August 2024 | ![]() 9 min read | Download PDF

9 min read | Download PDF

Michael Glenane, BE, MBA, Executive Director/Portfolio Manager

Leo Barry, BSA, MBA, Portfolio Manager

Tim Hall, BComm, Portfolio Manager

Ben Chan, Portfolio Manager

There’s something about small companies that makes people warm to them.

Maybe it’s the Australian love for the underdog, the gutsy small enterprise led by people with the courage of their convictions to have a go in a listed company world where a handful of financial and resources companies command the bulk of investors’ capital and attention.

Here are a few facts emphasising the size differences between companies in the S&P/ASX Small Ordinaries Index (ASX Small Ordinaries) against those in the large capitalisation dominated S&P/ASX 200 Index (ASX 200).

- The mean market capitalisation (cap) of companies making up the ASX Small Ordinaries is a touch over $1.6 billion1 whereas the mean market cap of companies in the ASX 200 is $12.3 billion.2

- The market cap of the largest company in the ASX Small Ordinaires is $8.6 billion,3 while the largest company in the ASX 200, BHP, boasts a $225.5 billion market cap.4

As investment managers, it’s not sentimentality but the potential for strong long-term returns that lies behind our devotion to small companies investing. An upshot is our belief that investing actively in small Australian companies, as a component of well-diversified investment portfolios, assists the wealth creation quest.

Moreover, because of the small cap index’s different sector composition, it represents a source of diversification from large cap investing.

Finally, there’s evidence that the small companies domain is especially rewarding for active investing as it receives less sell-side/broker research analyst coverage and thus it is possible to uncover promising companies before they are discovered by the broader investment community.

Let’s unpack the three claims.

Strong long-term return potential

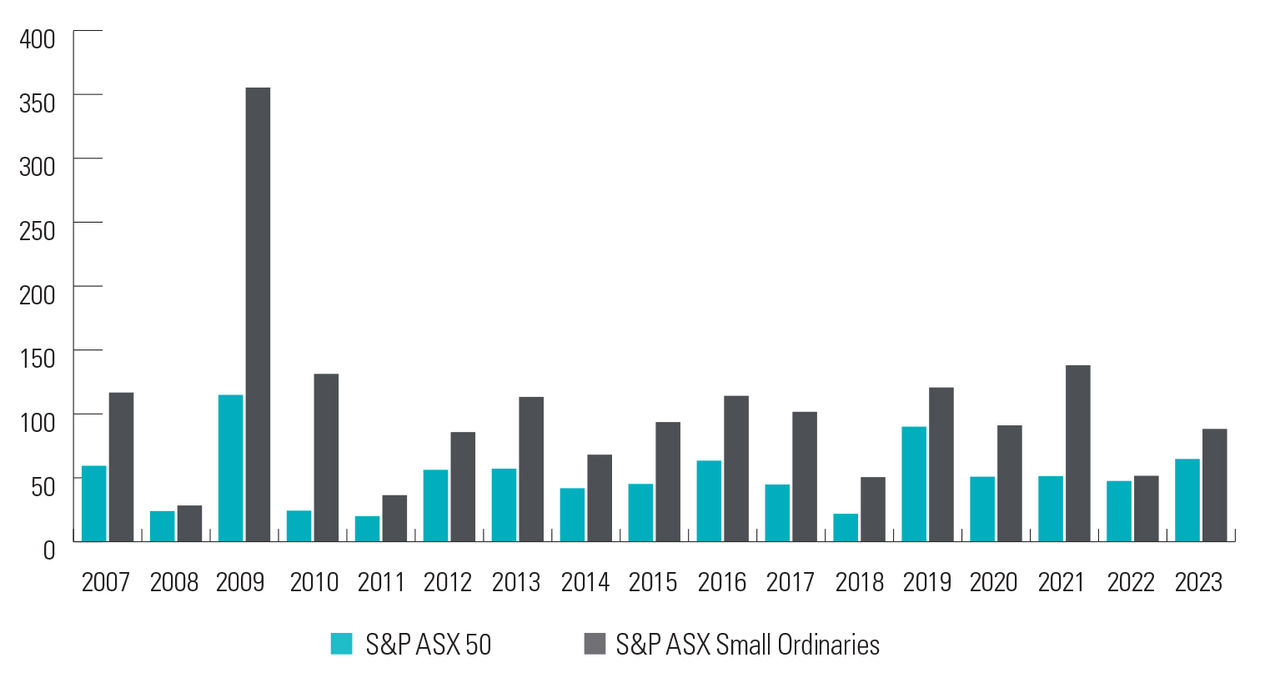

There are many ways of showing the strong long-term return potential of small companies. As active managers, we think one way of doing so is by comparing the average return of companies in the top decile of ASX Small Ordinaries performance with those in the top decile of S&P/ASX 50 Index (ASX 50) performance.

On a calendar year basis, the top decile of stocks in the ASX Small Ordinaries have generally outshone the top decile of companies in the ASX 50 (Chart 1).

Chart 1: Getting it right in small caps investing can be highly rewarding

Comparison of top decile performers in S&P/ASX 50 Index versus S&P/ASX Small Ordinaries Index

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with changes in the market.

As at 31 December 2023

Source: FactSet financial data and analytics

Sceptics may counter that this is cherry-picking as chart 1 compares the top decile of performance from the two indices rather than index returns. Fair enough, but as active managers, we devote time, effort, knowledge, and skill toward trying to pick winners and avoiding losers and so, from our perspective, contrasting top decile performance from each index makes more intuitive sense than comparing index returns.

We’re not passive managers simply matching the market return: we strive to outperform the market.

To be clear, small companies’ investing is riskier than large cap investing when measured by metrics such as the annual volatility of returns and so investors need to be comfortable with sharp performance gyrations. However, in our experience, gyrations have generally been compensated by strong long-term returns driven by active management.

Nowhere near growth ceilings

In our view, small companies, as a cohort, are advantaged by greater revenue generation, market-share expansion, and earnings-per-share growth potential than their large cap counterparts because they are far from being near their business and financial ceilings.

In our experience, many small companies operate in high-growth industries or niche markets where they can achieve higher earnings growth compared to their larger counterparts. This enhanced earnings growth often translates into superior share market performance.

Furthermore, many smaller companies that we are familiar with exhibit innovative and entrepreneurial cultures, which fosters technological advancements, new product developments, and speedy execution. These attributes can drive substantial business growth and amply reward shareholders.

Contrast this with the circumstances of large companies, as a group. When companies are already big, as well as dominant, think of Australia’s Big Four banks, or Telstra, for instance, limits to growth are no longer theoretical, but actual.

Barring global expansion, which is fraught with the many challenges of operating in unfamiliar countries, and which in many instances has burned Australian shareholders’ capital (the recent travails of construction giant Lendlease come to mind), it’s arguable that a lot of the household names dominating the ASX 50 are just about at their growth limits.

Efforts to squeeze out a little more efficiency each year, or winning a bit more market share by altering pricing seems to dominate the activities of companies that are already large and dominant. The days of outsized earnings growth or great multiple expansion are memories.

This helps to explain the hefty dividend payout ratios associated with many large Australian companies. In the absence of attractive growth prospects, which could justify sizeable capital commitments, companies opt to return large portions of their profits to shareholders via dividends and other select capital management programs.

There’s nothing intrinsically wrong with this but we equate equity investing with the quest for participating in earnings growth and associate that with the smaller end of the market capitalisation spectrum.

Diversification from large caps

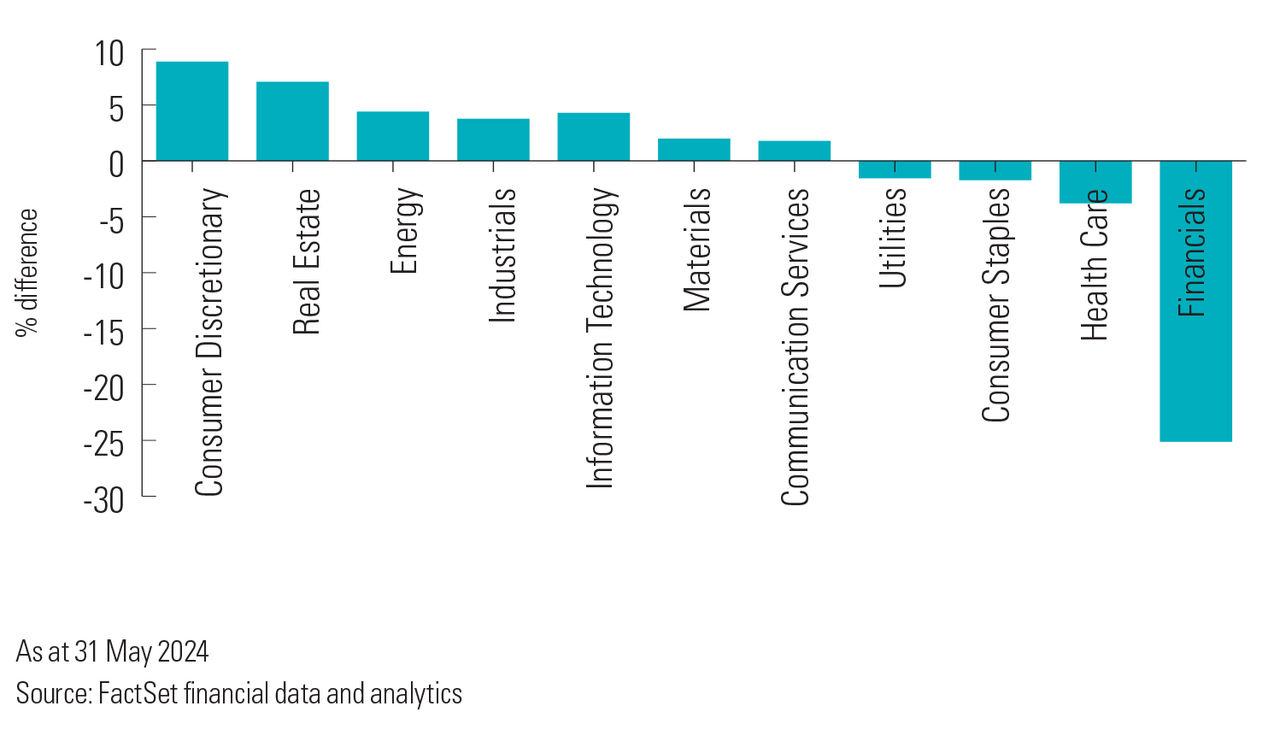

A quick glance at the sector composition of the ASX 50 confirms what generations of investors have known — even after decades of economic change and progress, the local share market remains very commodities and financials heavy.

Consequently, investors benchmarked to ASX 50 stocks are significantly leveraged to commodity price cycles (largely iron ore and metallurgical coal) and the credit cycle, associated with residential housing and construction, in the case of the Financials sector (Chart 2).

By contrast, investing in the small companies’ space, with its markedly different sector composition, represents a source of diversification versus the ASX 50 (Chart 2). Furthermore, given that consumer spending represents around half of Australia’s gross domestic product,5 the overweighting to the Consumer Discretionary sector in the small cap space (Chart 2) is arguably a source of strength.

Chart 2: Small caps provide diversification from large caps

Small caps vs S&P/ASX 50 sector weights

As at 31 May 2024

Source: FactSet financial data and analytics

Rewards from active small companies investing

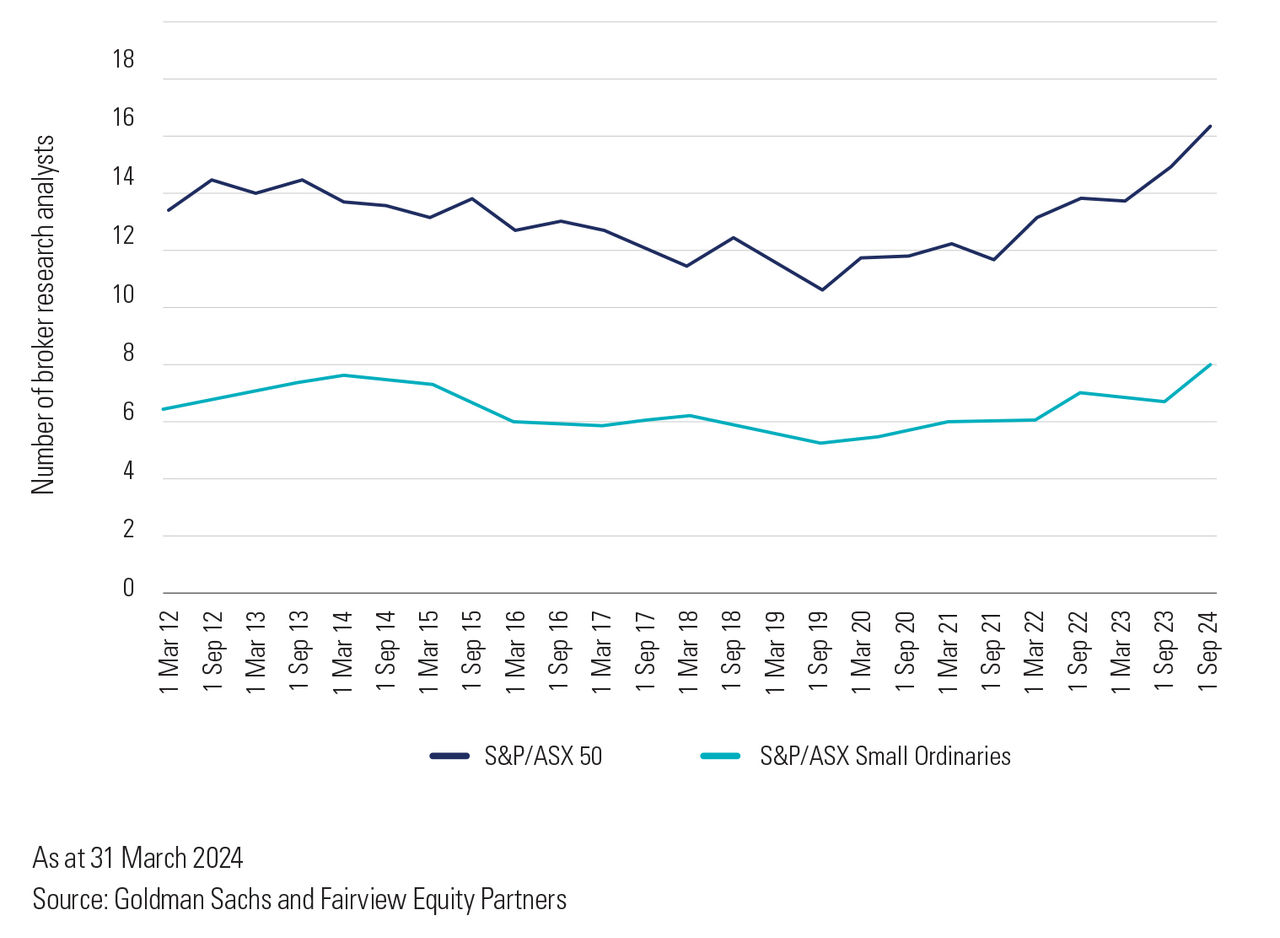

Last, but certainly not least, we think actively investing in small companies can be especially rewarding as the index is less covered by broker research analysts than the top-heavy ASX 50 (Chart 3) and thus it makes it more possible for active managers to uncover stocks with explosive growth potential, before their discovery by the broader investment community.

Chart 3: The small companies space gets significantly less broker research analyst coverage...

Average broker research analyst coverage per company by market capitalisation cohorts

As at 31 March 2024

Source: Goldman Sachs and Fairview Equity Partners

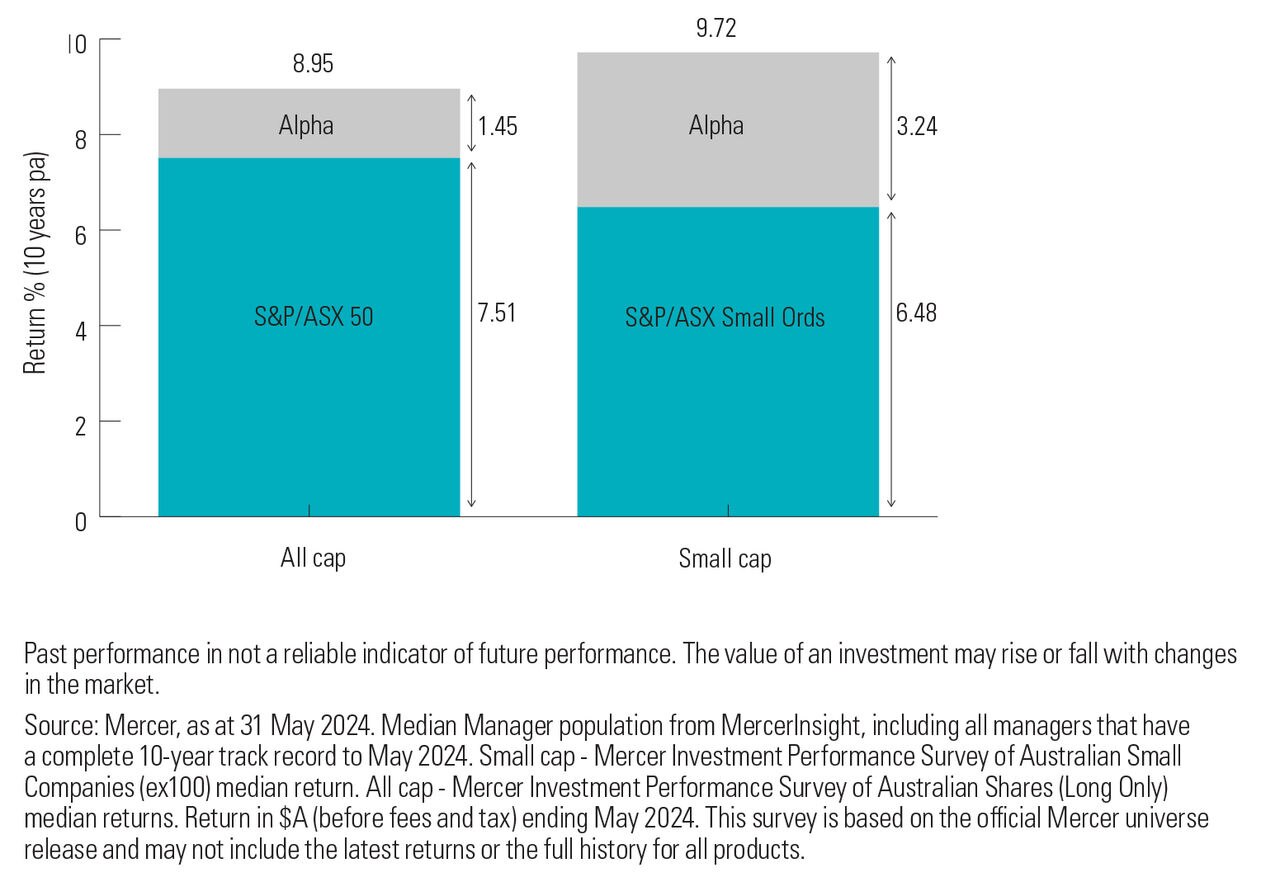

Unearthing small company stocks before they gain greater investment community recognition can, if done well and repeatedly, translate to substantial index outperformance relative to what may be obtained in large cap investing (Chart 4).

Chart 4: …which can translate to especially strong returns from active management

Comparison of active return (alpha) from small caps versus broader equity market

Past performance in not a reliable indicator of future performance. The value of an investment may rise or fall with changes in the market

Source: Mercer, as at 31 May 2024. Median Manager population from MercerInsight, including all managers that have a complete 10-year track record to May 2024. Small cap - Mercer Investment Performance Survey of Australian Small Companies (ex100) median return. All cap - Mercer Investment Performance Survey of Australian Shares (Long Only) median returns. Return in $A (before fees and tax) ending May 2024. This survey is based on the official Mercer universe release and may not include the latest returns or the full history for all products

Let’s dig into chart 4 a little more: over the 10 years to 31 May 2024, the S&P/ASX Small Ordinaries Index underperformed the S&P/ASX 50 Index. Despite this, the median small companies’ manager outperformed the median all cap manager by 0.77% per annum (before fees and tax). Additionally, around 33% of the total return for the median small companies’ manager was active return compared to about 16% of total return for the median all cap manager (Chart 4).

This, in our view, underscores the greater latent active return potential in small companies investing.

Examples of explosive growth companies

Two small company stocks, which we bought, on behalf of our clients for the Fairview Equity Partners Emerging Companies Fund, illustrate what’s possible from successful small cap stock selection.

The first is REA Group (REA), which operates Australia’s leading residential and commercial property websites – realestate.com.au and realcommercial.com.au – as well as the leading website dedicated to share property, flatmates.com.au and property research website, property.com.au.

The second is Pro Medicus Limited (PME), a provider of radiology information systems (RIS), Picture Archiving and Communication Systems (PACS) and advanced visualisation solutions across the globe.

We took positions in both companies when their shares were trading at sub-$10 and have maintained positions in both, at the time of writing.

Incidentally, at the time of writing, REA’s shares were trading at over $191[1] per share, while PME’s shares were trading at a little over $132 per share.7

These are stunning share prices gains compared to when we bought them and are examples of the kind of growth stocks that can be uncovered in the small cap world. Of course, there are small cap stocks that haven’t done so well, as well as those that have disappointed altogether, but the point is that active management, when executed well, makes a powerful difference in small companies investing.

Worth a look

We end as we began. We are small companies investing advocates because it offers the potential for strong long-term returns.

Secondly, because of the small cap index’s different sector composition, it represents a source of diversification from large cap investing.

Finally, there’s evidence that the small companies’ domain is especially rewarding for active investing as it receives less broker research coverage and thus it is possible to uncover promising companies before they are discovered by the broader investment community.

All up, we think small companies investing deserves a look for those with long investment time horizons.

1 S&P Dow Jones Indices. S&P/ASX Small Ordinaries, as of May 31, 2024. Factsheet.

2 S&P Dow Jones Indices. S&P/ASX 200, as of May 31, 2024. Factsheet

3 Ibid

4 Ibid

5 Australian household spending was 49.7% of GDP in 2022. Household spending. OECD data https://www.oecd.org/en/data/indicators/household-spending.html

6 REA Group Ltd (REA) shares were trading at $191.34 per share at around 11.45 am Monday 17 June 2024 https://www.asx.com.au/markets/company/REA

7 Pro Medicus Limited (PME) shares were trading at $132.52 per share at around 11.45 am Monday 17 June 2024 https://www.asx.com.au/markets/company/PME.

Important information

This communication is issued by MLC Investments Limited ABN 30 002 641 661, AFSL 230705 (‘MLCI’), the responsible entity of, and the issuer of units in, the Fairview Equity Partners Emerging Companies Fund, ARSN 133 197 501 (the ‘Fund’). MLCI has appointed Fairview Equity Partners Pty Ltd (‘Fairview’), ABN 45 131 426 938, AFSL 329052, a specialist Australian small company equities manager, as investment manager of the Fund. Fairview is majority owned by the three members of the investment team, each with an equal shareholding. The remaining interest is owned by the Insignia Financial group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Group’).

This communication is general in nature and does not take into account any investor’s particular objectives, financial situation or needs. Investors should, before acting on information in this communication, consider its appropriateness, having regard to their own objectives, financial situation and needs.

An investor should consider the current Product Disclosure Statement for the Fund (‘PDS’) in deciding whether to acquire, or continue to hold, units in the Fund. A Target Market Determination for the Fund is also required to be made (‘TMD’). A copy of the PDS and TMD are available from www.mlcam.com.au or by calling our Client Services Team on 1300 738 355.

Past performance is not a reliable indicator of future performance. Returns are not guaranteed and actual returns may vary from any target returns described in this communication. Any projection or other forward-looking statement (‘Projection’) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

The capital value, payment of income and performance of any financial product offered by any member of the Insignia Group is not guaranteed. An investment in any product offered by any member of the Insignia Group is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested.

Any opinions expressed in this communication constitute our judgment at the time of preparation and are subject to change. We consider any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of preparation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or in relation to any other information contained in this communication and neither Fairview nor any other Insignia Group member accept any liability for any loss arising from its use. In some cases, information has been provided to us by, or obtained from, third parties. While it is believed the information is accurate and reliable, the accuracy of that information is not guaranteed in any way. This communication is directed to and prepared for Australian residents only.