July 2025 | ![]() 15 min read | Download PDF

15 min read | Download PDF

Anthony Golowenko, Senior Portfolio Manager – Multi-Asset Diversified Choice

Investment professionals live in a constant state of alertness over potential threats that may be lurking over the horizon. Even when markets are calm and economic conditions appear to be benign, thoughts about possible threats to clients’ portfolios are never far. This vigilance stems from experience of events in one corner of capital markets having profound ramifications for asset prices in other parts of the world.

Think back to the Global Financial Crisis when stresses in subprime US real estate mortgages set off a terrible chain of events, or early in 2020 when an obscure virus in China crossed borders creating shocks everywhere.

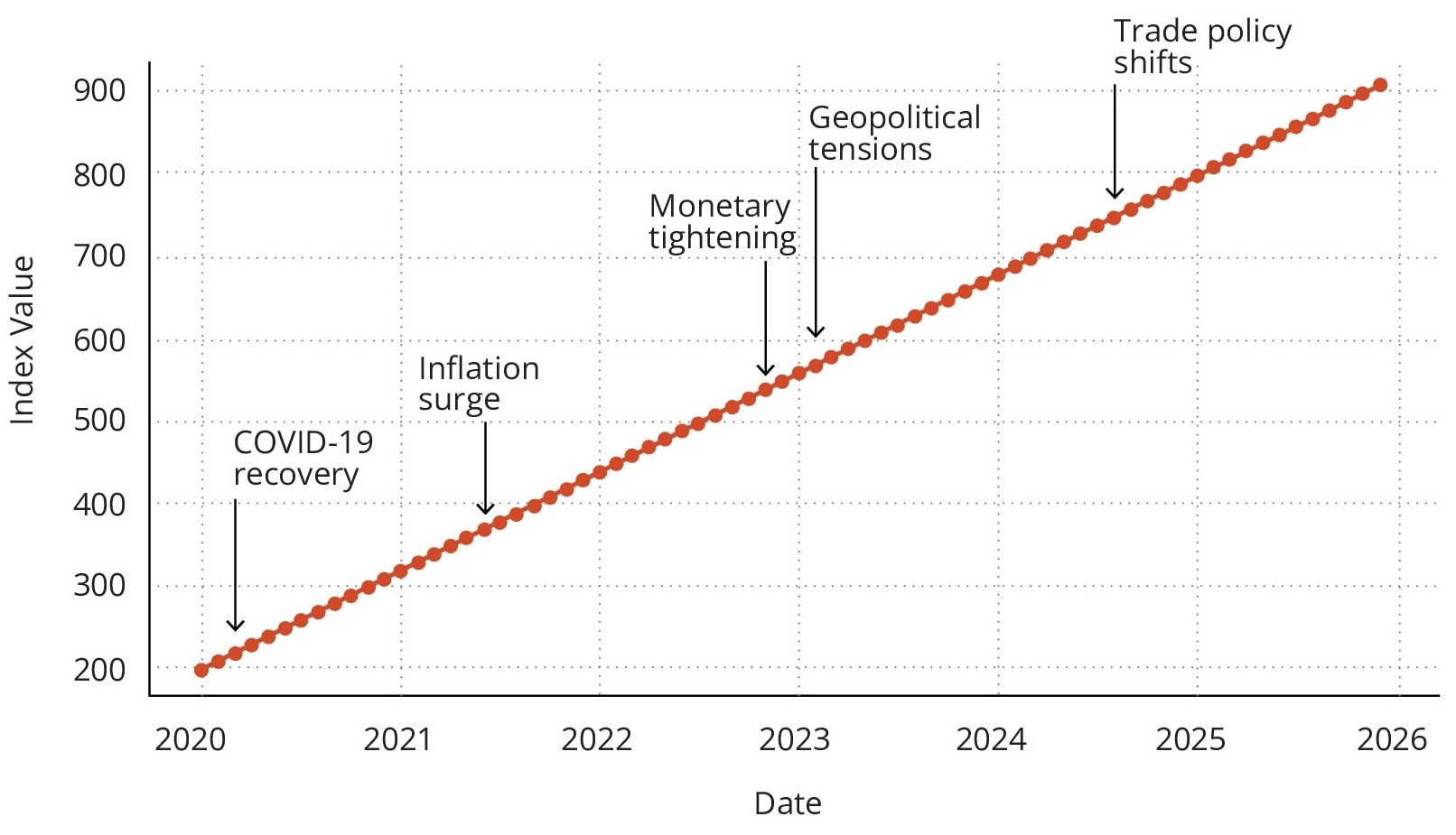

At this time, the upturning of the post WWII trade and economic architecture, created by the United States, and epitomised by the torpedoing of the liberal trading regime, dominates investor preoccupations (Chart 1) because it represents the ending of a decades-long status quo with little certainty about what may come next.

Chart 1: US trade policy shifts are preoccupying American investors...

Economic Policy Uncertainty Index monthly (2020 –2025)*

*The chart displays the value of the topic with the highest uncertainty index value for the month among US investors

Source: Macrobond

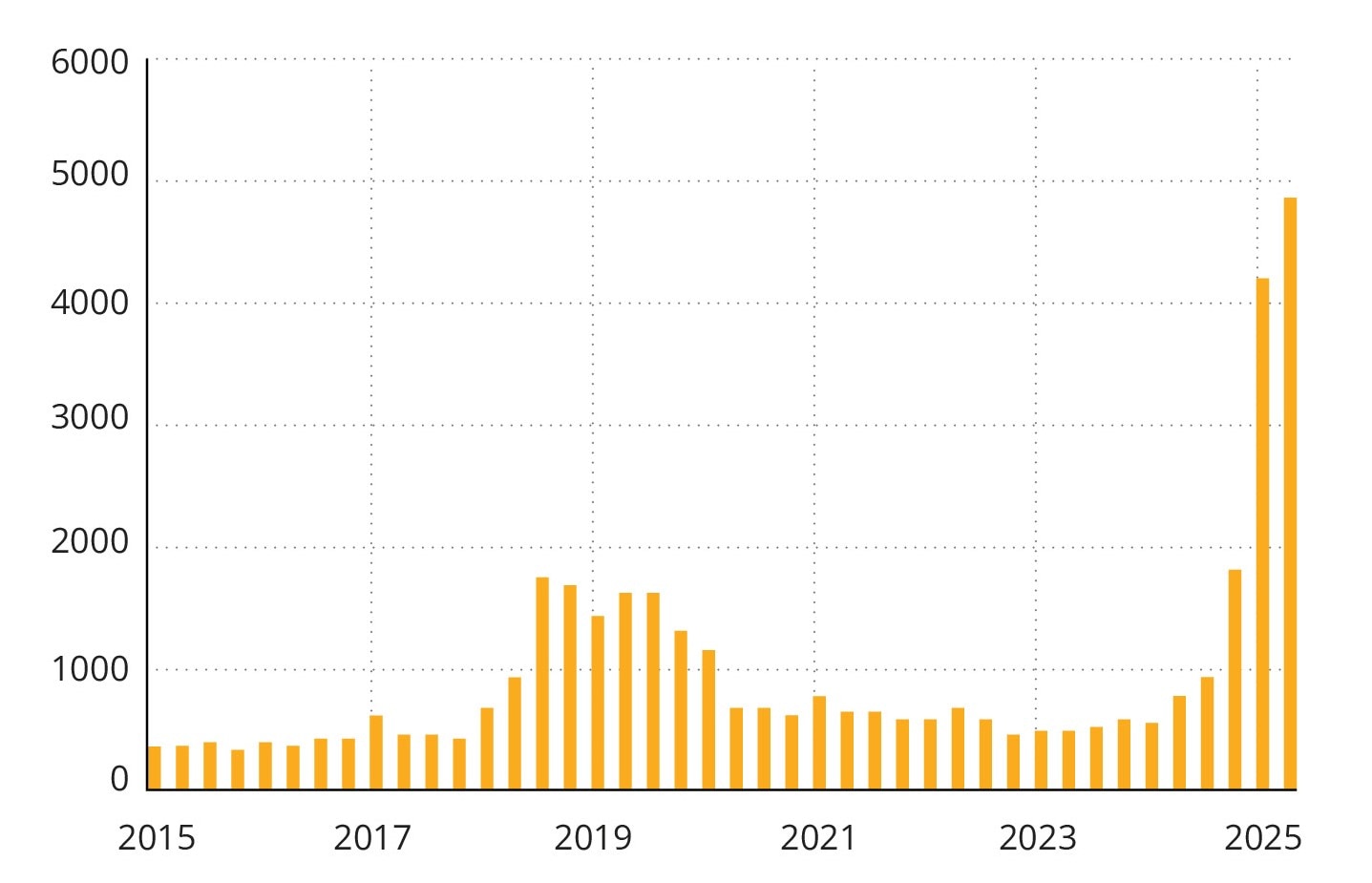

It’s not just investors who are consumed by shifts in US trade policy and the knock-on effects this is having: there’s been a spike in American business chiefs mentioning ‘tariffs’ during earnings calls (Chart 2).

It is the issue du jour and its gravitational pull is impossible to escape.

Chart 2: ...and corporate leaders too

‘Tariffs’ mentioned on earnings calls

Mentions of ‘tariffs’ on US earnings calls 31 January 2015 – 9 May 2025.

Source: FactSet

The Trump administration’s flurry of tariff announcements and subsequent modifications (Chart 3) in just a few months have caused markets to swing between alarm and relief.

Things move so fast that anything written about tariffs, at a given moment, stands the risk of being out of date in short order. A case in point was the 28 May decision by the US Court of International Trade blocking President Trump’s “Liberation Day” tariffs from taking effect, a ruling that was set aside just one day later by the US Court of Appeals, allowing the tariffs to remain in effect while the government appeals.1

Chart 3: Summary of Trump administration's tariff announcements, and modifications

Key tariff actions, their effective dates, and any subsequent changes or suspensions

| Date | Tariff Announcement | Details | Modifications |

|---|---|---|---|

| Feb 1, 2025 | Tariffs on China, Mexico, Canada; De Minimis Exemption2 Closed | 25% tariffs on most imports from Mexico and Canada (except certain Canadian energy products at 10%); 10% tariffs on China. De minimis exemption closed for these countries to curb low-value imports. | Suspended for Mexico and Canada for 30 days. De minimis exemption reopened for all three countries on Feb 7, 2025, to avoid overwhelming customs. |

March 3, 2025 |

Tariffs on Mexico and Canada Implemented |

25% International Emergency Economic Powers Act (IEEPA) tariffs on Canada and Mexico proceeded due to immigration and drug trafficking concerns. |

Temporary pause on automobile tariffs for Mexico and Canada announced March 5, 2025, for one month. Additional pause on United States-Mexico-Canada Agreement (USMCA-compliant) products until April 2, 2025. |

March 24, 2025 |

Secondary Tariffs on Venezuelan Oil Importers |

25% tariffs on goods from countries importing Venezuelan oil, effective April 2, 2025, to lapse one year after a country ceases such imports. |

No modifications or backdowns reported as of June 2025. |

April 2, 2025 |

"Liberation Day" Reciprocal Tariffs and 10% Baseline Tariff |

10% baseline tariff on all US imports effective April 5, 2025; higher tariffs (11%-50%) on 57 countries effective April 9, 2025. Examples: China (34%), EU (20%), Japan (24%). Triggered stock market fall. |

Higher tariffs (except China) suspended for 90 days on April 9, 2025, retaining 10% baseline. China tariffs increased to 125% on April 10, 2025, then reduced to 30% (with 10% baseline) on May 12, 2025. |

April |

Exemption for Electronics |

Expanded Annex II3 to exclude smartphones, computers, and other electronics (specific HTSUS headings)4 from reciprocal tariffs. | Refunds issued for tariffs collected on these goods since April 5, 2025. |

| April 29, 2025 | Anti-Stacking Executive Order5 | Prevented cumulative tariffs: goods under Section 232 tariffs (automobiles, steel, aluminium) or Canada/Mexico tariffs not subject to additional tariffs. Retroactive to March 4, 2025. |

US Customs and Border Protection (CBP) to process refunds per standard procedures. |

May 4, 2025 |

Proposed 100% Tariff on Foreign Films |

Announced intent to impose 100% tariffs on foreign films, citing national security and US film industry decline. |

No effective date set; proposal not implemented as at 14 June 2025. |

May 8, 2025 |

UK Trade Deal |

US to eliminate tariffs on British airplane parts and metals (up to a quota), reduce auto tariffs from 25% to 10% for 100,000 cars. UK to eliminate tariffs on US ethanol and increase US beef imports. |

10% baseline tariff retained; deal not fully finalised as at 14 June 2025. |

May 12, 2025 |

China Trade Agreement |

US and China agreed to reduce tariffs by 115%, retaining 10% baseline tariff. China to suspend 34% retaliatory tariff and non-tariff measures for 90 days. |

Effective May 14, 2025; US tariffs on China reduced to 30% (including 20% fentanyl-related and other existing tariffs). De minimis shipments from China adjusted to 54% ad valorem or US$100 per package. |

May 23, 2025 |

Proposed 50% Tariff on EU Imports |

Announced 50% tariff on all EU imports starting June 1, 2025, after negotiations stalled (initially 20%, reduced to 10% until July 8, 2025). |

Suspended following EU negotiations; 10% baseline tariff extended to July 9, 2025. |

June 4, 2025 |

Steel and Aluminium Tariff Increase |

Tariffs on steel and aluminium imports increased from 25% to 50%, effective June 4, 2025, to protect US industry and national security. UK exempted at 25% pending US-UK Economic Prosperity Deal. |

No modifications reported as of June 14, 2025. |

June 11, 2025 |

China Trade Deal Extension |

Extended May 12 China trade deal, retaining 20% fentanyl and 10% reciprocal tariffs, pausing higher tariffs for 90 days. |

Effective June 11, 2025, pending further negotiations. |

June 13, 2025 |

Expansion of Steel and Aluminium Tariffs |

Expanded Section 232 tariffs to include steel content in eight additional product lines (e.g., dishwashers, refrigerators), effective June 23, 2025. |

No modifications reported as at June 14, 2025. |

Notes and sources:

IEEPA authority: Many tariffs were imposed under the International Emergency Economic Powers Act (IEEPA), citing national emergencies like trade deficits, drug trafficking, or immigration. https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/; https://www.womblebonddickinson.com/us/insights/alerts/trade-update-trump-administration-tariffs

Retaliatory measures: China, Canada, and the EU imposed retaliatory tariffs (e.g., China at 125%, Canada at 25% on some US vehicles). Some were paused or reduced following negotiations.

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/; https://www.bbc.com/news/articles/cn93e12rypgo

As at 14 June 2025

Is President Trump playing four-dimensional chess or in a cul-de-sac?

For President Trump’s supporters, modifications that have tended to follow hawkish tariff announcements (Chart 3) are evidence that he plays four-dimensional chess while his opponents, including America’s economic competitors, play checkers. In their telling, hawkish announcements shock opponents into concessions, or at least negotiations, where the US can act from a position of strength.

Unsurprisingly, Mr Trump’s detractors see things differently and interpret conciliatory post tariff announcements as the actions of someone who finds himself in a cul-de-sac and thus compelled to retrace his steps.

It’s not unreasonable to say that President Trump is an inelegant communicator and so the rest of us must read between the lines of his remarks to discern a deeper meaning rather than manifestations of impulses.

In our view, President Trump is saying to the world that the US’ trade deficit is evidence that the country has for too long been the world’s largest consumer (and greatest borrower to finance its overconsumption), and it will no longer be the place where others send their excess production.

To correct this, as he sees it, the rest of the world must either find a way to consume more of what the US produces or pay for the privilege of accessing its vast pool of consumers and so bring about a more balanced global economy.

Achieving this without threatening global economic stability is going to be a very tall order. One encouraging sign has come from Germany where the country effectively abandoned in late 2024 the debt brake, a constitutional rule introduced in 2009 to enforce fiscal discipline, which limited the federal government's structural budget deficit to no more than 0.35% of GDP annually.6

Germany’s new Chancellor Friedrich Merz has been a vocal opponent of the debt brake and has made plain his desire for reviving the country’s role as a growth engine by encouraging both public and private investment.

Bond market warning

If moves out of Germany are one source of hope, the bond market has gone in the opposite direction firing a warning shot over America’s galloping indebtedness.

In late May, a US Treasury bond auction — specifically a US$16 billion 20-year bond sale — failed to attract sufficient demand, leading to a sharp rise in yields, which topped 5.1% at one stage.7

A snapshot of America’s fiscal situation gives reasons for creditors’ trepidation. The proposed 2025 budget has a total spending bill of US$7 trillion, against revenue of US$5.5 trillion, resulting in a budget deficit of about 6.2% of GDP.8

On current trends, America’s debt-to-GDP ratio is projected to surpass WWII levels by 2035, reaching 118%, driven by structural imbalances and compounding interest payments.9 Furthermore, interest payments on debt exceed defence spending10 emphasising the magnitude of the country’s fiscal strains.

The proposed budget also contains a section which could increase taxes on US investments by non-US investors, such as superannuation and pension funds, and thus potentially reduce investment returns. This derives from Washington’s displeasure at what it deems to be unfair treatment of US firms by governments through such things as taxes on digital services provided by US companies.

At the time of writing, it looked as though the administration has chosen not to go ahead with the new tax. Nevertheless, global and Australian investors will be keeping a close eye on the issue mindful of the potential for more swings and roundabouts in American policy.

US equity market has been more sanguine

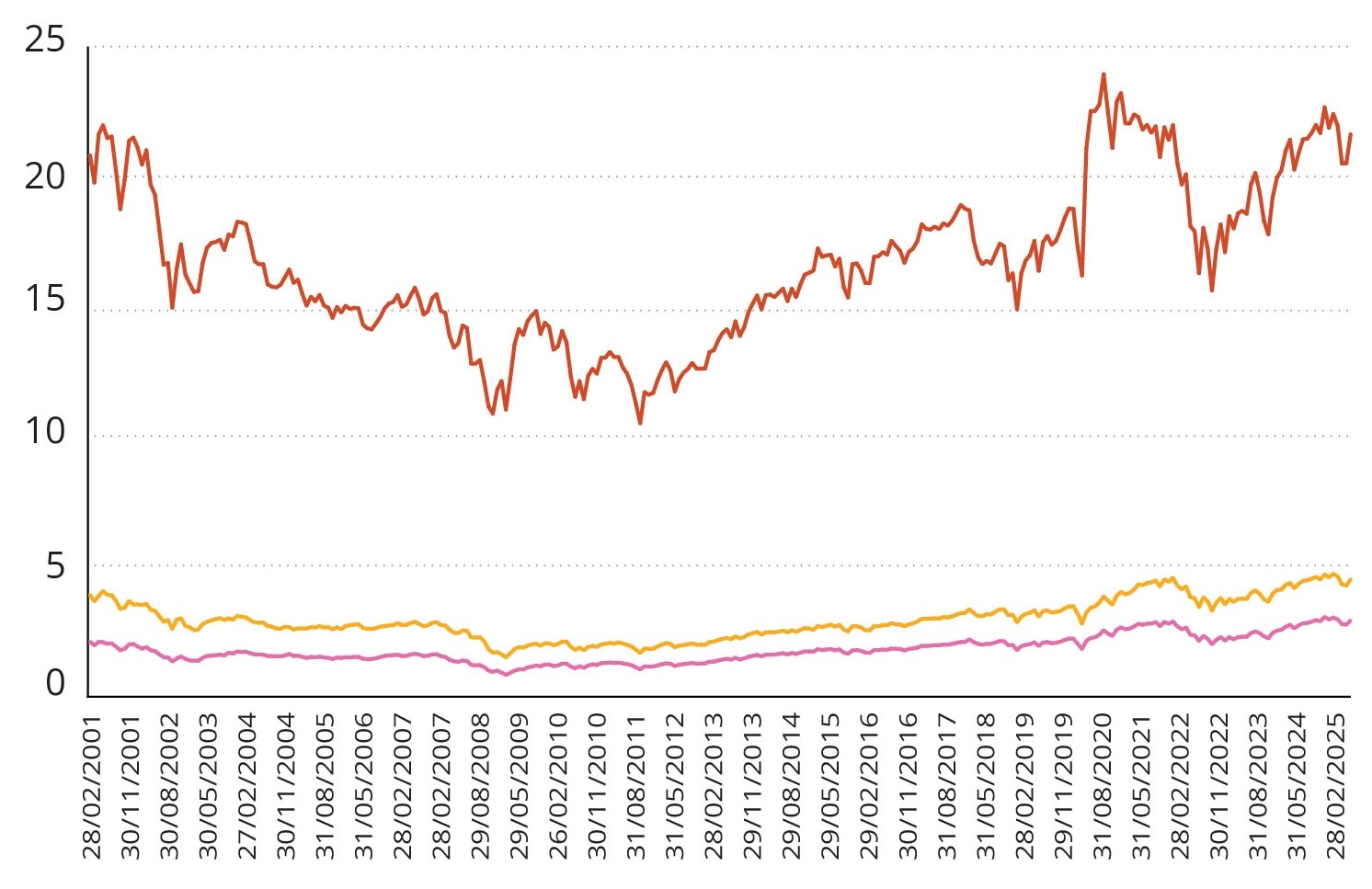

In contrast with the bond market, and notwithstanding share market ripples stemming from conflict in the Middle East, the US equity market (as measured by the S&P 500) has been less anxious as valuations are high, by historic measures, and are pushing back up to roughly where they were before tariff related worries intruded (Chart 4).

Chart 4: US Price-to-Earnings (P/E) ratio has recovered

S&P 500 index valuation (Feb 2001 – May 2025)*

*Top line is P/E estimate; Middle line is Price- to-Book estimate; Bottom line is Price/Sales estimate

Source: FactSet

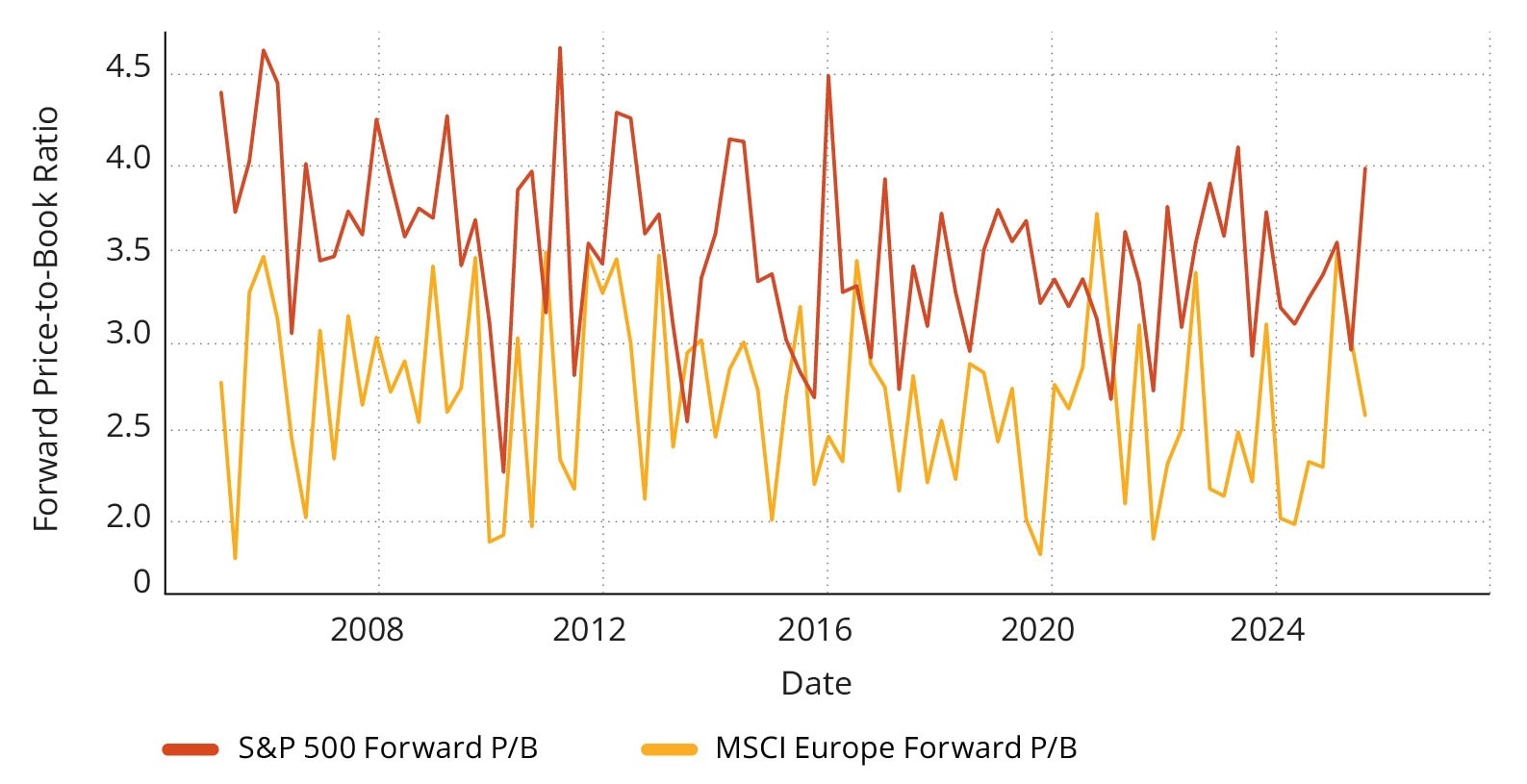

Another way of gauging US equity market optimism (arguably excessively so) is to compare the S&P 500 index’s forward price-to-book (P/B) of almost 4.0 versus the MSCI Europe’s forward P/B of 2.5 (Chart 5), representing a sizeable gap between the two indices.

Chart 5: The S&P 500 index’s forward P/B is significantly ahead of MSCI Europe’s

Forward price-to-book value (March 2005 – June 2025)

Source: https://yardeni.com/our-charts/, https://www.gurufocus.com/economic_indicators/4240/sp-500-price-to-book-value

Is the bond market too pessimistic or the US equity market too optimistic? There’s a mighty debate underway.

Moreover, are non-US equities, including European equities, positioned to perform better after being overshadowed by US equities for so long?

Our Separately Managed Accounts portfolio positioning: active management that looks far, deep, and wide

We are in the camp believing that the Trump administration’s trade reset has resulted in a firmer footing for global equities.

Beyond the narrow theme of ‘magnificent’ technology and artificial intelligence companies powering returns over recent years, we see broader themes developing against a backdrop of easing interest rates, more subdued inflationary pressures, and selective fiscal stimulus. This is the basis for an increase in global shares exposure as part of our recent asset allocation refinement.

At the same time, we have trimmed our large cap Australian share exposures too as the tech-like valuations assigned to Commonwealth Bank, for instance, suggest to us that investor expectations have become a bit too high.

Likewise, narrowing spreads on investment grade credits cause us to believe that valuations in this market segment may have become too rich. Profits taken from our investment grade credits have been deployed to listed global infrastructure and real estate businesses we judge as offering better value, consistent cash flows and thus more likely to deliver constructive total returns.

Underlying all our actions is our active management approach, which is anchored, in the first instance, to a long-term strategic asset allocation. The long-term perspective is complemented with shorter-term analysis of the economic outlook and asset class return expectations.

However, our investment process does not end there as we also integrate multiple scenarios of how markets and economies may progress. This means we’re not trapped into trying to guess a single correct future, but rather consider many possibilities and a far greater range of potential outcomes, and ‘contours’ if you like, of how market and macro events might play out across global investment markets.

In our view, the complexity of today’s market and geopolitical climate make it especially risky to leave portfolios on autopilot. Instead, steering portfolios with considered active management enables us to look ahead, and ideally, avoid traps and potholes, and seize opportunities.

Sources:

1 Trump's tariffs to remain in effect after appeals court grants stay, Reuters, 29 May 2025, https://www.usnews.com/news/world/articles/2025-05-29/us-ruling-that-trump-tariffs-are-unlawful-stirs-relief-and-uncertainty

2 The De Minimis Exemption refers to a U.S. customs regulation under Section 321 of the Tariff Act of 1930, which allows low-value shipments to enter the United States duty-free and with minimal customs processing. As of 2025, this exemption applies to imports valued at $800 or less per person per day, enabling retailers, particularly e-commerce platforms, to ship small packages without paying tariffs or undergoing extensive customs scrutiny.

3 Annex II relates to specific goods exempt from new reciprocal tariffs designed to protect critical supply chains and avoid inflationary pressures on essential goods, such as natural gas, bituminous coal, and petroleum derivatives.

4 HTSUS headings refer to specific classifications within the Harmonised Tariff Schedule of the United States (HTSUS), which is the official system used by US Customs and Border Protection (CBP) to determine the tariff rates and statistical categories for all goods imported into the US.

5 The "anti-stacking" Executive Order, formally known as Executive Order 14289, issued on 29 April 2025, eliminates the compounding of tariffs: if a product is subject to more than one tariff under different authorities, only one tariff will apply — typically the one deemed most appropriate for the policy objective. Previously, a single imported item could be subject to multiple layers of tariffs under different authorities.

6 German Basic Law (Grundgesetz), specifically Article 109(3) and Article 115(2), as amended in 2009 during the Föderalismusreform II. According to the Bundestag: "Ab 2016 darf die Neuverschuldung [des Bundes] maximal 0,35 Prozent des Bruttoinlandsproduktes (BIP) jährlich betragen"

("From 2016, the federal government's new borrowing may not exceed 0.35% of GDP annually"), German Bundestag: Bundestag votes for Debt brake in the Basic Law

7 Treasury yields top 5% and could rise more. Here’s what to do. Peter Cohen, 23 May 2025, Treasury Yields Top 5% And Could Rise More. Here’s What To Do

8 The budget and economic outlook: 2025 to 2035, Congressional Budget Office, The Budget and Economic Outlook: 2025 to 2035 | Congressional Budget Office

9 Ibid

10 For the first time, the US is spending more on debt interest than defense. Benn Steil and Elizabeth Harding, 23 May 2024, https://www.cfr.org/blog/first-time-us-spending-more-debt-interest-defense

Important information

This information is intended only for financial advisers and must not be distributed or communicated to “retail clients” as defined in the Corporations Act 2001 (Cth).

It has been prepared by MLC Asset Management Pty Limited (MLC Asset Management) (ABN 44 106 427 472, AFSL 308953), a member of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate.

MLC Managed Account Strategies are available via various investment platforms. Please refer to the MLC Asset Management website (www.mlcam.com.au) for a full list of platform availability. You should obtain a Product Disclosure Statement relating to the investment platform and consider it before making any decision about whether to acquire or continue to hold an interest in that product.

This information may constitute general financial advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that a financial adviser and investor should, before acting on the advice, consider the appropriateness of the advice having regard to the investor’s personal objectives, financial situation and needs. Any opinions expressed constitute our judgement at the time of issue and are subject to change without notice. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability or in respect of other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This communication is directed to and prepared for Australian residents only.