January 2026 | ![]() 11 min read

11 min read

David Chan, Portfolio Manager – MLC Private Equity

Alicia Chen, Assistant Portfolio Manager – MLC Private Equity

A lively debate is underway among private equity (PE) participants regarding the advantages and drawbacks of investing in private equity secondaries. Our aim is to present, what we hope, is a balanced view on the secondaries market today and its prospects.

Before delving deeper, it's helpful to clarify the distinction between primary and secondary PE funds.

In a primary PE fund, investors make commitments to a private equity fund manager during the initial fundraising stage. As deals are sourced and executed, investors are called upon to make capital commitments.

In contrast to primary investments, a private equity secondary involves buying or selling existing commitments in an established fund. These are off-market transactions that allow investors to trade private equity positions. Buyers conduct their own due diligence to assess value of the portfolio and determine the price they’re willing to pay.

While we prefer primary investments, we acknowledge secondaries play a role in portfolio construction, especially for investors seeking liquidity, exposure to established assets, or continued ownership of quality assets through continuation vehicles. Additionally, depending on market conditions, secondary markets can offer a valuable exit route for primary investors (for example, single asset continuation vehicle), particularly when demand for quality assets is high.

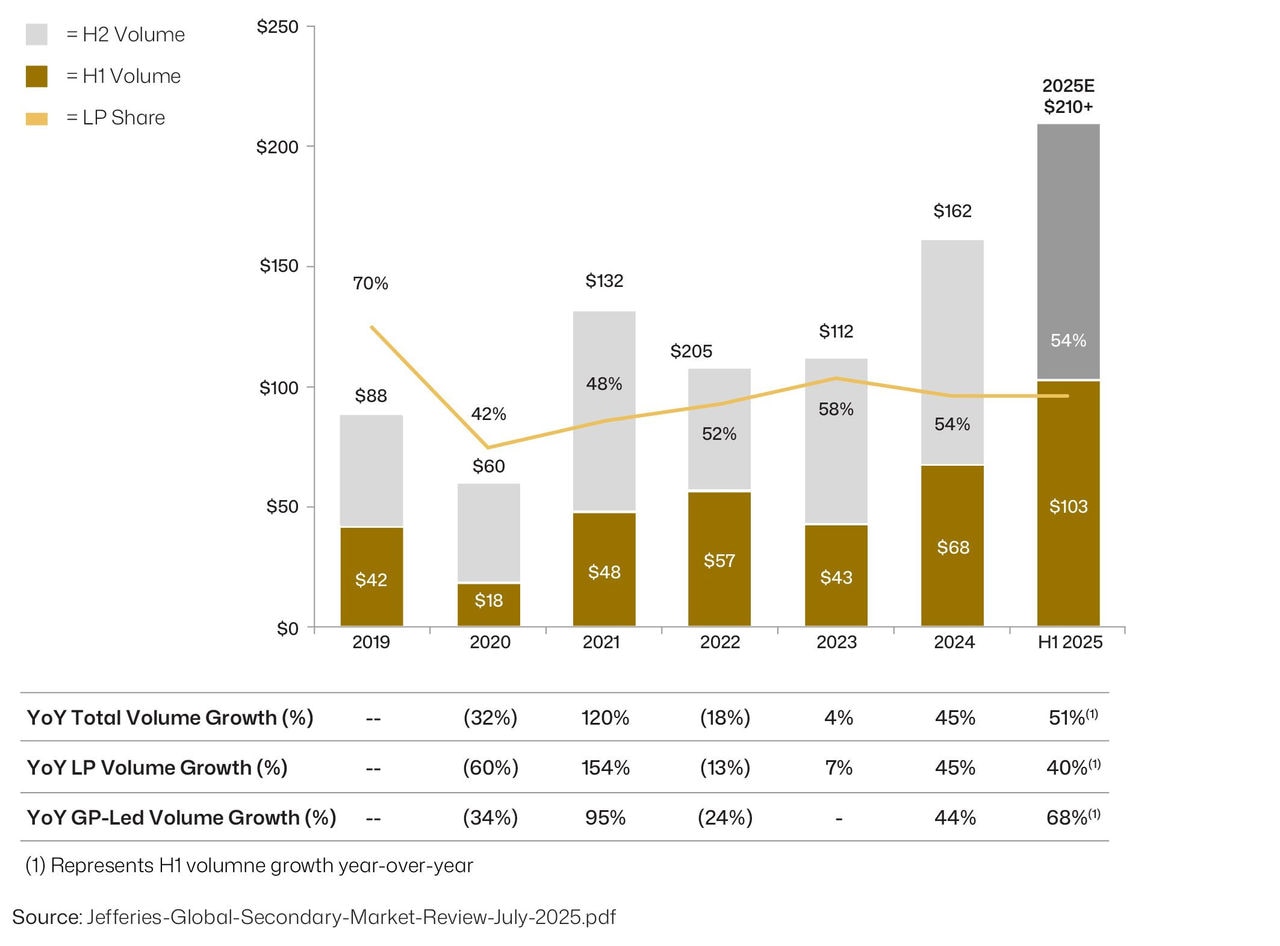

Activity in the secondaries market has been robust (Chart 1), following periods of investor caution amid elevated inflation and interest rates from 2021 to 2023. Volumes have continued to increase since 2024 as economic concerns eased, with projections suggesting they could reach US$300 billion by 2030.1

Chart 1: Secondaries transactions volumes have been uneven, but have risen more recently

Annual PE secondaries transaction volumes (US$ billions)

Sources of appeal

Proponents of secondaries investing highlight several benefits for engaging in PE this way, beginning with the balance between illiquidity and liquidity.

- A feature of PE is its illiquidity, with capital often tied up for 5-7years, and possibly even more, complicating early access to funds before maturity. Secondaries mitigate this by offering an exit path for investors seeking earlier liquidity.

- Secondaries entail buying interests in diversified PE funds that have already deployed capital into assets. This eliminates the blind pool risk inherent in primaries, where investors commit without knowing the specific investments the fund will pursue.

- Secondary investors gain better insight into the portfolio's track record, including asset performance, capital allocation trends, and anticipated exit timelines. This differs from primary investments, which depend on prospective growth and asset development.

- Finally, because secondaries usually involve funds already several years into their lifecycle, returns may materialise more quickly as the fund approaches its harvesting phase. This also helps sidestep the J-curve effect common in PE, where early years yield minimal returns due to fees and nascent value creation in portfolio companies.

Secondaries can seem highly attractive at first glance. However, as with any investment, buyers must carefully assess the quality of the asset and determine a fair price.

Many secondary investors aim to purchase at a discount to the asset’s stated value, referred to as a 'discount to NAV', to compensate for risk. Some take advantage of this by revaluing the asset shortly after purchase to boost short-term returns.

That said, the quality of the underlying asset remains critical. While secondaries have a place in private equity, we believe the outlook may be less favourable than recent trends may suggest.

Shrinking discount window suggests potential underperformance versus primaries

Our caution stems primarily from the principle that an investment's entry price significantly shapes its future returns. A lower entry point enhances upside potential, while a higher one constrains it.

As evidenced by 2024 and H1 2025 transaction volume data in chart 1 and forecasts for growing capital flows into the secondaries space,2 competition is intensifying as fund-raisers capitalise on growing investor interest.

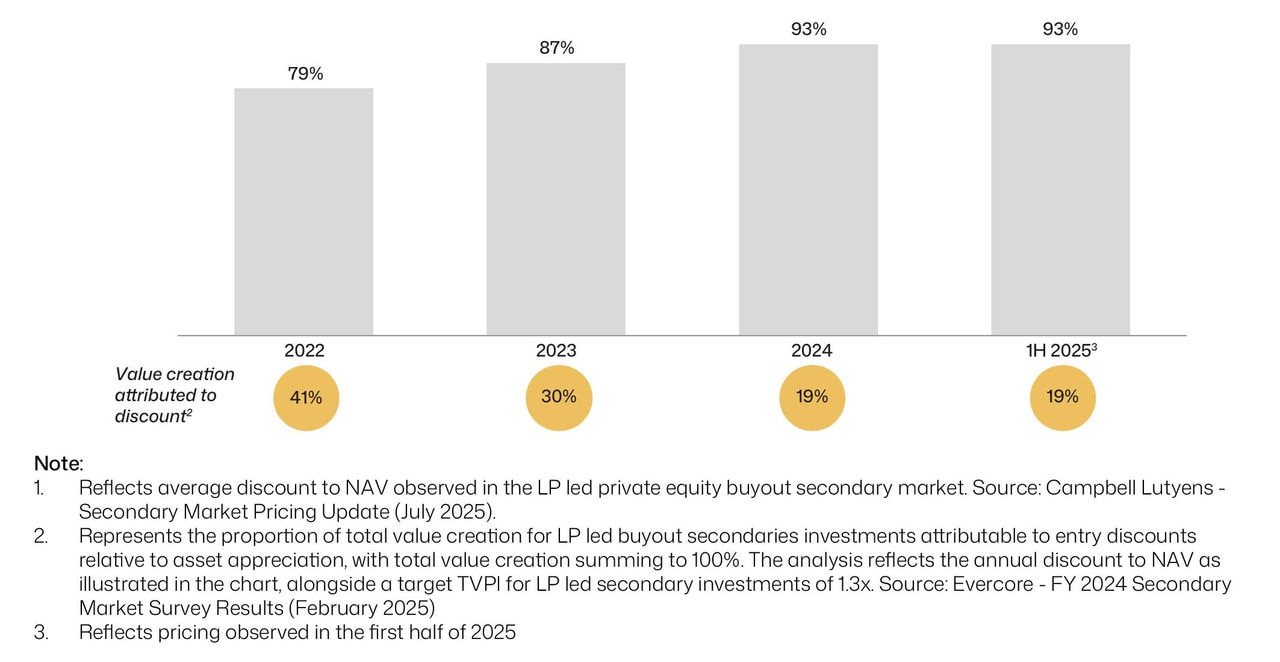

However, this heightened competition has led to a substantial narrowing of the net asset value (NAV) discounts in secondaries compared to underlying asset values from 2022 to 2024 and continuing into 2025. As a result, the value uplift from these discounts has more than halved during this timeframe (Chart 2).

Chart 2: Shrinking value creation attributable to secondaries net asset value discount

Buyout secondaries pricing (% NAV)

Moreover, research indicates average buyout secondaries pricing increased from 91% to 94% of NAV in 20243 reflecting fiercer buyer competition and diminished potential gains as prices approach fair value.

We should not be surprised by this, after all, such is the nature of market competition.

Anomalies, such as the large discount assigned to secondaries, several years ago (Chart 2) create arbitrage opportunities which draws more capital, leading to compressed margins and returns, and that’s what’s transpired.

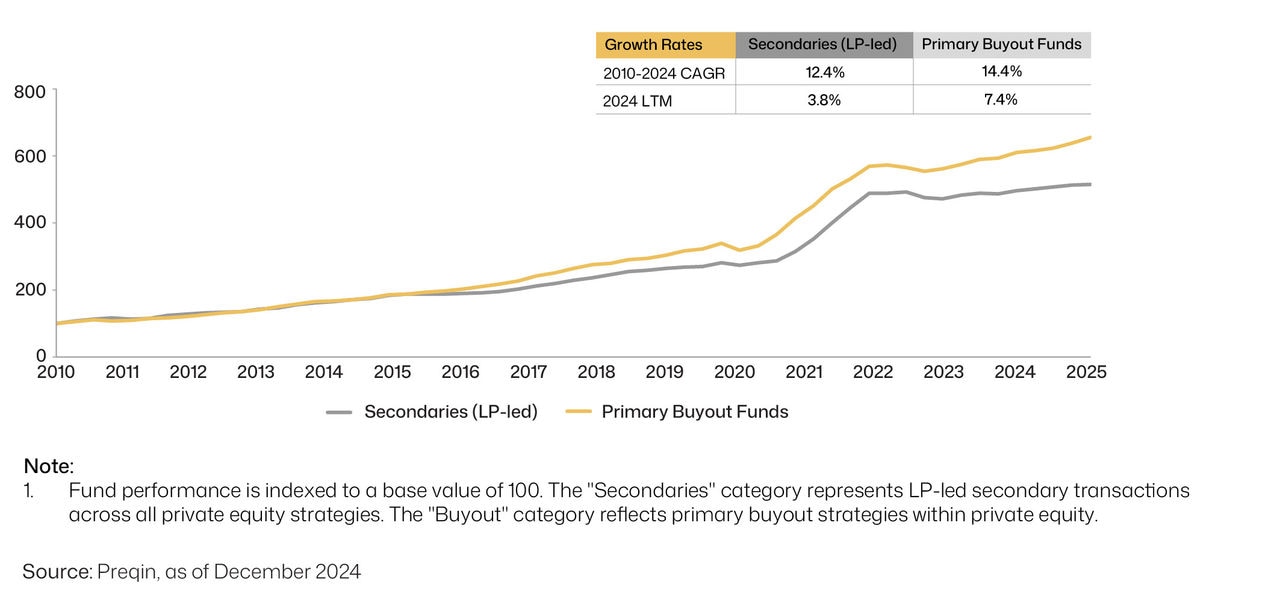

In fact, secondaries have underperformed primary buyout funds since 2010, with the gap widening notably since 2020 (Chart 3).

Chart 3: Secondaries funds’ performance has lagged primary funds’ performance

Relative performance (index to 100)

Discounts to NAV can make secondary investments seem appealing, but price alone shouldn’t drive investment decisions, in our view. Discounts often signal underlying issues, and if asset quality is poor, a lower entry price won’t necessarily improve outcomes.

Buying into a fund several years after its inception also means much of the value creation may already be reflected in the NAV, leaving limited upside unless the discount is substantial. With discounts narrowing in today’s secondaries market, the potential for outsized returns would seem to be more limited.

If secondaries offer less opportunity for value creation, primary investments, with access to new deals and full value-creation cycles, may offer a more compelling proposition.

Why primary investments can be advantageous

The key issue in today’s debate is whether the price paid in a secondary transaction fully reflects the value already created and how much potential return remains for the buyer.

Our view is grounded in our own experience as global private equity investors since 1997.

Private equity managers play an active, hands-on role in driving performance, particularly in the early stages of ownership when operational and financial improvements can have the greatest impact.

This often begins with strengthening leadership teams, addressing inefficiencies and implementing strategies to sharpen pricing, enhance sales, or digitise processes. Financial restructuring, tighter reporting and governance oversight provide further discipline and accountability.

Alongside these foundations, managers pursue growth strategies such as acquisitions, new markets and product expansion, ensuring businesses scale in both size and resilience.

The combination of operational uplift, financial optimisation, and strategic growth underpinned by strong governance is what defines the private equity value creation cycle and underscores why accessing this process from inception is so compelling, in our experience.

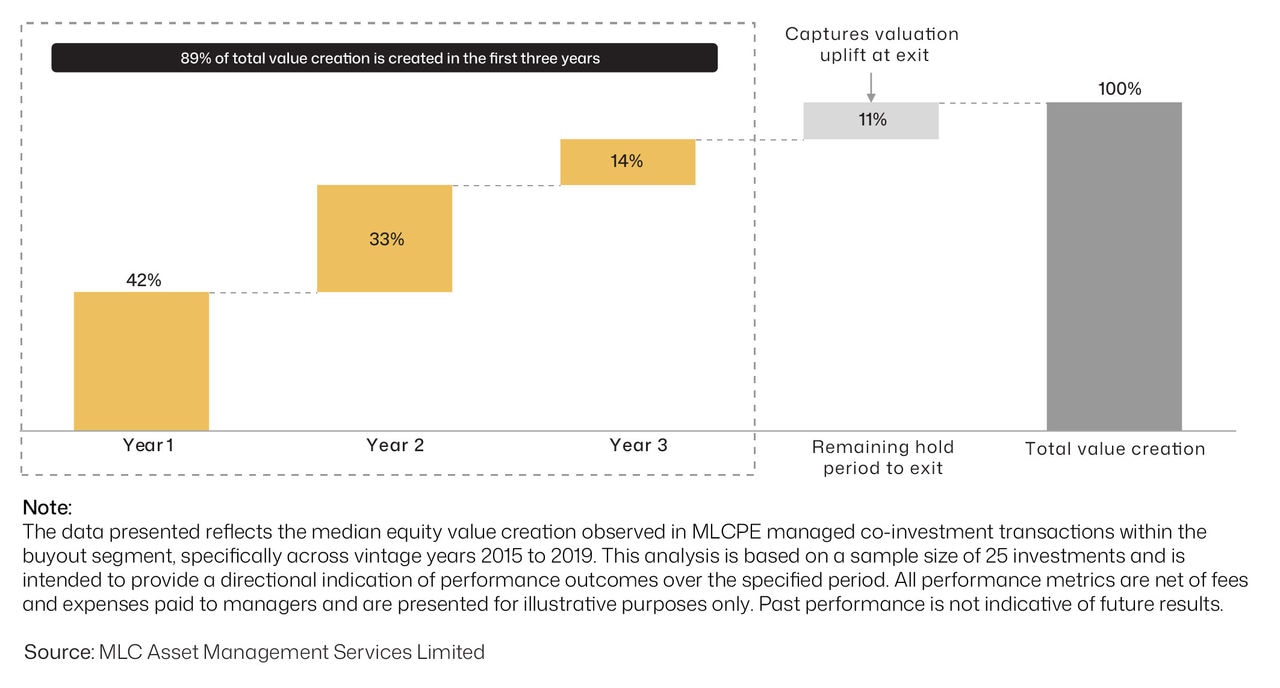

To illustrate, we examined value creation in our PE co-investments within the buyout space for vintage years 2015 to 2019. The findings are telling as we discovered that 89% of total value creation occurred in the first three years (Chart 4) leaving just 11% for the subsequent holding period until exit.

In our experience, the first institutional capital is transformative as it involves improving management, enhancing governance, aligning incentives, and accelerating the business model, often within the first 100 days.

After this foundation setting, the PE value uplift playbook rolls forward something like this: In years two and three, revenues are scaled, adjacent businesses acquired, and markets expanded. From years four to seven, the business is polished and ideally, packaged for exit.

All up, primaries can drive value creation in the early stages through hands‑on involvement, shaping growth strategy at the board level and alongside management.

Chart 4: The greatest proportion of value creation often occurs in the first three years

Total equity value created from buyout investments (% per year)

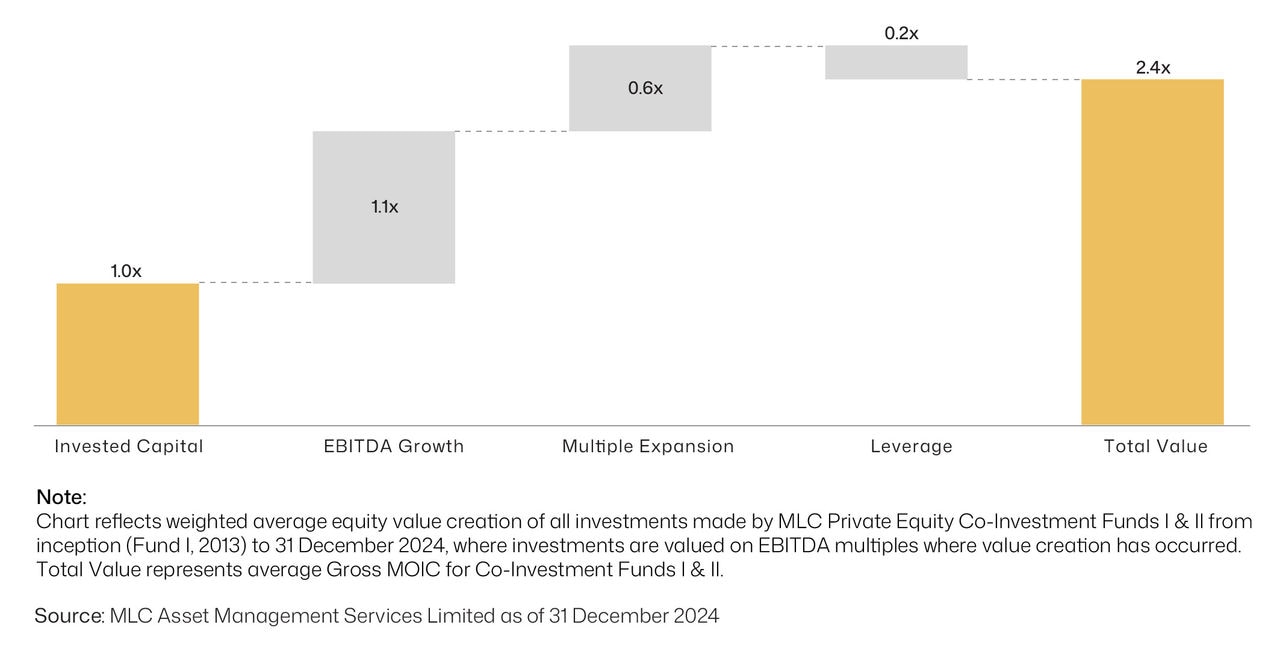

While it's often assumed that PE returns stem mainly from multiple expansion or leverage, our PE co-investment program demonstrates that operational enhancements, evidenced by Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) growth, have been the main driver of value (Chart 5).

Chart 5: EBITDA growth has been the cornerstone of value creation in our PE co-investments

Source of mid-market private equity value creation

Furthermore, multiple expansion has become harder to rely on as is leverage given interest rate volatility over a typical seven-year holding period.

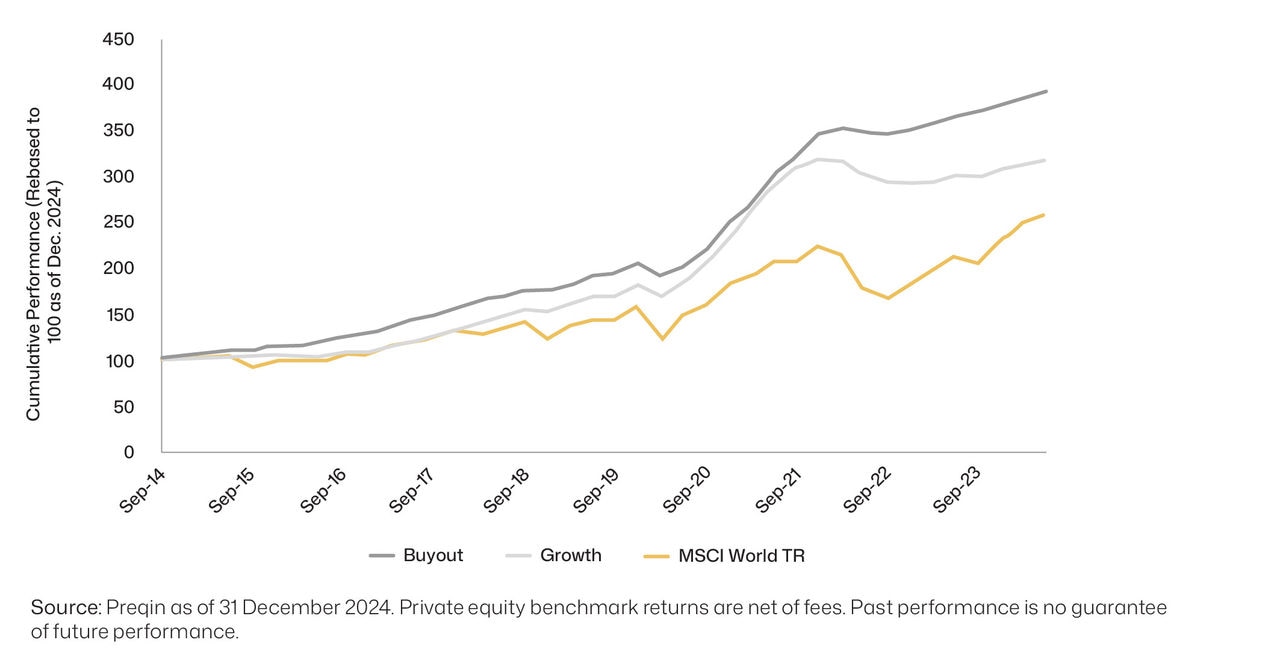

Primaries have outperformed over the long-haul

Our inclination toward primaries is informed not only by the strong outcomes from our primaries and co-investments-focused approach but also by the upbeat historical performance of PE primaries overall.

The Preqin Buyout index generated 20-year annualised returns of 14.8% (as of Q3 2024) versus the MSCI World 20-year annualised return of 9.2% (Chart 6).

As with investing generally, we believe diversification is key to building a sound PE primaries-dominant program. In the context of building a private equity portfolio, we emphasise diversification across a variety of private equity investment attributes, such as strategies, industries, vintages, geographies and managers.

Chart 6: PE Buyout and Growth categories have outperformed global listed shares

Performance of Preqin Buyout and Growth indices versus MSCI World

Key to unlocking primary performance: Importance of manager selection

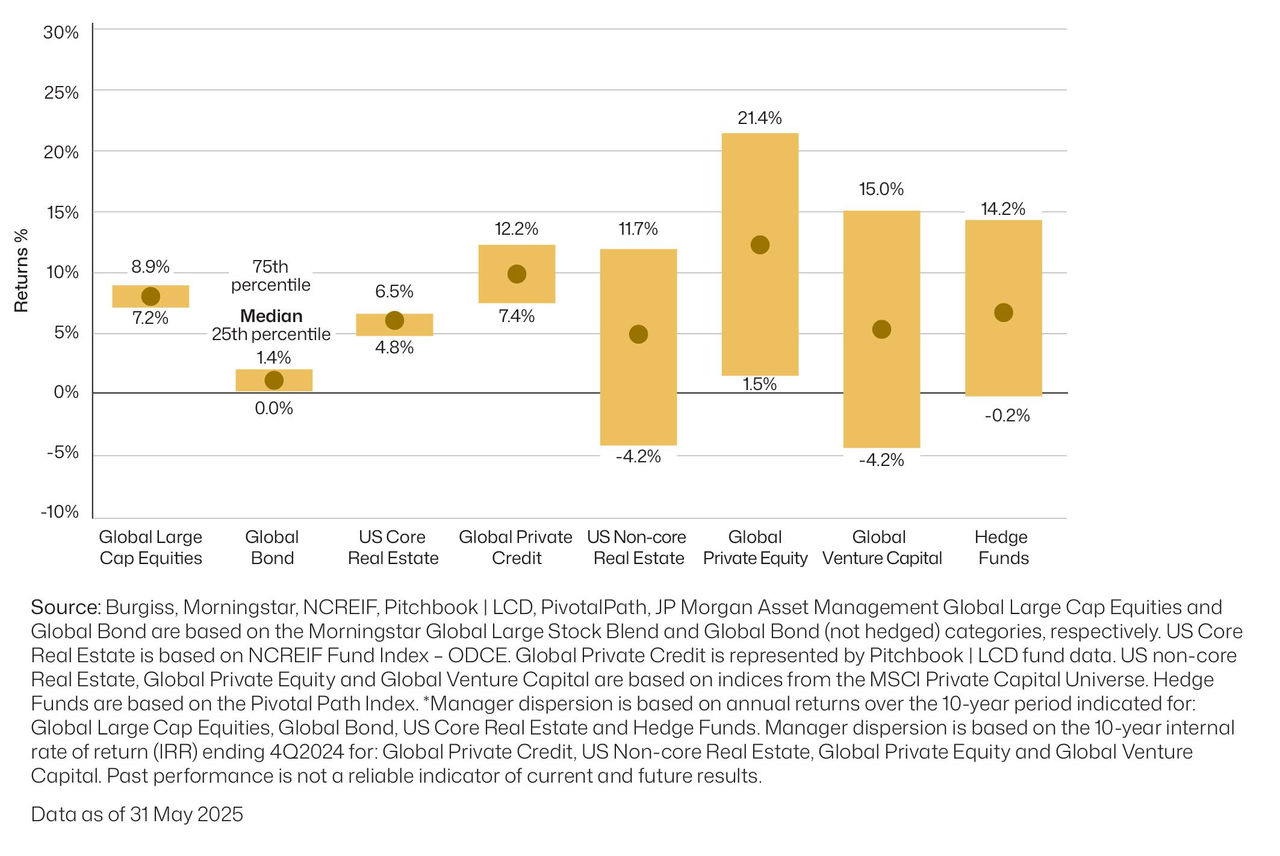

It can be easy to be beguiled by returns shown in Chart 6 but extra vigilance needs to be exercised in PE investing because manager selection is more important than usual in the private equity arena.

Just as not all companies are equal, not all PE managers are equally capable with JP Morgan data revealing an almost 20-percentage-point performance differential between the top-performing private equity managers and the bottom-performing managers in Chart 7, a dispersion almost 12 times wider than in listed global large cap equities.

We believe this places an usually high onus on the importance of deep relationships with the world’s most capable PE managers and being connected within the industry. The PE landscape is relationship-driven, and top performers are often inaccessible to newcomers, preferring established partners.

Chart 7: PE managers’ dispersion of returns far exceeds public equity managers’ performance dispersion

Median, top quartile, bottom quartile performance dispersion of private and public investment managers (based on returns 1Q 2015 – 1Q 2025)*

In our view, superior managers exhibit certain traits that drive their success:

- Better deal sourcing. Without public data on private firms, networks and relationships are vital. Seasoned managers with broad connections are better placed to identify, negotiate and secure premium opportunities, fostering a positive feedback loop as their track record improves.

- More favourable entry valuations. Skilled managers can source propriety deals and negotiate better terms and valuations, enhancing return profiles and cushioning against underperformance.

- Potential for value creation through industry specific specialist PE managers. Many PE deals involve revitalising businesses through operational upgrades, margin improvements, strategic growth and talent enhancements, where specialist managers excel. Specialist managers with industry backgrounds, bring domain experience to the investee company thereby creating the potential for faster and more enduring value creation.

Beyond the benefits already mentioned, we believe long-term primary investing offers several other advantages:

- Access to first-time fund managers: Our broad network across private equity allows us to support emerging managers, often teams we've previously worked with or monitored for a long time. This early backing enables us to negotiate favourable terms as an anchor institutional investor.

- Industry influence: Our established presence means we serve on advisory boards across multiple firms, positioning us as trusted partners. This influence allows us to provide strategic input on investments, exits, and other key decisions of the firm.

- Accessing new emerging secular themes: We identified early-stage themes, such as the humanisation of pets, specialist healthcare consolidation, energy efficiency, and the circular economy, that may take years before opportunities arise in the secondary market to invest in them

Ultimately, this isn’t about choosing primaries over secondaries, or vice versa, but about taking a disciplined approach to private equity.

In our view, primary investments offer core exposure and greater value-creation potential, while secondaries can play a ‘supporting’ role in a well-constructed PE program. Despite growing interest in secondaries, we believe the evidence supports prioritising primary commitments.

References

1 williamblair.com/-/media/downloads/ib/2025/williamblair-pca-secondary-market-report-survey-march-2025.pdf

2 williamblair.com/-/media/downloads/ib/2025/williamblair-pca-secondary-market-report-survey-march-2025.pdf

3 https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf

Important information

The information in this document has been prepared for Australian residents only and not for residents of any other jurisdiction.

This document has been prepared by MLC Asset Management Pty Ltd ABN 44 106 427 472, AFSL 308953 ('MLC Asset Management' or 'we'), a member of the group of companies comprised Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (‘Insignia Group’) The information in this document is intended for wholesale clients (as defined under the Corporations Act 2001 (Cth) in Australia. An investment with MLC Asset Management does not represent a deposit or liability of, and is not guaranteed by, the Insignia Group. The information in the document is of a general nature only, it is not investment advice. The information in this document does not constitute to any offer, invitation or solicitation in respect to any financial product or service. Opinions constitute our judgement at the time of issue and are subject to change. Neither MLC Asset Management nor any member of the Insignia Group, nor their employees or directors give any warranty of accuracy or reliability, nor accept any responsibility for errors or omissions in this document. In some cases the information in this document has been provided to us by third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. Any reference in this document to a specific company, security, asset or any other investment is for illustrative purposes only and should not be taken as a recommendation to buy, sell or hold that investment. Past performance is not a reliable indicator of future performance. Any projection or other forward looking statement (‘Projection’) in this communication is provided for information purposes only. Whilst reasonably formed, no representation is made as to the accuracy of any such Projection or that it will be met as actual events may vary materially.