10 October 2022 | ![]() 6 min read

6 min read

Originally published on Livewire Markets

Rachael Lockyer was destined for a career in private equity. Entrepreneurial flair was in her family and at the ripe young age of 18, the Auckland native had a team of 20 school colleagues making etched wine glasses for corporate clients. This early venture was Lockyer's first foray into business, and the proceeds would help pay for her university degrees.

"I'd always wanted to work in private equity because I'm from a family of entrepreneurs. I started my own business when I was 18, funded my university education, and always wanted to be at the front of business," Lockyer says.

Following stints at Macquarie Group and Credit Suisse, Lockyer secured a role at Ironbridge Capital, a Sydney-based private equity firm, in 2012, and she hasn't looked back.

Lockyer is now a Portfolio Manager in MLC Asset Management's Private Equity team and is preparing to bring the company's well-established capability to the retail market. MLC's private equity programme has been running for 25 years and, in the past decade, has delivered 18.5% returns per annum. While there is no universally used global private equity benchmark, for comparison global listed equities delivered a return of 10.7% (MSCI ACWI) over the same timeframe - for the period ending 30 June 2022.*

Private equity is an asset class gaining interest from a broader range of investors, partly due to its attractive return potential but also as the role of private equity in a portfolio becomes better understood.

Perhaps the biggest advocate for private equity is Australia's Future Fund. As of 30 June 2022, the Future Fund held a 17.2% allocation to private equity, more than double the 8.1% allocated to Australian equities.

According to Lockyer, attitudes within the industry on the benefits of diversity are also changing.

"One of my proudest achievements of being in the Australian PE industry is helping the industry grow from eight women back in 2012 to over 60 women today. I've seen a distinct change in the approach that private equity funds in Australia have towards hiring and retaining women, where most funds now see the benefit of having diverse teams. Diverse teams bring greater diversity of thought, experience and analytical rigour to investment decision making, and also provide incremental benefits in generating diverse deal flow and forming relationships with more diverse founders of great businesses," Lockyer says.

It seems that some of the barriers to the opaque world of private equity are slowly coming down, which is good news for investors looking to get exposure to an asset class that has historically been the domain of institutional investors such as pension funds and the ultra-wealthy.

What returns have private equity funds delivered?

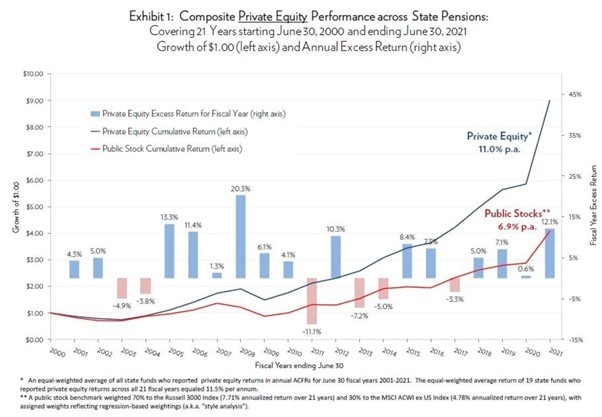

One of the allures of private equity is undoubtedly the prospect of attractive returns. An analysis of a 21-year period from 2000 to 2021 found that private equity allocations by state pensions produced an 11.0% net-of-fee annualised return.

This represents a 4.1% outperformance relative to the 6.9% annualised return from investing in public stocks, according to Stephen Nesbitt, Chief Executive Officer of Cliffwater, a private equity advisory firm. As noted previously, past performance is not indicative of future performance and actual returns for future investments may differ from past performance.

Source: CIAI.org / Cliffwater

The drivers of private equity returns

Lockyer says the return outcomes are driven by several factors, including the depth of due diligence that private equity firms undertake. Private equity funds typically spend between 1% and 2% of the transaction value on due diligence. Depending on the deal size, that can amount to anywhere from $2 million and $10 million dollars allocated to research and due diligence.

"That means the PE funds know these businesses inside and out before they get involved, and they know exactly how the value creation will work over time. And they have management aligned financially and strategically on delivering that outcome," Lockyer says.

A private equity firm will typically make an investment where it believes it can increase the value of a business and get a return on the investment in a three-to-five-year period. Such firms often have deep networks they can draw on to support the management team and implement changes before seeking to sell the business to a trade buyer, another private equity fund or via a listing on an exchange.

Of course, there is a trade-off that investors need to accept if they want to consider private equity. Traditional private equity funds require committed capital for between five and ten years. Distributions get paid as investments are sold, however, there is no regular and predictable dividend payment.

In addition, there is limited transparency regarding the underlying investments, so you are investing in the reputation of the firm, its people, and its track record.

Relationships are a competitive advantage for private equity investors and Lockyer was tight-lipped when I asked her to name some of the preferred funds that MLC looks to invest alongside.

What is the outlook for private equity investing?

Private companies face the same challenges as their listed counterparts, albeit their shares don't trade daily. Lockyer says that the prospect of higher inflation is a risk MLC has been monitoring for years – so it isn't a new topic.

MLC Private Equity's investment process focuses on investing in private equity funds that are leaders in their field and in co-investments alongside those funds. The common attributes of both types of investments include industry-leading companies in favourable sectors that can pass on price increases if they face incremental pricing pressures in supply chain costs, which provides a degree of inflation protection

This approach means that the team's portfolio is skewed towards companies that are cash generative and should be well placed to weather the tougher economic times ahead in respect of rising inflation.

"We don't invest in funds that will be the “Barbarians at the Gate” and put very high levels of leverage on to companies to get financial returns. I think the days of value creation relying on financial leverage alone have been and gone," Lockyer says.

According to Lockyer, valuations and vendor expectations in private markets have followed a similar trend to those of listed companies. This results in more realistic valuations. She also believes many private company operators are now looking for an exit after a stressful few years.

"The first half of this calendar year has been an absolute cracker. We've just seen so many fantastic private equity deals at reasonable valuations. We're participating in many deals as co-investors, directly investing in these companies alongside the private equity funds. At the same time, we remain highly selective and are also turning a good number of deals away that don't fit within our portfolio. But overall, our team is extremely busy," Lockyer says.

A four-bagger as demand for electric vehicles surges

One deal that Lockyer was cleared to discuss was the firm's recent partnership with Next Capital, which invested in NZ Bus. As the name suggests, NZ Bus is a New Zealand-based bus company that was generating about $18 million in EBITDA when Next Capital and MLC invested in the business in 2019.

Through a combination of improving logistics, right-sizing the cost base, renegotiating contracts and accelerating the introduction of electric buses, Next Capital grew the EBITDA figure for NZ Bus to $55 million in two and half years.

"It costs double to buy an electric vehicle bus versus a diesel bus, but the diesel bus fleet required upgrading. So, Next Capital chose to set up long-term contracts with the city councils to enable a strong return on capital on the electric vehicle buses, with most of these to be purchased by the next owner," Lockyer says.

The combination of long-term contracts and the appeal of an electric vehicle fleet drew strong interest from infrastructure buyers, private equity funds, and trade players. NZ Bus was recently sold to Kinetic for an enterprise value of approximately NZ$400m, netting Next Capital and MLC 4.1 times return on their initial investment and 69% internal rate of return (IRR) in three years.

Source: Twitter

All about people

While Lockyer says she is delighted about the outcome of the firm's NZ Bus investment, it is the bus that she can't see that keeps her up at night. And that, of course, is the key person risk that comes with many forms of active management.

"We minimise key person risk by investing in private equity funds that are run by multiple senior people, not just one leader. We also like to see clear evidence of succession planning and a satisfied second tier of senior professionals in the fund who can step up in the event that the Managing Partners move on or retire," she says.

Ultimately, Lockyer says, successful investments are driven by people, being a combination of strong private equity managers and senior executives in the companies themselves who drive high-performing and positive company cultures and deliver results above expectations.

“The best outcomes we see are in companies who have genuinely built a culture where the team is motivated and aligned to achieve the results in the private equity fund’s business plan, driven by a CEO who really embodies this vision. You can’t see this in an investment paper but through various enquiries and interactions over the course of due diligence, you are able to feel it. It’s another level of due diligence we add to our investment filter, and it’s served us well over time." However, while investors should be excited about the growing access, they should also exercise caution and ensure they understand the differences in the way private equity works from traditional asset classes and the potential risks of investing in private equity," Lockyer says.

* Please note past performance is not indicative of future performance.

Important information

This article has been prepared by Livewire. Livewire gives readers access to information and educational content provided by financial services professionals and companies ("Livewire Contributors"). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

MLC Asset Management Pty Ltd (MLCAM) (ABN 44 106 427 472, AFSL 308953) is part of the Insignia Financial Group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 (formerly IOOF Holdings Ltd) and its related bodies corporate. No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication or MLCAM’s services. Past performance information is not indicative of future performance. Returns are not guaranteed, and actual returns may vary from any past performance described in this communication.