May 2025 | ![]() 6 min read | Download PDF

6 min read | Download PDF

Bob Cunneen, Senior Economist and Portfolio Specialist

Australia’s central bank cuts interest rates again by 0.25% to 3.85% in May 2025

The Reserve Bank of Australia (RBA) has conceded reality that interest rates are too high for Australia’s economy. Many consumers have struggled with the burden of the ‘cost of living’ crisis. The daily reminders are the expensive visits to the supermarkets and the extra-ordinary costs of housing whether you have a mortgage or are a renter.

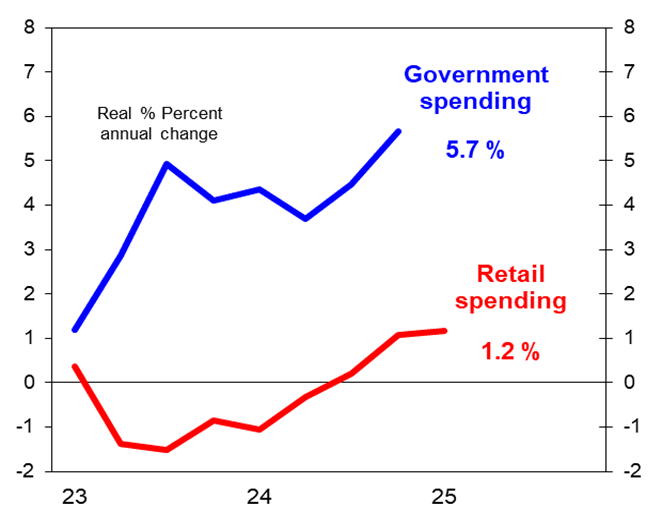

The clearest sign that the Australian consumer has been struggling is retail spending. Over the past year to March 2025, Australian retail spending only increased by 1.2% (Chart 1) in real terms. ‘Real’ in this case means that your nominal spending is adjusted for changes in consumer prices. Hence inflation is taken out of this spending to capture the actual ‘real’ change in spending. This real retail spending measure captures all those costly food visits to Coles, Woolworths, IGA and Aldi as well as those to Bunnings and Mitre 10 for hardware and even the rare dining out at a café or restaurant if you managed to win the lottery.

Chart 1: Australian consumer versus government spending

Source: Australian Bureau of Statistics.

If you are an optimist, you could highlight that this real retail spending growth has improved over the past year to 1.2%. In 2023 and 2024, real retail spending was actually falling. That was then a ‘Retail Recession.’ However, even this new optimism fails to consider that this retail spending measure was also boosted by population growth. As the Australian Bureau of Statistics (ABS) noted with their March 2025 report, Australia’s “retail volumes per capita are down 5.9% since the peak” in June 2022. The ‘Retail Recession’ has been even more dramatic and prolonged for retail business than what is reflected in Chart 1.

The key driver of Australia’s economic growth over the past two years has been government spending as seen in Chart 1. Total Federal and State government spending has increased by 5.7% in the past year to December 2024. Australia’s economic activity has become highly dependent on governments continuing to spend generously on education, health, infrastructure - such as rail and road networks - as well as welfare payments.

Yet Australia’s jobs market is healthy, so the economy cannot really be struggling …

Once again, the optimists will suggest that the Australian economy is solid with strong jobs growth and a low unemployment rate at 4.1%. April’s labour data provides some justification for this positive view. However, if you are a realist and examine the available ABS data to February 2025, the reality is more challenging. Approximately 57% of the jobs created in the past year have been in health care and public administration. These are government financed jobs rather than private sector generated employment. Hence, just like broader economic activity, the current labour market strength is heavily dependent on government support.

So why has the RBA been so cautious in cutting interest rates?

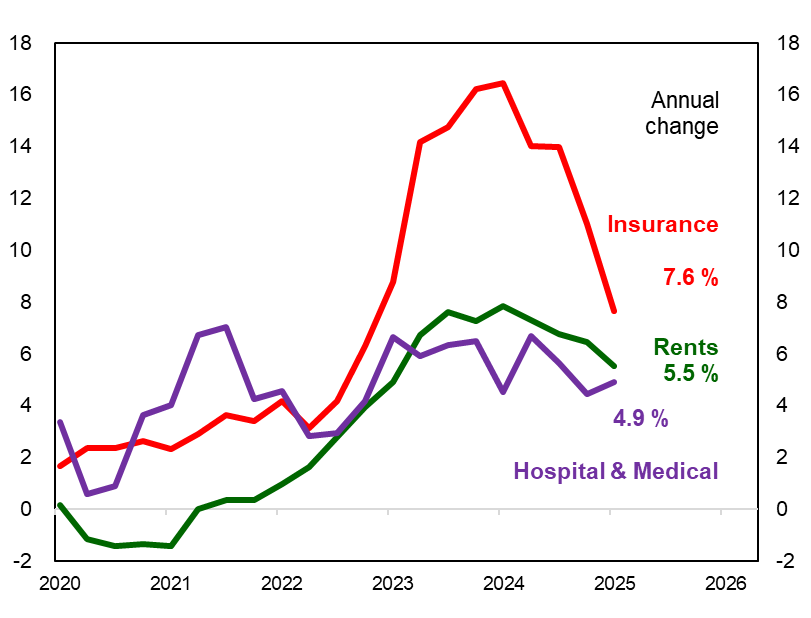

The only valid justification for the RBA keeping interest rates high is the view that Australia’s inflation risks are still problematic. There is some evidence to support this. The March quarter Consumer Price Index (CPI) did show persistent annual inflation in the services sector such as insurance (7.6% annual change), rents (5.5%) and hospital and medical (4.9%) as seen in Chart 2. These stubborn price pressures suggest that the inflation threat has not fully faded away.

Chart 2: Australian consumer versus government spending

Source: Australian Bureau of Statistics.

However, the reality is that insurance, rents and medical expenses are not responsive to higher interest rates but reflect their own fundamental drivers. Australian consumers are paying higher costs for these services because of specific challenges – in the case of insurance there is a distinct lack of competition, for rents there is an acute lack of housing supply and for medical expenses we have an ageing population with more complex health needs. The RBA keeping interest rates high will not solve these specific problems in insurance, rents and medical costs.

Has the RBA “changed their tune” with this interest rate cut in May?

Previously the RBA was worried about inflation risks. Their February 2025 forecasts had Australia’s headline annual inflation rate accelerating from 2.4% in the December quarter 2024 to 3.7% at the end of this year. Now the RBA has changed their inflation forecast for the end of this year to 2.8%.

Have the lyrics and melody of the Australian economy shifted enough to justify this ‘change of tune’? Yes. Firstly, the Federal government extended the electricity rebate by a further six months to December 2025 with a $150 payment per household. Stable electricity prices take the edge off inflation. Secondly, the RBA’s assessment of immediate inflation risks has faded given a more cautious view on Australia’s economic growth prospects. With Australian retail spending so subdued and US President Trump’s tariff agenda casting a shadow over business investment, Australia’s economic growth in 2025 is likely to be another year of disappointment. The RBA is now forecasting Australia’s economic growth at 1.5% in 2025 compared to our long-term potential growth rate of circa 2.7%. The Australian economy is still “out of tune” but lower interest rates can improve the sound with retail spending providing more beat.

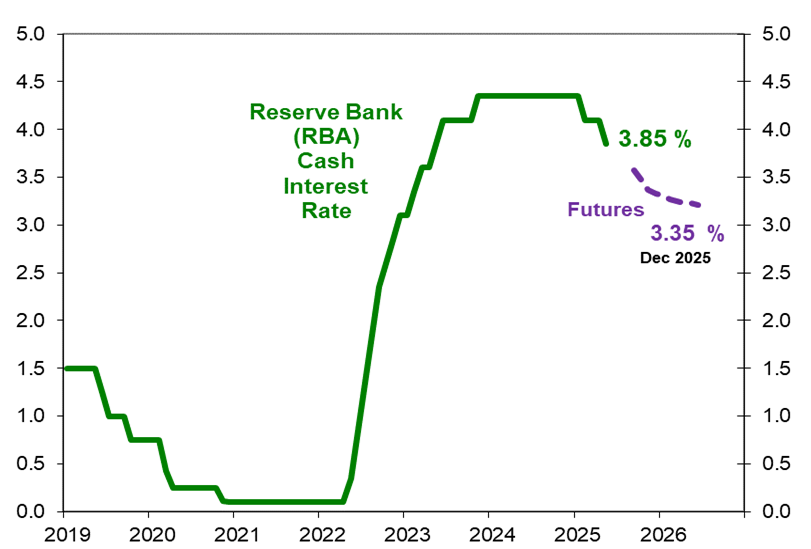

Futures markets are now pricing in the RBA cutting interest rates by 0.5% by the end of 2025. (Chart 3). Clearly this is welcome news to consumers with a mortgage which is circa one third of households. For renters who make up the other third of households this is more mixed news. Lower interest rates could encourage some landlords to ease the burden of rent payments. For renters, the challenge on meeting the weekly rental and the acute shortage of affordable housing remains troubling. For those who are reliant on interest income, which is another circa one third of households, this is a setback in terms of less money coming in. Yet compared to 2020-2021 when cash interest rates were only 0.1%, the current 3.85% cash rate and potentially only 3.35% at the end of this year is still a good deal better than the pandemic years.

Chart 3: Financial markets are pricing in further cuts to interest rates in 2025

Source: Australian Stock Exchange (ASX) 30 Day Interbank Cash Rate Futures Implied Yield Curve.

Confronting reality …

Given that Australian consumers are finding conditions tough, economic activity is subdued and inflation has fallen - there is a compelling case for the RBA continuing to cut interest rates this year.

Consumers are still struggling to keep food on the table and a roof over their head. The deafening noise of rising inflation has faded to an echo. The RBA has finally become realistic on the need for lower interest rates.

Sources:

Australian Bureau of Statistics, ‘Australian National Accounts: National Income, Expenditure and Product. Reference period: December Quarter 2024’ (released on 05/03/2025).

Australian Bureau of Statistics, ‘Consumer Price Index, Australia. Reference period: March Quarter 2025’ (released on 30/04/2025).

Australian Bureau of Statistics, ‘Retail Trade, Australia. Reference period: March 2025’ (released 02/05/2024).

Reserve Bank of Australia, ‘Statement by the Monetary Policy Board: Monetary Policy Decision’ on 20 May 2025.

Reserve Bank of Australia, ‘Statement on Monetary Policy - May 2025’, Forecasts (page 8).

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLC), part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication. The capital value, payment of income, and performance of the Funds are not guaranteed. An investment in the Funds is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested.

This information may constitute general advice. It has been prepared without taking account of an investor's objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The returns specified in this communication are reported before management fees and taxes. Share market returns are all in local currency.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions, or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice), or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm's length basis. MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.