November 2025 | ![]() 9 min read

9 min read

In September, Jennifer Lam, Antares’ Building Materials and Packaging Analyst and Deputy Portfolio Manager for the Dividend Builder and Broadcap portfolios, embarked on a two-week fact-finding trip to deepen industry insights and strengthen portfolio strategies.

Primary mission: to meet people at the coal face of the US housing market and gauge current and potential future market conditions (as well as take the country’s general economic temperature).

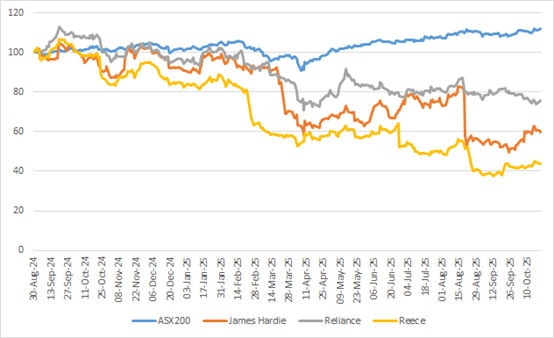

The US housing market is a major earnings and share price performance driver for prominent ASX building material stocks James Hardie, Reece Group, and Reliance Worldwide. Having underperformed the broader Australian equities market for much of the last 12 months, could an improvement in the US housing market be on the cards to deliver share price recovery for these stocks?

The trip involved multiple states (Georgia, Indiana, New York, North Carolina, Texas, Tennessee) and meetings with housing market and construction industry participants (home builders, remodelling contractors, building product producers and distributors, big-box retailers, industry representative bodies, steel product manufacturers) as well as some packaging related meetings on the side.

Reliance Worldwide also hosted investors at its Atlanta headquarters for a sneak peak of its new and very impressive training facility to be used for product demonstration and marketing purposes.

Housing a lot of disappointment

The housing market has arguably been one of the more disappointing aspects of the US economy over the last 12 month. The return of the Trump Administration brought hopes of an economic revival from policies such as business de-regulation and tax cuts, and with that a lift in demand for housing and housing related services (e.g. home renovations). Additionally, there were expectations that the 1.0% cut to the US Federal Reserve cash rate during CY2024 would help spur investments in housing.

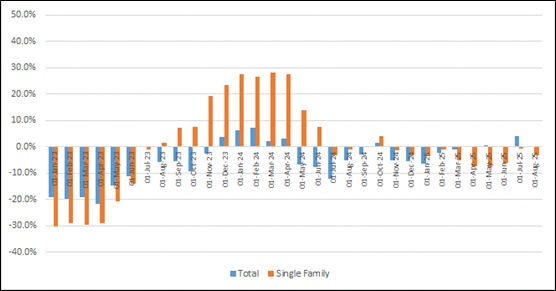

Unfortunately, the housing market has shown very little improvement more than 12 months on from the 2024 election. In fact, it has worsened in some key segments, e.g. the market for new single-family homes (Figure 1).

The factors challenging the market before the election continued, the main one being affordability. Moreover, many major volume homebuilders who had built speculative housing stock in expectation of demand improvement were left with excesses stock when hoped for demand didn’t eventuate. In response, they are now cutting back housing production to balance demand and supply.

Figure 1: US Housing Starts (Changes to Rolling 3 Month Total)

Source: Antares Equities, October 2025

The underperformance of the US housing market versus expectations has been a major cause of share price softness for these ASX building material companies (Figure 2, along with company-specific factors, e.g. James Hardie’s unpopular with shareholders acquisition of decking company AZEK.

Figure 2: Performance of the S&P/ASX200 Index vs Key ASX Building Material Stocks (Normalised)

Source: Antares Equities, October 2025

During the trip the US Federal Reserve delivered another 0.25% cash rate cut, with the market expecting more such cuts before the end of 2025. How did industry participants feel about this? Are we getting closer to an inflection point?

Confidence – the missing ingredient

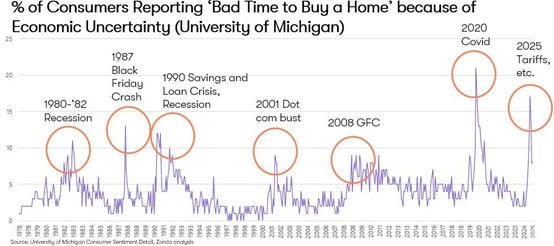

A common theme that emerged across our US meetings was the absence of consumer confidence and how its absence is arguably the key drag on housing demand at present. Given the choice of better consumer confidence or more rate cuts, the former was preferred by companies we met with. To quote one homebuilder: “We can still sell homes in a higher rate environment, but not to unemployed people.”

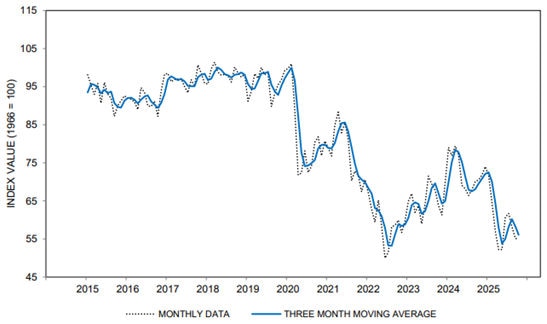

US consumer sentiment has plummeted since the November 2024 election (Figure 3), and it’s easy to see why.

Consumers have been confronted with a constant barrage of negative headlines (e.g. trade wars, and now government shutdowns) and while overall employment is still sound, softening trend is evident.

There is a view that there is pent-up housing demand, but over the near-term potential home-owners appear to be asking themselves “will I have a job to pay my mortgage?” The lack of confidence is causing them to sit on their hands (Figure 4) until there is more economic certainty.

Figure 3: University of Michigan US Consumer Sentiment Index

Source: University of Michigan, October 2025

Figure 4: University of Michigan US Consumer Sentiment “Bad Time To Buy a Home” Index

Source: Zonda, October 2025

More than central bank rate cuts required

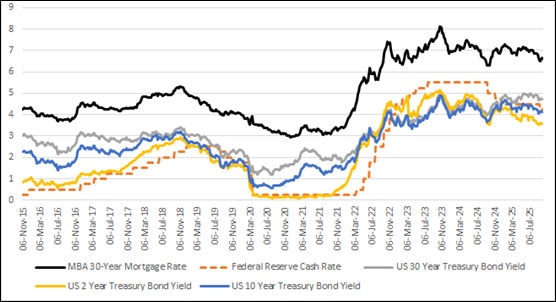

Home building and building material companies’ share prices tend to rise on expectations of central bank rate cuts, however, our meetings also reminded us there is more to mortgage interest rates than official cash rates.

A cash rate cut of 0.25% does not automatically translate to a 0.25% drop in spot mortgage interest rates.

Rather, the fixed rate for a typical 30-year US mortgage is more influenced by the yield on the longer dated US Treasury bonds, plus market dynamics affecting yields on mortgage backed securities (MBS): Figure 5 and 6 show the relationships between these various rates and yields vary over time.

Figure 5: US 30-Year Mortgage Rate vs US Treasury Bond Yields & Federal Reserve Cash Rate (%)

Source: Antares Equities, October 2025

Figure 6: Spread between US 30-Year Mortgage Rate vs Federal Reserve Cash Rate & US Treasury Bond Yields (%)

Source: Antares Equities, October 2025

Trump to the housing market rescue?

In September, the Trump administration announced that it was considering declaring a “national housing emergency.” As a side note, this would be the Administration’s 11th emergency declaration during this second term, the 10th being the “crime emergency” in Washington D.C.

Is that something for the housing market and investors to be excited about? Not so fast, said those we met.

Many of the constraints within the home construction market lie with state and local governments and agencies (e.g. zoning codes, permitting timelines, regulatory costs) and these are considered to be beyond the Federal administration’s direct control, even in an “emergency” setting.

The Federal government could incentivise state governments to undertake regulatory reforms with funding as a carrot; make financing easier for emerging sectors like manufactured housing; exempt certain construction and building products from the tariff regime; or make federal land available for construction and building product production (e.g. timber plantation for lumber).

The general consensus, however, is that wholesale changes will be hard for Federal authorities to achieve.

50 states

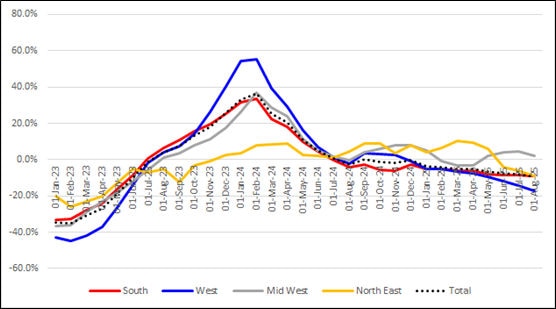

A trip involving criss-crossing multiple states also provides a reminder of how economic and market conditions can diverge materially across regions and markets. While the conversations in Texas were relatively downbeat, a visit to Indiana presented a different picture with new housing construction still growing and the local economy benefiting from recent manufacturing investments.

There is also the divide between high income and lower income households. Food and beverage packaging companies we met with spoke of lower volumes due to cost-of-living pressures.

Some food and beverage companies have been also been reluctant to use promotions to stimulate demand due to the “Make America Healthy Again” campaign as well as the potential for popular GLP-1 medications like Ozempic nullifying any promotions impact.

By contrast, home remodelling contractors servicing higher end, less interest rate sensitive clientele referenced steady business from households paying mainly with cash.

Such differences remind us of the need to dig deeper beyond aggregate-level data when assessing companies with specific regional or market exposures, a prime example being James Hardie which is overweight in its exposure to southern states, such as Texas, and Florida.

Improvements will come, but not so soon

Our research journey commenced with hopes for some green shoots. Alas, while the housing market is not expected to exhibit material deterioration, no one is expecting improvements over the next few months either. Indeed, a look at the latest housing permitting statistics (Figure 7, a lead indicator on housing construction activity) supports that conclusion (permits still declining year on year).

Figure 7: US Single Family House Construction Permits by Region (Changes to Rolling 3 Month Total)

Source: Antares Equities, October 2025

Our meetings with the construction material and steel producers offered a broader perspective on the US’ building and construction industry beyond just the residential sector (i.e. also into commercial, industrial and infrastructure construction), and there we found more positivity.

Data centre construction was the one consistent bright spot, and there are also sound levels of non-residential constructions happening (e.g. stadiums, manufacturing plants, warehouses, schools).

The funding and investment benefits of The Infrastructure and Jobs Act and the CHIPS and Science Act (from the Biden Administration) are still flowing through. Furthermore, benefits from the Big Beautiful Build Act (and Trump’s push to increase domestic production) are still to come (noting it takes years for major construction projects to go from start to finish).

On the downside, high tariff rates (on imported manufacturing equipment) and higher cost of capital (higher risk premium required) are also weighing on project economics for US companies considering more domestic investments.

Manufacturing labour shortage issues are also emerging due to the immigration crackdown, and the thumping rise in visa fee changes (e.g. the US$100,000 fee for the H-1B skilled worker visa) are raising concerns for sectors ranging from technology, financial services to manufacturing. No major impacts yet, but risks to watch.

Key takeaways

With potentially more US Federal Reserve rate cuts on the horizon, our summary thoughts are:

- Don’t just monitor rate cuts – also look at consumer confidence. Besides interest rates, what else is happening to influence on the up or downsides?

- Mortgage rates are influenced by more than just Federal Reserve policy – also consider longer-dated government bond yields and the spread levels between their yields and mortgage rates (and MBS yields).

- Different folks, different strokes – there are dangers in just looking at aggregates. Be mindful of variations between regions and end markets.

- The US is not broken, improvements should come…but perhaps not tomorrow. While there are potentially strong share price and earnings upsides for the building material stocks once the US housing market starts its recovery in earnest, patience will likely be needed to see this materialise.