July 2025 | ![]() 7 min read

7 min read

Why NexGen Energy (NXG) remains our preferred exposure

On-the-ground signals support a long-term investment case

Following direct conversations with industry executives, utility buyers, brokers, and developers—alongside insights gathered at the World Nuclear Fuel Market (WNFM) conference— we remain confident that uranium is undergoing the early stages of a structural re-rate. The persistent gap between long-term supply and demand is becoming clearer and the contracting market is already responding.

The key drivers of our view include:

- Declining output from legacy assets and constrained development pipelines due to permitting, financing, and geopolitical risk

- Accelerating demand from decarbonisation policies, national energy security strategies and the electrification of data infrastructure

- Strategic contracting activity by utilities suggesting a willingness to pay well above current spot levels for reliable future supply

- Corporate participation and offtake diversification: Notably, in June 2025, Meta announced a partnership with Constellation Energy to procure clean energy from the TMI-1 nuclear facility to power its data centre operations. This marks one of the clearest signals yet that tech infrastructure is leaning into nuclear as a long-term baseload solution—adding further weight to the uranium demand outlook.

NexGen: Best-in-class exposure for the new cycle

Our preferred vehicle for exposure remains NexGen Energy (NXG). The company’s flagship project, Rook I, located in Canada’s Athabasca Basin, is not just one of the world’s highest-grade and lowest-cost uranium discoveries—it is also one of the most advanced from a permitting and ESG standpoint.

What stands out from our research is:

- Permitting de-risked: Provincial approvals are already in hand. Federal approval from the Canadian Nuclear Safety Commission (CNSC) is expected between November 2025 and February 2026. Historically, no uranium project at this stage has been rejected by the CNSC.

- Strategic offtakes: NXG has already signed three utility contracts, including at least one with no floor and a high ceiling (US$150/lb), and another linked to full spot price. These terms point to strong utility appetite and suggest greater pricing flexibility than many realise.

- Minimal capex overhang: Unlike most developers, NexGen’s early-stage capital requirements are manageable, and the company is not reliant on the spot market to move before advancing.

- Community support and ESG profile: Local First Nations support is well- documented, and the asset is widely seen as environmentally and socially progressive by industry stakeholders.

- Exploration upside: The company’s success along the Patterson Corridor East is extending the life of the project, making it more attractive from an M&A standpoint. Major producers such as BHP and Cameco, which are increasingly constrained by aging assets and shorter mine lives, may find NXG’s long-life potential compelling.

What the market is overlooking

Despite the strong macro thesis, investor positioning remains hesitant. Short interest in uranium equities remains elevated, largely anchored to the belief that supply can be scaled quickly. Our research suggests otherwise.

Supply bottlenecks we identified include:

- Geopolitical tightening: Transfer pricing rules in Kazakhstan, export levies, and the phasing out of Russian material in Western markets are already reducing mobility of product.

- Permitting inertia: Even in uranium-friendly jurisdictions, developers face multi- year approval cycles and escalating scrutiny. In Australia, for example, uranium policies are fragmented across states—with bans still active in Victoria and WA.

At the same time, demand is broadening in ways traditional models are not yet capturing. Hyperscale data centres, AI workloads, and advanced manufacturing are all seeking long-term baseload power solutions. Utilities are quietly increasing coverage targets from 18 to 24 months—effectively boosting near-term demand by up to 40%.

The contracting market is where the signal lies

The spot market remains thin, opaque, and often misunderstood. Standard trades are around 100,000 pounds (~US$7.5m) —dominated by hedge funds trading among themselves.

Utilities are instead focused on term contracts, many of which are being quietly negotiated off-market.

From our conversations, we’re now seeing:

- Floors are being set around US$70/lb, with ceilings in the US$130–150/lb range (spot US$72)

- Some buyers are seeking supply lock-ins out to 2050

- Utilities are reluctant to disclose pricing due to commercial sensitivity, but the trend is clear: long-term buyers are securing premium-priced supply

As this activity becomes more visible to the broader market, we expect capital to return to the sector.

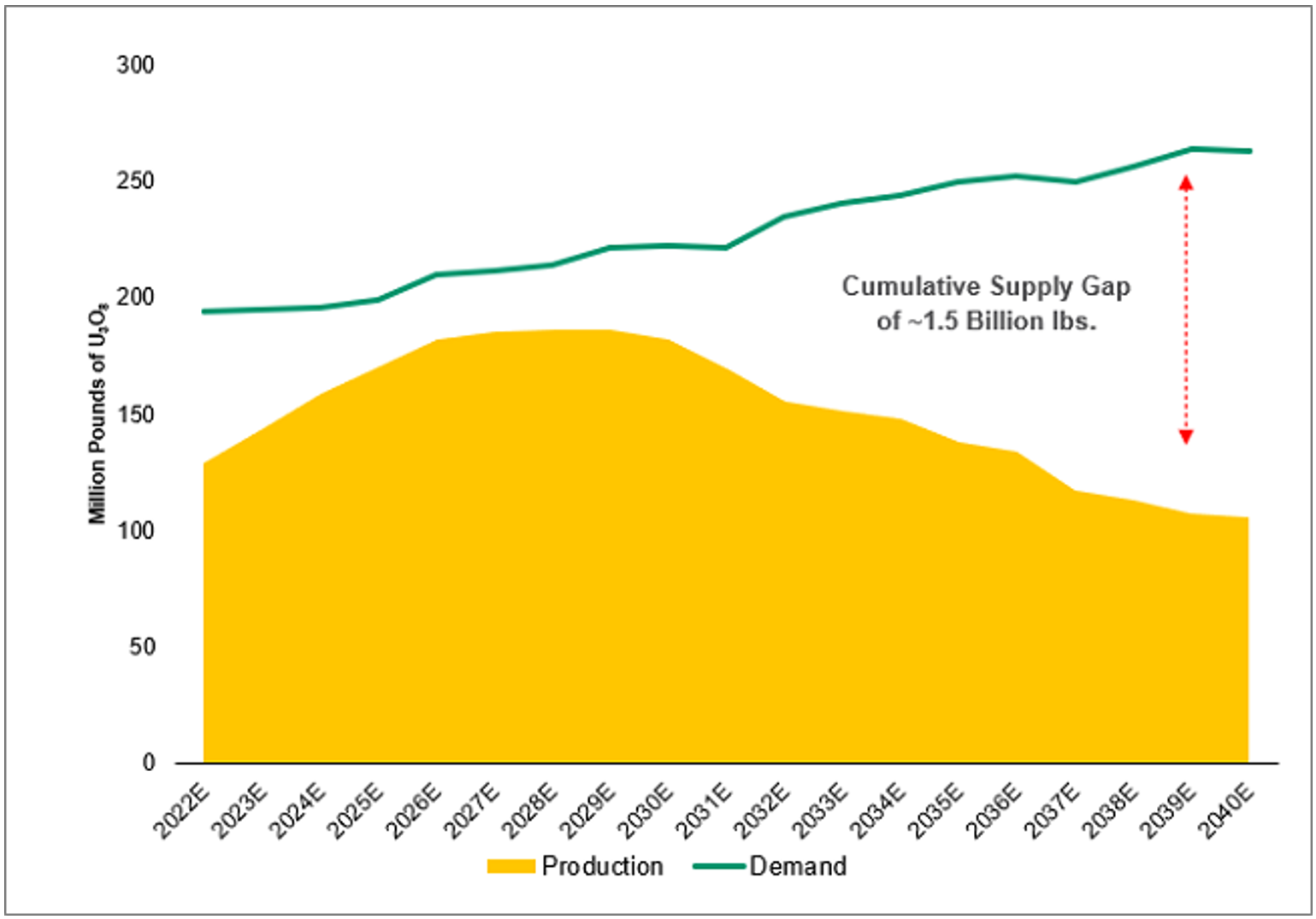

Figure 1: Global uranium supply vs demand

Source: UxC LLC, Q2 2023 estimates (nb: pre-AI/data centre energy demand); World Nuclear Association, as of 1 August 2023.

Figure 1 highlights uranium’s growing role in global energy and illustrates the widening gap between supply and demand. It underscores long-term investment potential and the structural deficit faced by utilities, who must navigate complex trade-offs between commercial viability and sustainability goals.

What this means for Antares’ portfolios:

We see uranium as an essential pillar of the global energy transition and a misunderstood opportunity in today’s market. Investors remain overly focused on spot volatility, while missing the deeper structural shift unfolding in the term market and in forward demand forecasts.

NexGen Energy provides a rare mix of quality, exploration upside, and exposure to a structural price re-rate. It is held across several of our non-income focused strategies and, with momentum building, we see significant upside still ahead.

Important information

This communication is issued by Antares Capital Partners Limited (ACP) trading as Antares Equities in its capacity as an investment manager. ACP is part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information and commentary provided in this communication is of a general nature only and does not relate to any specific fund or product issued by an Insignia Financial Group entity. The information does not take into account any particular investor’s personal circumstances and reliance should not be placed by anyone on the information in this communication as the basis for making any investment decision relating to the purchase of a fund or product issued by an Insignia Financial Group entity or any other financial product including stocks mentioned. Before acting on the information, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available from the applicable Insignia Financial Group website or by calling us, before deciding to acquire or hold an interest in a financial product issued by an entity within the Insignia Financial Group.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. Actual returns may vary from any target return described and there is a risk that the investment may achieve lower than expected returns.

Any opinions expressed constitute our judgement at the time of issue and are subject to change without notice. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability or in respect of other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This communication is directed to and prepared for Australian residents only.

This article outlines our view of the stocks mentioned in the context of the portfolios we manage. The information presented should not be used to form a view on the appropriateness of a direct investment in the stocks, or in a financial product managed by Antares. If you are considering investing in a financial product issued or managed by a member of the Insignia Financial Group we urge you to obtain a copy of the PDS and consult with a financial adviser. For more information please refer to the “Important Information and Disclaimer”.