Understanding the basics of secondary transactions in Private Equity markets

June 2024 | ![]() 7 min read

7 min read

Unpacking differences

Before we start to explain secondary transactions, it is worth understanding the difference between a primary and a secondary fund investment within private equity.

For me, it is not so much the type of asset being invested into, but rather the timing of your entry point into that particular investment.

A primary fund investment is a commitment to a private equity fund manager made during the initial fundraising stage. An investor commits capital from which the underlying private equity manager draws on over several years to make investments into private companies. Ultimately, in the later stages of the fund life, hopefully the investor receives their investment back with a profit when the underlying companies are sold.

With a secondary investment, an investor is effectively purchasing a primary fund investment from another party during the life of that particular investment. This may happen when an investor wishes to exit or sell their primary fund investment position before the end of the life of the fund (typically, closed ended private equity funds have a life of ten years). So a secondary investment can be summarised as the sale of an existing fund investment to another investor.

It is worth noting the secondary market is really an institutional market. Positions traded in secondary markets are typically at least a couple of million dollars, can be complex and require well-resourced teams to value, negotiate and execute the secondary transaction. As such, the secondary market is not usually accessible to retail investors.

Why do secondary fund transactions occur?

There are a number of reasons secondary fund transactions occur.

From a seller’s perspective:

- a liquidity need may arise or situations where an investor has liabilities to be met,

- the investor may want to undertake another type of investment,

- an investor's allocation to a particular asset class may have risen above a certain threshold and they might want to bring their allocation down, or

- a change in overall investment strategy occurs requiring a need to rebalance a portfolio more broadly.

From a buyer’s perspective, a secondary acquisition may:

- provide access to private equity (PE) managers an investor doesn't have,

- accelerate fund deployment,

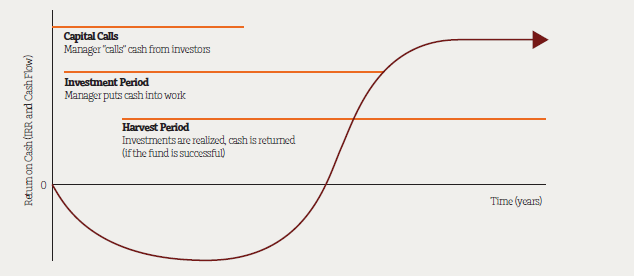

- reduce the typical J-curve of a PE fund (see chart below),

- provide more clarity on the investments contained within a fund (reducing so called ‘blind pool’ risk – see explainer box below), and

- shorten the time to receiving cash distributions from that position.

Further, often secondary positions are transacted at a discount to net asset value (NAV) in the market.

Blind pool risk

A private equity manager communicates its investment strategy when raising funds from investors, however at the point of the fund raise investors do not typically know into which companies their funds will be invested in, as asset acquisitions happen over a number of years after the fund’s close. This is known as a ‘blind pool’ risk and most primary fund investments carry such blind pool risk.

J-curve

The J-curve refers to a PE fund’s typical patterns of returns, over the life of the fund. In the J-curve, initial returns can be negative as investors are contributing capital for investments with no near-term return on that capital (as investments are initially held at cost) and the PE fund also incurs acquisition expenses and management fees, detracting from returns. This period of initial negative performance can span 3-4 years, following the PE fund’s inception. As time progresses, the negative trend transitions to a positive one as a performing fund underlying investment values increase and assets are ultimately sold at a profit. Returns eventuate in later years as value is created through operational and financial uplifts over a number of years from acquisition, which potentially create the conditions for profitable exits (sale of assets).

Quality and due diligence are key

Whatever the reason for a secondary fund acquisition it is important to be highly selective. As with any investment the quality can vary widely, and close scrutiny (or ‘due diligence’) is essential. Investors need to understand the quality of the underlying assets and having a strong relationship with the manager themselves is beneficial.

With secondary investments often available at a discount to net asset value (NAV) in the market, opportunities may appear attractive at first sight, but this may only be an optical discount. If the underlying asset is not of high quality, then it’s unlikely to be an opportunity worth selecting -

sometimes things are cheap for a reason.

Pricing a transaction in secondary markets

Like any investment, investors need to be clear on the price they are willing to pay to ensure they take on an acceptable risk/reward profile, and be disciplined about their walk-away price. Investors should carry out extensive due diligence and ultimately come up with a price they are comfortable in paying. Unlike public markets, there is no established liquid market or an exchange market for these assets. Much like when someone is selling their house, the vendor may start with an idea of what the house may be worth and what they’d like to sell it for, but it’s only when the auction starts, and bids are received, the seller can really gauge what price they may achieve.

Secondary market investors also look to be compensated for the risk they are taking on and for providing the liquidity to the selling investor. A buyer needs to solve for their target return, and just simply paying the net asset value (NAV) may not leave enough upside potential in those assets to achieve the required target returns.

More specifically, if a secondary position is purchased after a couple of years of the underlying fund’s close, some of the value accretion may have already occurred and reflected in the NAV. A secondary buyer needs to make sure that there is enough value creation potential left in the remaining fund life to achieve their target return, and that sometimes can only be achieved if that position is acquired at a discount to net asset value (NAV).

Understanding net asset value (NAV) and secondary investment returns

The NAV is the net asset value of the fund, as typically measured by the underlying fund manager. If a negotiation ends in a buyer purchasing at a discount to the NAV, then they are potentially making an immediate return on day one assuming the asset is ‘written up’ to NAV after the acquisition. That said, while the investor may have acquired something at a discount to NAV on day one, the value of the investment can still go up or down in future. This emphasises the importance of due diligence and a thorough understanding of the investment opportunity.

This reinforces the earlier point around some things being cheap for a reason.

Secondaries can provide an opportunity for attractive returns, but it’s still possible to pay too much, or, worse still, buy into a bad investment that falls in value over time.

In closing

Primary investments and secondary fund investments can both play a role in portfolios, but selection is critical. MLC Private Equity is extremely selective when it comes to assessing secondary acquisition opportunities. It is particularly important for us to do our diligence properly and to really understand the quality of the fund manager and underlying assets in detail. Just because something is ‘cheap’ doesn't mean it is a good investment.

Important information

The information in this communication has been prepared for Australian residents only and not for residents of any other jurisdiction.

This information has been prepared by MLC Asset Management Pty Limited (MLCAM) (ABN 44 106 427 472, AFSL 308953) (ABN 30 002 641 661, AFSL 230705). MLCAM is part of the Insignia Financial Group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of the services provided by MLCAM.

The information in this communication is prepared for information purposes only, it is not intended to be financial advice or investment recommendation. The information contained in this communication does not take into account your objectives, financial situation or needs. Because of that, before acting on this information we recommend you obtain financial advice tailored to your own personal circumstances. Any opinions expressed in this communication constitute our judgement at the time of issue. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability.