starters, it’s the sheer size of the opportunity set.

In the United States, for instance, around 200,000 privately owned mid-size companies with revenues between US $10 million and $US1 billion have been a driving force in the domestic economy for decades.1This group represents around one-third of US private sector gross domestic product (GDP) and employs around 48 million people.2

Many of these businesses are facing succession issues with baby-boomer founders considering retirement and weighing up selling the business to private equity, or alternatively passing over the reins to a relative or someone they know to run the business.

We see this as a substantial catalyst for more private equity transactions in the mid-market sector over coming years. That said, private equity managers and not just waiting for the future to arrive, rather have been pushing strongly into the mid-market segment with 3,352 buyouts being transacted in the US middle market in 2024 valued at a touch over US$358 billion.3

Achieving faster growth

It’s not hard to see why mid-sized companies are attractive for private equity investing.

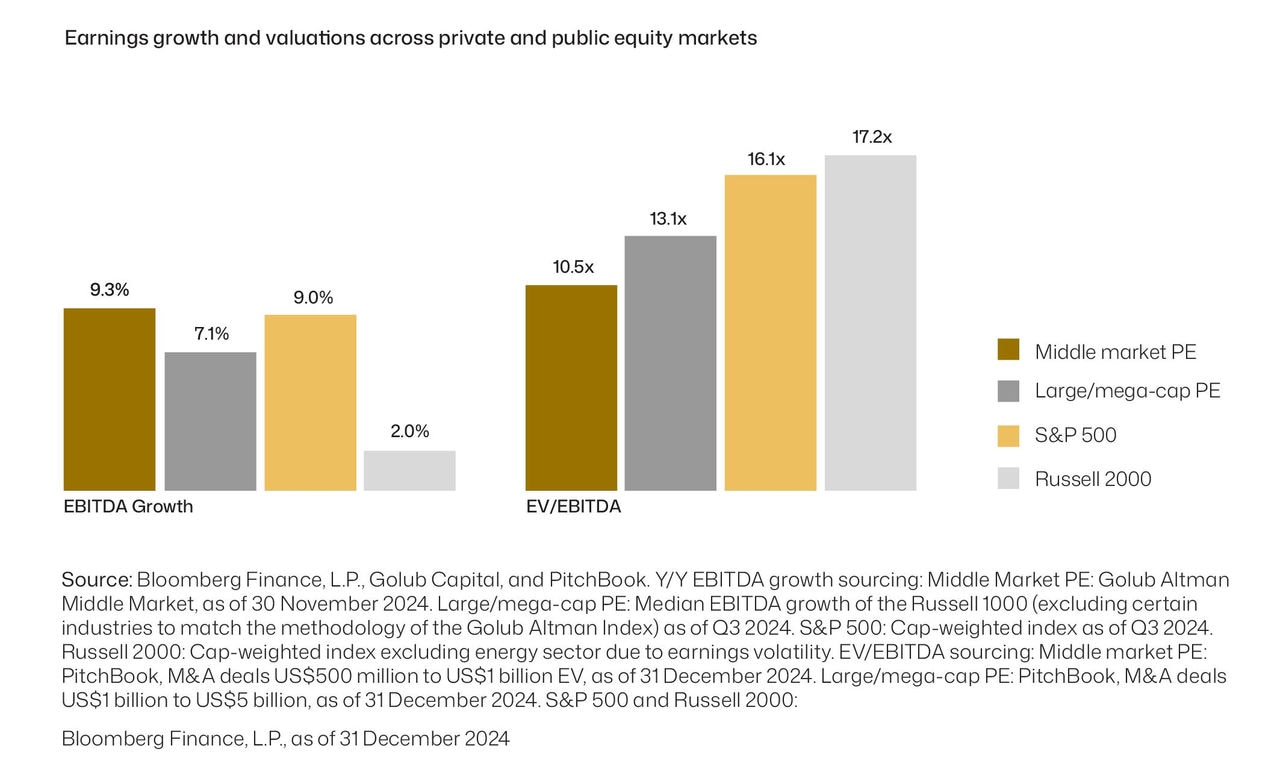

For starters, they grow faster than large ones. On average, US middle-market companies under private equity ownership have achieved 9.3% annual Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) growth compared to 7.1% for large companies owned by private equity managers.4

Private middle market firms’ earnings growth also beats earnings growth delivered by large-cap listed US companies (as measured by the S&P 500 index) and small cap firms (as measured by Russell 2000 index, Chart 1).5

Desirably, mid-size companies’ strong earnings profile is coupled with attractive valuations with PE-owned US mid-size firms’ valuations being at discount to large US PE-owned companies’ valuations, as well as the valuations of companies that make up the S&P 500 Index and Russell 2000 index (Chart 1).

We think this owes to the flexibility, entrepreneurial leadership, and untapped efficiencies that private equity firms can help unlock in the mid-market space.

Chart 1: PE-owned mid-size US companies have exhibited higher earnings growth and lower valuations than their larger counterparts

Earnings growth and valuations across private and public equity markets

Lower purchase price, greater potential upside

Another way of unpacking mid-sized companies’ valuation advantage can be found in their purchase multiples with middle-market companies’ purchase multiples being 10.4 times versus 12.4 –12.9 times for large-market companies.6

Lower purchase multiples imply that small and middle-market buyouts require less leverage to achieve their target returns. In fact, the average middle market transaction typically uses 32% less leverage compared to large company related transactions.7

In our view, this pricing gap gives PE managers room to improve performance and sell at potentially higher valuations.

At the same time, lower purchase multiples imply that middle-market buyouts require less leverage to achieve their target returns. In fact, the average middle market transaction typically uses 32% less leverage compared to large company related transactions.8

This suggests that middle-market companies provide better value and lower risk.

An investment sweet spot

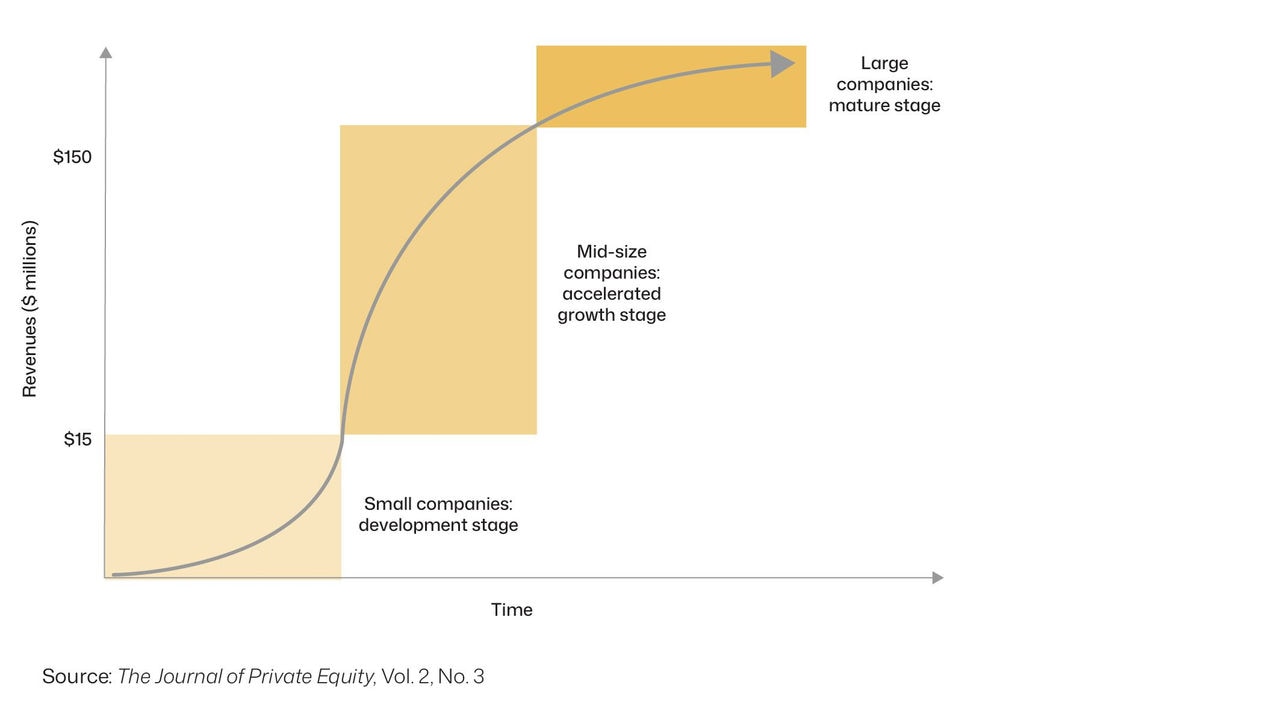

All up, we think well-chosen mid-sized companies are in the investment sweet spot (Chart 2) as they are less financially vulnerable than small companies and have greater growth potential than large companies.

Chart 2: Mid-size companies are in the investment sweet spot

In our view, mid-size companies are not as financially vulnerable as small companies, and have already proven themselves to some extent, having successfully matured from start-ups or small companies to financially and operationally more mature mid-sized ones.

In other words, they are more grown-up and big enough to generate real cash flows, but not so big that future growth becomes harder to achieve or to quickly adapt to technological changes and new business dynamics. Moreover, mid-size companies typically have more business growth and business process improvement potential than larger, more mature companies.

In our view, they are ideally suited for the ‘active management’ approach of specialised private equity managers who work closely with company management teams to drive growth, enter new markets, professionalise operations, and increase margins.

The best mid-cap companies are those with clear market leadership in a specialist sector, dependable revenues and unique or ‘mission critical’ technologies or products.

Mid-cap sectors that can enhance PE portfolios

The technology and health sectors are experiencing transformational changes which are reshaping business, and society more generally, and are beneficiaries of long-term structural tailwinds. As a result, we believe they have the potential to enhance private equity portfolio outcomes over time.

In our view, some of the best opportunities lie in technology businesses that have reliable cash flow and provide mission-critical products and services to their customers, rather than simply revenue growth potential. They are targeting real needs and improving the “plumbing” of an industry or have a core business that is essential for consumers.

Such businesses tend to have pricing power in the market, and cross-sell other adjacent services to customers, who truly value the product and service the business is providing. The cost base is typically small relative to revenue, and we see strong gross margins and profitability in these types of businesses.

Specialist technology expertise can help to fast track the improvements of companies in times where it is critical to accelerate technology uptakes, such as the COVID period. Our managers are also incorporating artificial intelligence (AI) into their products and services, where applicable.

Healthcare is also experiencing growth on the back of greater health spending related to longevity, ageing populations, and the rising cost of ever-more advanced treatment technologies and methods.

In our view, specialist healthcare private equity mangers outperform generalist managers in the sector, due to the discrete nuances of managing these investments and the various risks involved including retaining specialist labour workforces, managing insurance and government funded payers, and regulation. There remain strong opportunities in the sector, particularly in healthcare businesses of scale.

Risks

Of course, any investment comes with risk. For PE investments, a major risk is the timescale for returns. A typical investment might take 4-5 years or even longer to be sold, and investors typically demand a premium to compensate for this.

Worth a look in a time of change

The world seems to be at a crossroads of great changes including powerful structural themes are disrupting the global status quo and societies.

The post WWII liberal economic order that rested on free-trade and open markets is being fiercely challenged by protectionist impulses and economic nationalism favouring domestic industries while punishing outsiders. Supply chains painstakingly stitched over decades are being unwound with no clarity on when and in what form they will be reconfigured.

Climate change, and the fitful energy transition, artificial intelligence, robotics, and below-replacement level birth-rates across many developed as well as developing countries are all combining to reshape societies, industries and economies.

It seems likely that the composition of winning and losing companies from this ferment will be different from today.

In a challenging environment, it is worthwhile looking at specialist private managers who think deeply and act decisively to improve businesses they are investing in, while accessing broad diversification.

Key points about MLC Private Equity

- MLC has been a private equity investor since 1997. From the outset, ours has been a global program recognising that the global private equity opportunity set is far greater than one restricted to Australia.

- We have over A$6.2 billion in private equity investments, on behalf of superannuation members and other clients, and have executed over 370 portfolio investments since 1997, creating over A$7.3 billion in value.9

- MLC maintains relationships with around 20 core private equity managers globally.

- The global mid-market segment is the focus of MLC’s private equity program. Only around 20% of global private equity capital is in this segment which we believe creates the potential for higher returns that larger buyout strategies.

Through its large private equity program, MLC is able to access preferred co-investment deals from General Partners (private equity managers). This allows us to curate what we regard as the best deals from “Best in class” global managers.

References

1 https://www.futurestandard.com/insights/chart-of-the-week/private-equity-middle-market

2 Ibid

3 Data from PitchBook found in https://www.investmentcouncil.org/wp-content/uploads/2025/08/AIC-2025-Small-Biz-Middle-Market-Review-08202545.pdf

4 Middle market private equity: Growth at a reasonable price

5 Ibid

6 https://www.areswms.com.au/livewire-why-is-the-u-s-middle-market-important/

7 https://www.futurestandard.com/insights/article/the-middle-ground-balancing-fear-greed-and-returns-with-middle-market-private-equity

8 Ibid

9 Total value creation since inception (net of fees and expenses) is over A$7.3 billion as at end September 2025. Note: this includes realised investments of A$12.4 billion plus unrealised investments of A$4.1 billion less A$9.2 billion of capital invested. These investments were/are held by multiple client portfolios and not representative of a particular portfolio’s performance. Past performance isn’t a reliable indicator of future performance.

Important information

This document has been prepared by MLC Asset Management Pty Ltd ABN 44 106 427 472, AFSL 308953 ('MLC Asset Management' or 'we'), a member of the group of companies comprised Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (‘Insignia Group’) The information in this document is intended for wholesale clients (as defined under the Corporations Act 2001 (Cth) in Australia. An investment with MLC Asset Management does not represent a deposit or liability of, and is not guaranteed by, the Insignia Group. The information in the document is of a general nature only, it is not investment advice. The information in this document does not constitute to any offer, invitation or solicitation in respect to any financial product or service.

Opinions constitute our judgement at the time of issue and are subject to change. Neither MLC Asset Management nor any member of the Insignia Group, nor their employees or directors give any warranty of accuracy or reliability, nor accept any responsibility for errors or omissions in this document. In some cases the information in this document has been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. Any reference in this document to a specific company, security, asset or any other investment is for illustrative purposes only and should not be taken as a recommendation to buy, sell or hold that investment. Past performance is not a reliable indicator of future performance. Any projection or other forward looking statement (‘Projection’) in this communication is provided for information purposes only. Whilst reasonably formed, no representation is made as to the accuracy of any such Projection or that it will be met as actual events may vary materially.