January 2026 | ![]() 10 min read | Download PDF

10 min read | Download PDF

Bob Cunneen, Senior Economist and Portfolio Specialist

“2025 proved to be a positive year for share investors but required perseverance and resilience.”

Global shares made record highs but Australian shares were stragglers on the ascent

Global shares delivered strong returns in the past year. Optimism on ‘Artificial Intelligence’ (AI) and lower interest rate settings in Europe and the United States were the key drivers for rising share prices. These strong share gains come despite the tragic Russian-Ukraine War as well as the conflicts in the Middle East.

Global shares (hedged) recorded a remarkable 19.7% return for the year. Notably, the highest performing share indices were not based on Wall Street’s hype but were in Asia. Korean shares with a 95.6% return led the charge while Hong Kong (35.1%), Taiwan (33.3%) and China (30.5%) also delivered impressive gains in local currency terms.

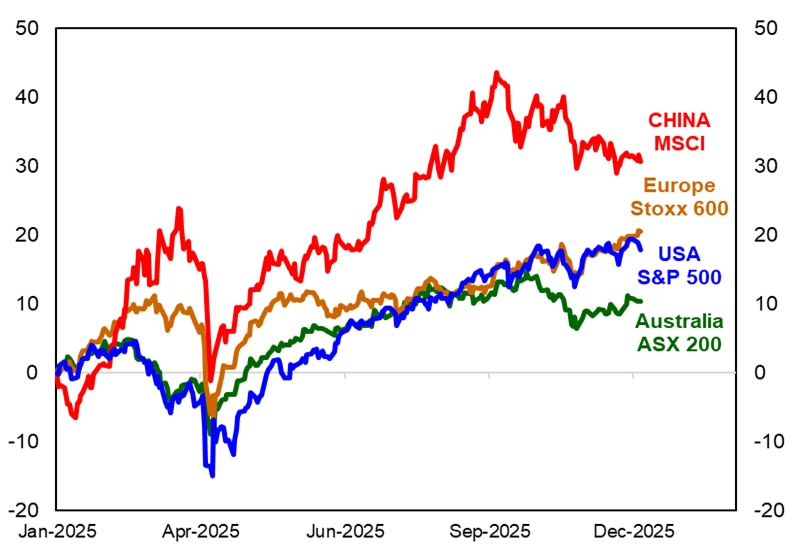

European shares also managed to outperform Wall Street with a 20.6% gain compared to the S&P 500 17.4% annual return (see Chart 1). The returns from Australian shares at 10.7% (ASX 300) were solid but trailed the rest of the world.

Chart 1: Global share total returns in 2025

Source: Refinitiv, MSCI and S&P Global

Yet 2025 proved to be a rollercoaster ride for global share markets. From his first day in the White House threatening Canada and Mexico to the impositions of a 145% tariff on China, 20% for Europe and 10% for Australia, President Trump has been influential. Initially global share markets went into a tailspin in March and April 2025. Fortunately, President Trump announced a pause on tariffs on 9 April which proved to be a turning point allowing a global share recovery.

Enthusiasm for technology has been the key positive driver of 2025 returns for global shares. The largest AI chipmaker, NVIDIA, delivered a 39% annual price increase and ended the year as the world’s most valuable company. Korea’s Samsung Electronics 125% annual price gain, a 44% price surge for Taiwan Semiconductor and Europe’s ASML 36% gain display that the exuberance for technology is a global mania and not just a US fad.

Table 1: Asset class returns in Australian dollars – periods to 31 December 2025

| Asset class | Returns | |||

|---|---|---|---|---|

| 1 year | 3 yrs (pa) | 5 yrs (pa) | 10 yrs (pa) | |

Cash |

4.0% |

4.1% |

2.7% |

2.1% |

Australian bonds |

3.2% |

3.7% |

-0.4% |

2.0% |

Global bonds (hedged) |

4.4% |

4.0% |

-0.6% |

2.0% |

Global high yield bonds (hedged) |

8.1% |

8.0% |

3.0% |

5.4% |

Global listed infrastructure (hedged) |

11.4% |

7.4% |

6.7% |

7.3% |

Global property securities (hedged) |

7.5% |

6.0% |

3.1% |

3.0% |

Australian shares |

10.7% |

11.4% |

9.8% |

9.3% |

Global shares (unhedged) |

13.6% |

21.3% |

14.5% |

12.7% |

Global shares (hedged) |

19.7% |

19.7% |

11.2% |

11.2% |

Emerging markets (unhedged) |

24.0% |

17.1% |

7.3% |

9.4% |

Past performance is not a reliable indicator of future performance.

Sources: FactSet, MLC Asset Management Services Limited. Benchmark data: Bloomberg AusBond Bank Bill Index (cash), Bloomberg AusBond Composite 0+ Yr Index (Aust bonds), Bloomberg Global Aggregate Bond Index Hedged to $A (global bonds), Barclays US High Yield Ba/B Cash Pay x Financials ($A Hedged) (global high yield bonds) FTSE Global Core Infrastructure 50/50 Index Hedged to $A, FTSE EPRA/NAREIT Developed Index (net) hedged to $A (global property securities), S&P/ASX300 Total Return Index (Aust shares), MSCI All Country World Indices hedged to $A and unhedged (net) (global shares), and MSCI Emerging Markets Index (net) unhedged to $A (emerging markets).

By contrast, Australia’s key technology companies were ‘could have beens’ in 2025. Wisetech recorded a painful -43% price fall while Xero declined by -32%. This is a key factor behind Australia’s broader share market failing to match global counterparts. There was also disappointment with a previous star in CSL whose price declined by -39%.

Australian bonds annual returns in 2025 were modest at 3.2%. Even with the support of the Reserve Bank of Australia (RBA) cutting the cash interest rate three times from 4.35% to 3.60%, the revival in Australia’s inflation in the final months of the year caused consternation. Bond markets began to contemplate that the RBA could be raising interest rates in 2026 to reduce inflation.

Global bonds (hedged) delivered a more reasonable 4.4% annual return. Bond markets have experienced turbulence in the past year given the shifting sands on economic activity, inflation and political risks. Yet the benefit of lower interest rate settings by the American and European central banks provided the beneficial tailwind. Global high yield bonds (hedged) made a very strong 8.1% annual return as investors considered that the elevated yields available are attractive for income despite very narrow credit spreads.

Global economy is mixed but proved resolute to President Trump’s tirades

Global economic activity has been ‘multi-speed’ in the past year. The US economy has been the key source of strength. American technology companies have ramped up business investment in a spectrum of assets including advanced computer chips and large data centres for information storage. Notably, the US economy recorded annual gross domestic product (GDP) economic growth of 2.3% in the year to September 2025 compared to potential growth estimates of around 1.8%. Consumer spending has been solid given the benefit of Wall Street’s gains as well as Congress making permanent the large income tax cuts from President Trump’s first term in the White House back in 2017. Most American consumers have even shrugged off the higher prices imposed by President Trump’s tariff increases but the impact is more severe for low-income families.

Yet there has been signs of weakness with US jobs growth softening and the unemployment rate rising to a four year high of 4.6 %. The US central bank cited that the “downside risks” to the US job market were a key reason for cutting interest rates in 2025.

European economic growth has gradually picked up speed to 1.6% for the past year. Yet Germany has continued to struggle with only 0.3% annual growth given weaker global demand for their conventional luxury cars compared to China’s vast array of cheaper electric vehicles.

China’s economic growth at 5.2% in the past year appears impressive but there is a harsher reality beneath the surface. China’s consumer spending remains subdued given the weakness in the residential property market. Falling property construction and apartment prices have undermined confidence in China’s long term growth prospects. China is also being challenged by President Trump’s tariff agenda which has the potential to damage China’s exports. China so far has managed to find other destinations for its exports.

Amongst Australia’s other major trading partners, economic growth has also been more encouraging. India’s economic growth at 8.3% is the strongest amongst major nations and illustrates India’s long-term potential.

Australia’s economy has experienced improved consumer spending, modest jobs growth and a stable unemployment rate around 4.3% in 2025. However, consumer inflation remains high and persistent. Australia enters 2026 with the possibility that the central bank may need to raise interest rates to cool inflation.

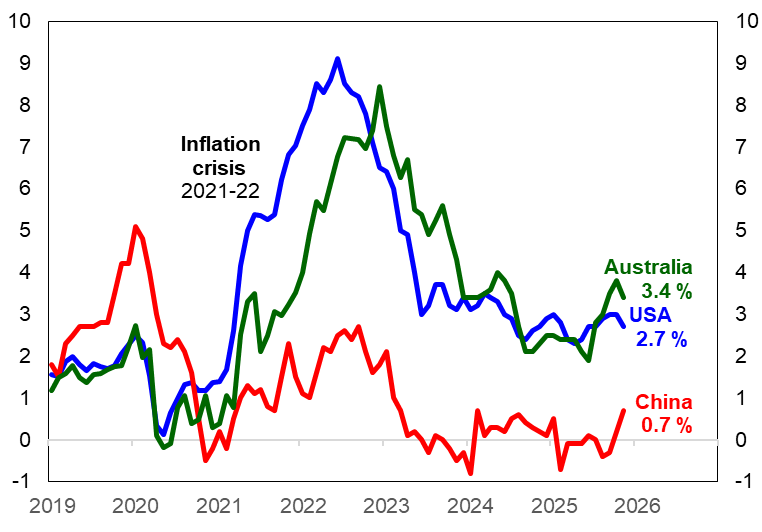

Inflation is still a concern to consumers

While global inflation has generated less headlines in the past year, prices are still a worry for the consumer. The “Cost of Living Crisis” that dominated 2021 and 2022 seems perpetual, as we are all still paying persistently high prices for the basics of food, health care and housing. Even the modern necessities of chocolate and coffee have become luxuries given the price surge over the past year.

Inflation in the United States has been stable around 3% for the year. Considering that President Trump’s tariffs are a tax that directly raise prices, the stable US inflation appears to have surprised. However, tariffs are a long-term challenge that ultimately raise consumer prices, distort economic activity and damage productivity. The full tariff pain for the US consumer is yet to come. Fortunately for the global economy, China continues to be a source of cheaper good prices as the ‘factory to the world’. However, China’s future role in producing low-cost goods is also questionable given President Trump’s agenda to contain China’s rise.

Chart 2: Global consumer inflation

Source: Australian Bureau of Statistics, US Bureau of Labor Statistics, China National Bureau of Statistics.

Australia’s inflation has proven more persistent and troubling at 3.4% in the year to November 2025. Notably, the key basic services such as education (5.4% annual inflation), health (3.6%) and housing (5.2%) all show persistent price pressures. Electricity costs have surged 19.7% in the past year as state government rebates have come to an end. Indeed, 2026 appears to offer another spark in electricity charges. The Federal Government announced in December 2025 that their electricity rebate program would also switch off.

The past year has also provided dramatic and terrible events. The Middle East remains cursed by violence as witnessed by the Gaza conflict and the Israel – Iran war in June 2025. Russia’s devastating invasion of Ukraine in 2022 is still casting a dark shadow over Europe and remains a threat to energy security and political stability. The economic importance of these conflicts is that these could intensify rapidly and serve as a threat to global oil supplies. Both Iran and Russia are large oil producers. While most of the current Iranian and Russian oil supply typically goes to China and India, any further turmoil could generate higher global oil prices and inflation.

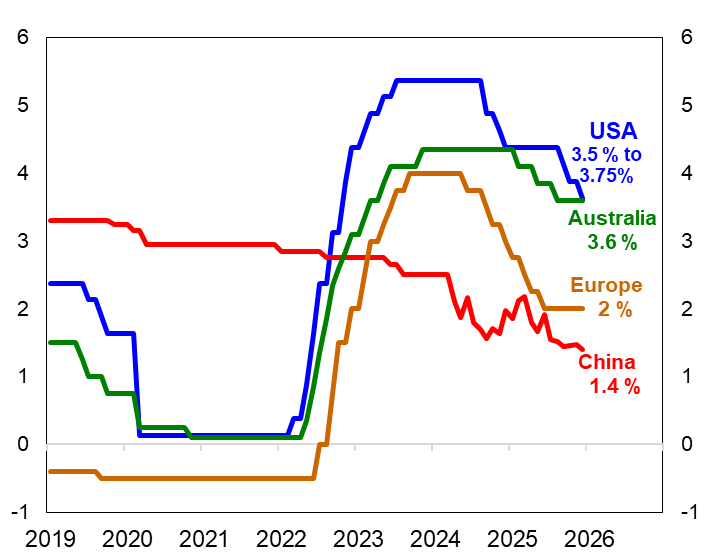

Lower interest rates have been a tailwind for investment markets

Investors have taken encouragement from falling global interest rates (Chart 3). Most central banks lowered their cash interest rates in 2025 given that inflation is now near their circa 2% targets.

Chart 3: Global interest rates

Source: Reserve Bank of Australia, US Federal Reserve, European Central Bank and People’s Bank of China

The US Federal Reserve and the RBA were the most assertive with 0.75% in interest rate reductions in 2025. Yet this is really a catch-up to the sharper interest rate cuts in China and Europe in financial year 2024-25. For the US Federal Reserve, the key motivations have been criticism by President Trump on “high interest rates” and the realisation that US jobs growth was slowing down.

The RBA cut interest rates by 0.25% in February, May and August. This was primarily driven by Australia’s lower inflation results earlier in the year. Australia’s annual inflation fell to only 1.9% in June 2025. However, since then the inflation ‘tea leaves’ and ‘coffee shots’ have left a bitter taste with rising prices. The most recent commentary from the RBA indicates concern that Australia’s inflation is proving “more persistent”. Accordingly, the RBA Board has remarked that “an increase in the cash (interest) rate might need to be considered at some point in the coming year.”

Global prospects

Enthusiasm for AI and technology were the key factors supporting rising global share prices in the past year. Lower global inflation has also allowed central banks to selectively cut interest rates which has also been favourable. Typically, a lower interest rate environment can boost corporate profits and thereby share prices.

Investors have also taken the view that US President Trump’s agenda for tariffs is ‘more bark than bite’. Both Europe and Japan have agreed to a 15% tariff with President Trump. However, China and the US are still negotiating on tariffs. Until a formal agreement is signed, investors should be cautious.

Global share markets are also challenged by considerable global political risks. The Russian-Ukraine war remains an ominous cloud over Europe’s security. The precarious Middle East political climate is also a major potential threat to global oil supplies.

Australia’s economic prospects are vulnerable to political tensions between China and the US. Given China is the key export destination for circa 30% of Australian exports, the relationship between Beijing and Washington is critical to Australia’s national income and security. Tensions over tariffs or Taiwan would be a major challenge to Australia’s economy and share market prospects.

Australian consumers are also still challenged by persistent inflation. The Federal Government’s recent announcement that electricity rebates have ended as well as persistent price pressures in food, health and housing indicate the ‘Cost of Living crisis’ is continuing. There is a chance that the RBA may feel compelled to raise interest rates in 2026 to reduce inflation.

Given these complex and significant risks, investors should maintain a disciplined and diversified strategy.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLC), part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

This information may constitute general advice. It has been prepared without taking account of an investor's objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation, and needs.

Past performance is not a reliable indicator of future performance. Share market returns are all in local currency.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions, or recommendations are held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice), or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm's length basis. MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.