November 2025 | ![]() 8 min read | Download PDF

8 min read | Download PDF

Dan Farmer, Chief Investment Office

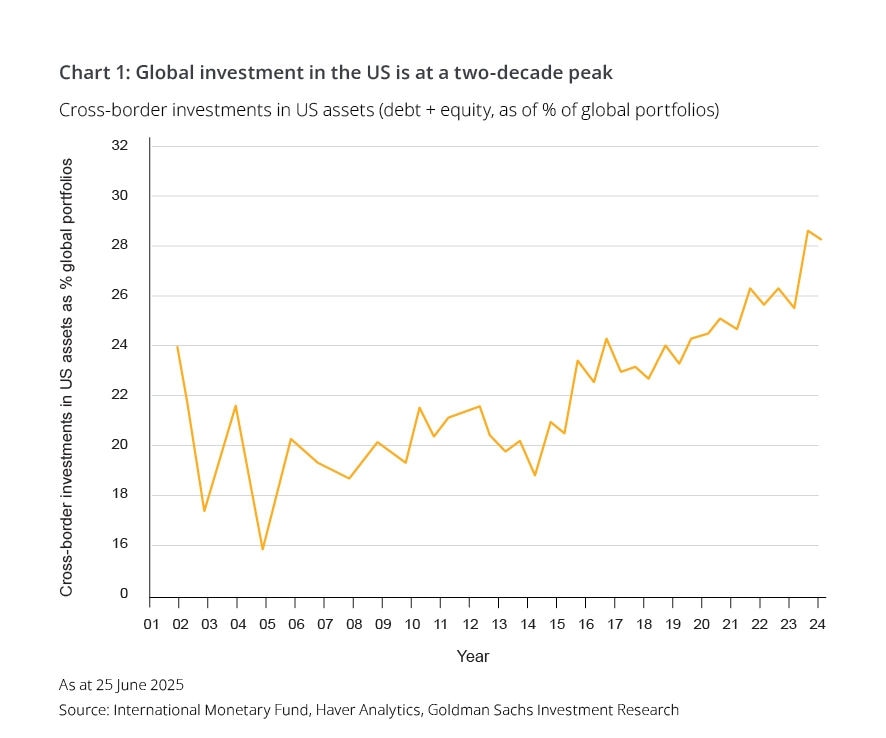

The gravitational pull of the United States’ capital markets continues to attract global investors. Despite some unease over Washington’s policy gyrations, cross-border investment in the US is at a two-decade peak (Chart 1).

Reports of the death of US exceptionalism, at least those relating to its markets, would appear to be exaggerated. High-profile economist and commentator, Nouriel Roubini, for one, asserts that the US leads in 10 of the 12 sectors poised to shape the next economic era, including artificial intelligence, robotics, quantum computing, biotechnology, aerospace, and space exploration.1

China, by contrast, is deemed to lead only in electric vehicles and some segments of clean energy technology.2

The US remains a hub of innovation, drawing investors desiring exposure to cutting-edge industries.

The critical question is not whether to invest in the US — its appeal is undeniable — but how much to allocate and what value to place on its industries, companies, and asset classes.

While we continue to view the US as a compelling destination for client capital, we are increasingly identifying attractive opportunities elsewhere, particularly in emerging markets, as discussed later in this note.

US market over-reliant on technology heavyweights?

It’s understood that future investment returns hinge significantly on the entry price.

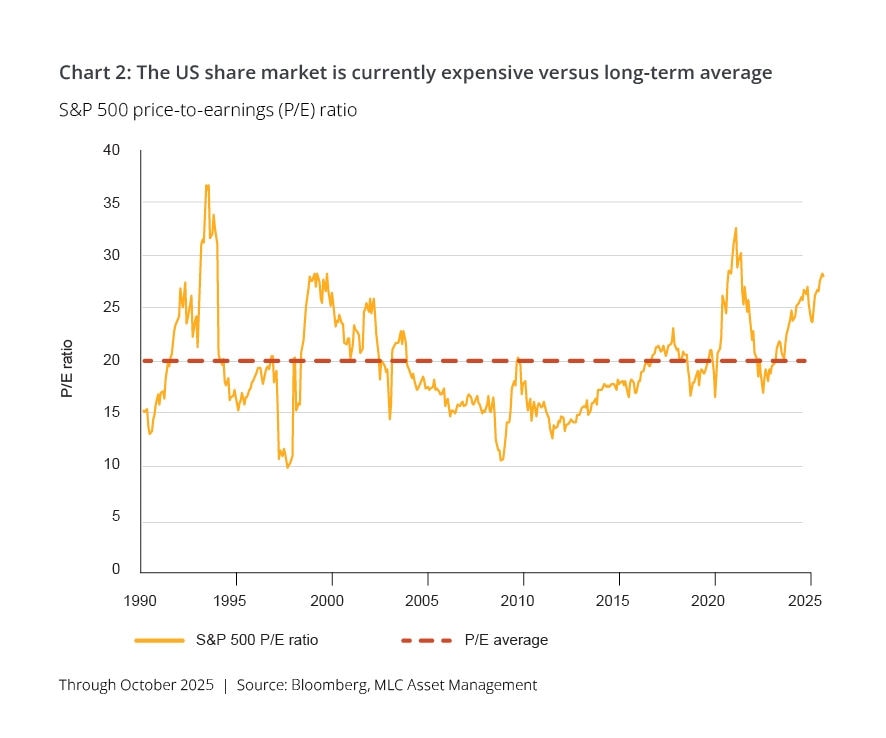

Currently, the US equity market, as measured by the S&P 500, trades at a sizeable price-to-earnings ratio premium versus the average since 1990 (Chart 2). This premium suggests that future returns may underperform compared to purchasing at or below long-term averages.

A closer look reveals that a disproportionate share of the S&P 500’s rise stems from the Magnificent Seven — Apple, Microsoft, Alphabet (Google’s parent company), Amazon, Meta Platforms (Facebook’s parent company), Nvidia, and Tesla. These companies accounted for over half of the S&P 500 index’s 58% total return (in USD terms) from 2023 to 2024.3

Their collective P/E ratios average out to roughly 33.3,4 an elevated figure but potentially justified by their strong profit margins, dominant market positions, and high-quality offerings.

That said, these lofty valuations capitalise high expectations requiring sustained outperformance to justify further price appreciation — a tall order, in our view.

Recall that Nvidia’s share price slipped in late August despite exceeding revenue and earnings forecasts as investors fixated on slightly weaker-than-expected data centre performance and absent H20 chip sales to China.5

“Priced for perfection” seems to convey Nvidia’s status and that of other market darlings.

So, what’s the picture for the 493 companies in the S&P 500, outside the Magnificent Seven?

The remaining 493 S&P 500 companies trade at an average P/E of around 22, well above the historical S&P 500 average of 17 (Chart 2). This contributes to the index’s overall high valuation and signals caution for forward returns, we believe.

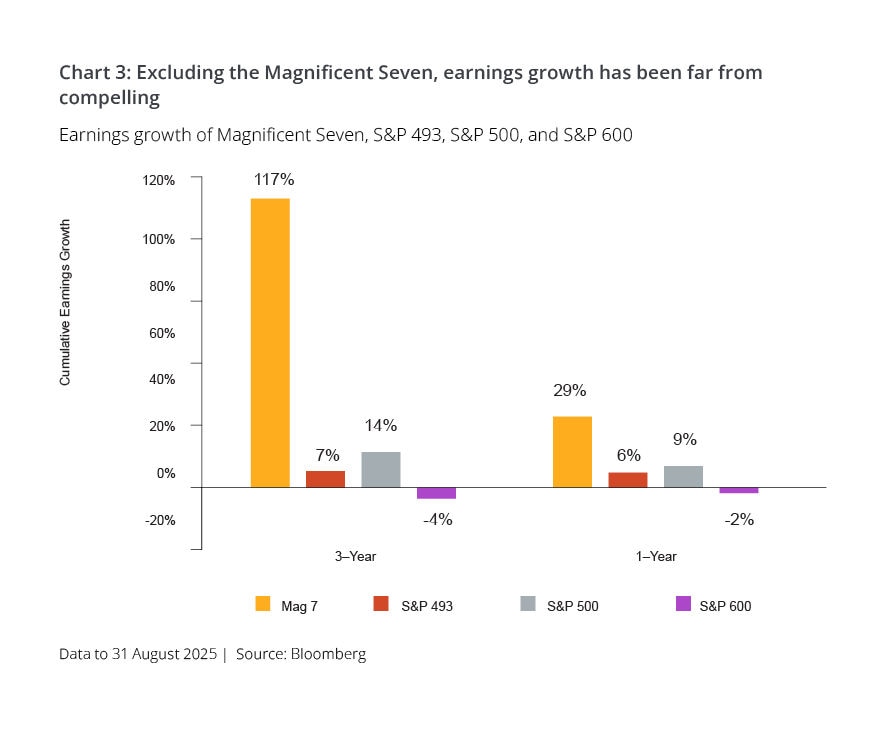

A disparity in earnings growth further underscores this concern, with the Magnificent Seven driving the lion’s share of the index’s earnings, while the broader S&P 493 has lagged markedly (Chart 3).

Additional data underscores the market’s dependence on a narrow set of drivers. Since ChatGPT’s launch in November 2022, AI-related companies have contributed 80% of the S&P 500’s earnings growth and 90% of its capital expenditure growth.6

AI spending accounted for about 0.5% of US GDP in the first half of 2025, or one-third of total growth.7 Without AI, GDP growth would have been closer to 0.9%. By the end of 2026, AI spending could represent 40–50% of GDP growth.8

If AI spending slows, the outcomes may be sobering for US stocks, in aggregate, as well as the economy.

Passive investing and market concentration risks

There’s been a lot of airplay in recent years about the growth of passive investing. We are not anti-passive investing. Far from it.

Our approach embraces active, passive, and smart beta strategies, with passive investments included in some of our diversified portfolios for cost-effective, broad market exposure.

However, risks should be kept in mind when investing passively, particularly in the current US market environment where passive strategies account for about 54% of exchange-traded funds (ETFs) and mutual funds.9

Passive investors are by definition indifferent to valuations, and have amplified the rise of technology stocks, particularly the Magnificent Seven, as their earnings and multiples have expanded.

Passive investing can be thought of as a momentum strategy and it does raise the question of what may occur if there is a sharp market drawdown.

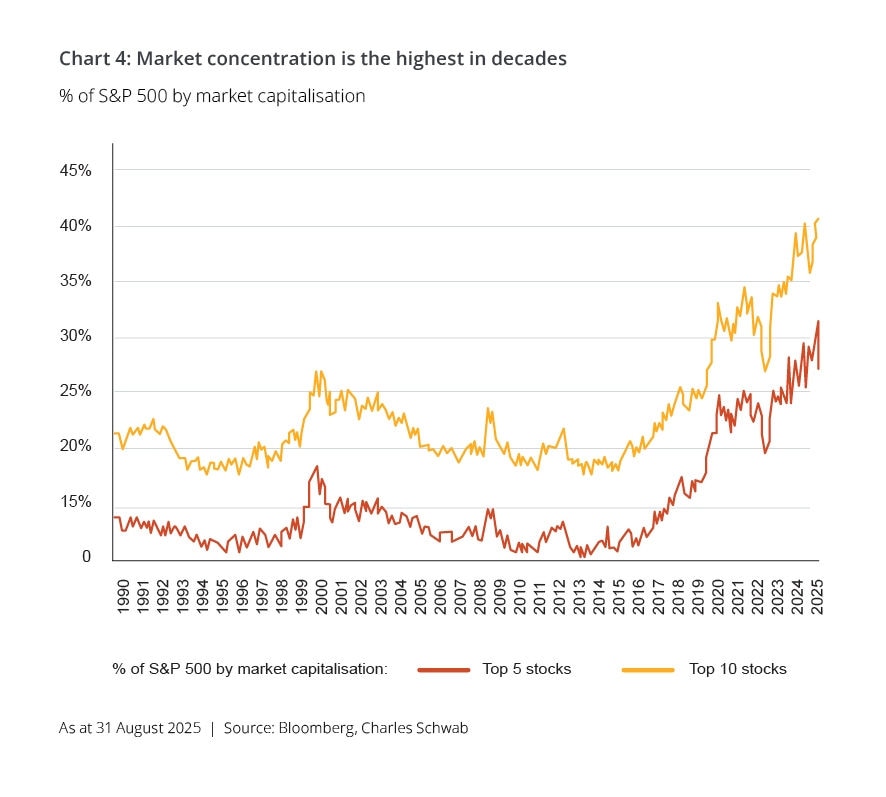

The S&P 500’s earnings and valuations are increasingly tied to a small cohort of companies fuelling an AI-driven capital expenditure cycle. This concentration reduces the diversification benefits of passive investments (Chart 4). In periods of market stress, over-reliance on a handful of dominant firms could undermine portfolio resilience.

Embracing global investment opportunities

As strong proponents of diversification, we believe now is an opportune time to explore equity opportunities beyond the US to complement existing exposures.

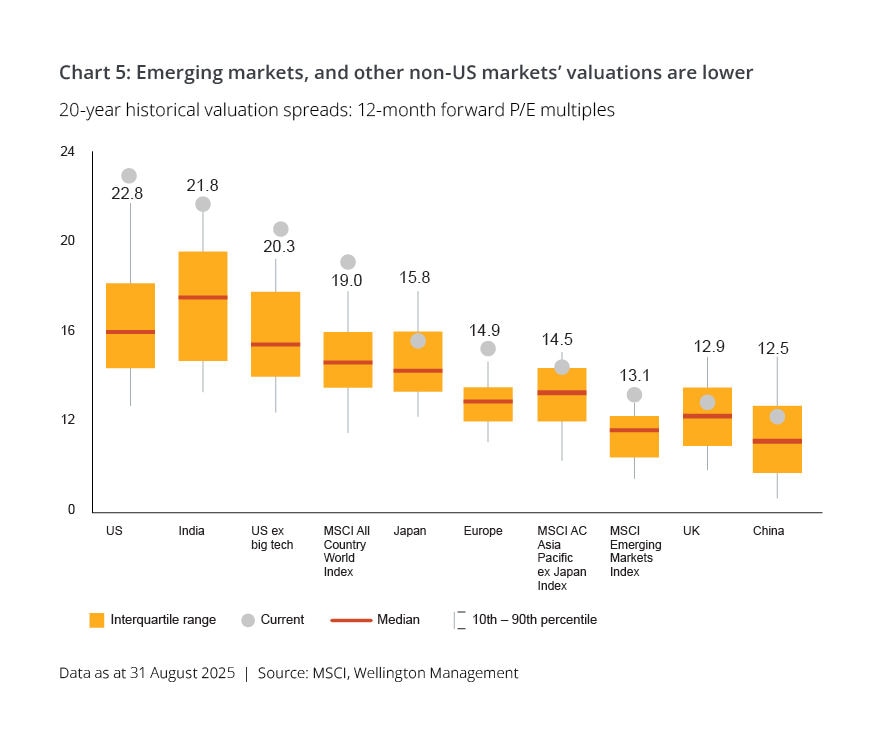

Non-US equity markets, including emerging markets, trade at lower valuations than their US counterparts (Chart 5). While a valuation discount alone does not justify investment, it serves as a starting point for deeper analysis.

Non-US equities, including emerging markets, have been out of fashion for some time and it’s always difficult to pinpoint what may catalyse greater investor interest in markets beyond the United States.

In earlier decades — specifically the 1970s, 1980s, and 2000s — non-US equities, as represented by MSCI EAFE (Europe, Australasia, and the Far East), delivered stronger average annual earnings growth than the S&P 500.10 If new market drivers emerge, it’s not unreasonable to expect a changing of equity market leadership.

For now, active managers, like ourselves, can capitalise on this by identifying quality businesses with underappreciated earnings potential across global markets. Investors open to diverse risk profiles may find opportunities in a broadening of equity return drivers.

Emerging markets are worth a look

In our view, emerging markets present fertile ground for selective stock picking. China, which constitutes around 30% of the MSCI Emerging Markets Index,11 offers reasons for cautious optimism.

Despite the struggles of its real estate sector, China’s economy is diversifying, with growth in services, electric vehicles, AI, robotics, high-end manufacturing, and green energy creating compelling investment prospects.

Emerging markets also provide technology exposure at lower valuations than US tech leaders, with the technology sector comprising about 25% of the MSCI Emerging Markets Index.12 Asian technology, hardware, and IT firms are, we believe, well-positioned to benefit from consolidation and structural demand from hyperscalers.13

The healthcare sector in emerging markets is another area of innovation, with drug discovery rivalling Western companies in speed and quality.14

Additionally, demand for commodities such as palm oil, cocoa, copper, and precious metals should support exporting emerging markets and their companies.15

While emerging markets are more volatile than developed markets, their current valuation discount to developed market equities (Chart 5) suggests a reasonable risk-reward trade-off for investors willing to tolerate the associated risks.

Our asset allocation for these times

We maintain a modestly pro-risk stance, underpinned by supportive central bank policies, resilient corporate fundamentals, and improving economic growth signals. Given elevated US equity valuations, we are increasing allocations to non-US equity markets, with a particular focus on emerging markets.

Corporate balance sheets remain reassuring, with strong interest coverage, but tight public credit spreads temper our enthusiasm for this asset class. Private credit offers attractive risk-adjusted returns through disciplined mid-market lending. Nevertheless, we have a broadly neutral stance in private credit too as we think other unlisted asset classes offer better opportunities during this cycle.

Select real estate sectors, such as industrial properties tied to digitisation and logistics, remain important parts of our diversified holdings. We are also increasingly optimistic about domestic retail, particularly neighbourhood shopping centres, and opportunistic global real estate assets acquired at discounts with value-add potential.

In fixed income, we think a short duration position is sensible as long-end yields will likely trend higher as the global economy softly lands in 2025 and transitions back into expansion in 2026.

As disciplined, long-term investors, we adjust portfolios gradually, avoiding abrupt shifts.

Our active management approach is grounded in a strategic, long-term asset allocation framework, complemented by shorter-term economic and asset class return analyses. By incorporating multiple scenarios for market and economic outcomes, we avoid relying on a single forecast, enabling us to navigate a wide range of potential futures.

1 Roubini, Suggests Rare Optimistic Outlook for the U.S. Economy | The WealthAdvisor, May 1, 2025

2 Ibid

3 Oaktree Insights: The roundup. September 2025 edition. Top takeaways from Oaktree’s quarterly letters

4 Ibid

5 Nvidia Earnings: Why Did Shares Fall After a Beat? | EBC Financial Group

6 docu-202510-fundamental-equity-quarterly.pdf

7 Ibid

8 Oaktree Insights: The roundup. September 2025 edition. Top takeaways from Oaktree’s quarterly letters

9 Market Concentration Risks | Charles Schwab September 15, 2025

10 Reevaluating Regional Diversification: The Case for Non-US Stocks | AB 27 June 2025

11 Why It’s Time for China Equity to Go Solo | State Street September 29, 2025

12 MSCI Emerging Markets Index September 30, 2025

13 (Re)emerging-markets: 10-reasons for optimism | Wellington Australia Institutional August 20, 2025

14 Ibid

15 Ibid

Important information

This communication is issued by MLC Investments Limited ABN 30 002 641 661 AFSL 230705, IOOF Investment Services Ltd ABN 80 007 350 405 AFSL 230703 and OnePath Funds Management Limited ABN 21 003 002 800 AFSL 238342 each in their capacity as responsible entity and trustee of the various funds issued by them. These entities are part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information and commentary provided in this communication is of a general nature only and does not relate to any specific fund or product issued by an Insignia Financial Group entity. The information does not take into account any particular investor’s personal circumstances and reliance should not be placed by anyone on the information in this communication as the basis for making any investment decision. Before acting on the information, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available from the applicable Insignia Financial Group website or by calling us, before deciding to acquire or hold an interest in a financial product issued by an entity within the Insignia Financial Group.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Actual returns may vary from any target return described and there is a risk that the investment may achieve lower than expected returns.

No company in the Insignia Financial Group guarantees the repayment of capital or the performance of an investment, unless expressly stated in a PDS. Any investment is subject to investment risk, including possibly delays in repayment and loss of income and principal invested.

Any opinions expressed constitute our judgement at the time of issue and are subject to change without notice. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability or in respect of other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This communication is directed to and prepared for Australian residents only.