July 2025 | ![]() 8 min read

8 min read

This article has been written by the Antares Equities Team.

This article outlines our view of the stocks mentioned in the context of the portfolios we manage. The information presented should not be used to form a view on the appropriateness of a direct investment in the stocks, or in a financial product managed by Antares Equities (Antares). If you are considering investing in a financial product issued or managed by Antares or another member of the Insignia Financial Group we urge you to obtain a copy of the PDS and consult with a financial adviser. For more information please refer to the “Important Information” at the bottom of the article.

We recently travelled through five US states and two EU countries. We met with over 45 corporates and market participants ranging from boat and recreational vehicle dealers, casino operators and AI professionals to consumer goods companies in both the fast moving consumer space, as well as luxury and travel – giving us a fairly comprehensive perspective of major themes in global markets.

Top of mind were the following topics:

- The state of the US economy.

- Was / is the sell America trade a real thing?

- What will AI actually deliver?

- How do the world’s major consumer companies see the world’s economy?

We discuss each topic, and where relevant, the implications for stocks in or under consideration for our portfolios.

What is the state of the US economy?

We headed to the US with a little trepidation given the various media reports about travel in the US. So the shock was the flight was full, as were the flights of my colleagues on the trip and I had the easiest US customs clearance I can recall in the US.

Indeed, full flights were a feature of my trip (I took six internal US flights and two Amtrak trains, also full). This was a surprise given that Delta and other US airlines withdrew or downgraded guidance for calendar year 2025 around April. Yet it was clear that Americans were moving around for various reasons and fares are certainly very high indicating no shortage of demand. This view was supported by our meetings with RV and boat dealers as well as casino operators through the mid west. Leisure spend was resilient, albeit not bullish. April had seen some concerns and while this coincided with the so-called “Liberation Day” tariff announcements, the underlying reason seems more about disruptions to tax returns caused by DOGE (Department of Government Expenditure) spending cuts.

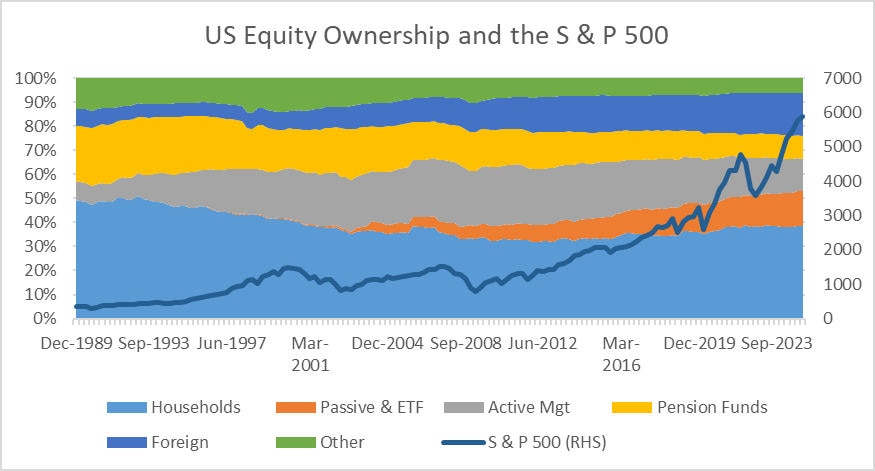

We attended the JP Morgan Telco, Media and Technology conference in Boston which saw us interact with nearly 20 corporations from those sectors. We will discuss this some more around AI below, but again, there was little to suggest that the US economy was on the brink of a recession in the various trading updates. Some, like Block Inc (ASX Code: XYZ, held by Antares Equities) were extremely bullish, while the highlight was the presentation from brokerage group, Robin Hood. As market participants we were surprised to learn the magnitude of trading by private individuals in the US (See Figure 1), and this bullish mindset helps explain the resilience of the US consumer given the rise in the value of stocks of over recent years.

Figure 1: US Equity Holdings v S&P 500

Source: Goldman Sachs, Federal Reserve, EPFR; July 2025

The chart shows the percentage of ownership of the US equity markets, highlighting that over 40% of equities by value are owned by US households. In this context it is interesting to note that in the 30 years prior to COVID (31/12/1989 to 31/12/2019), the S & P 500 returned 7.6% compound annual growth rate. Subsequently, this has more than doubled in the past 5 years to 17.7%, adding a material wealth effect to the upper demographic segments of the US population.

Our conclusion: The US consumer will remain resilient and US Equities will remain supported given structural retail investor support based on long term success. (US households / retail investors own 40% of the S&P500 either directly or indirectly and they were buying the market on “Liberation Day” as many institutional and professional investors sold.)

Was Sell America a real thing?

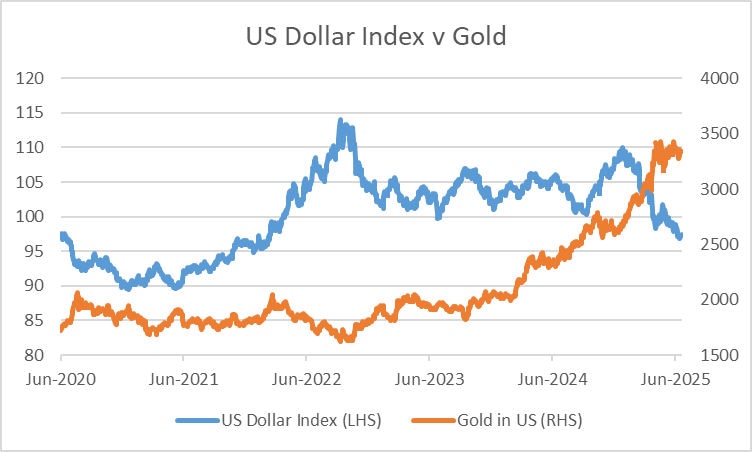

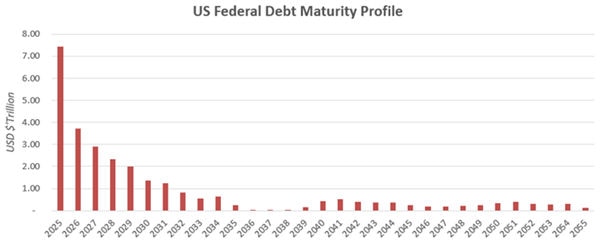

As with the discussion on visiting the US, there have been numerous reports that the “America First” policies of the Trump Administration have caused global asset allocators to look to other markets and jurisdictions for investment opportunities. The weakness of the US Dollar in recent months and the rise of gold suggests there is some empirical evidence to support the notion (see Figure 2), albeit they rose in tandem in latter 2024. Figure 4 suggests it may well be more the level of debt issuance required in CY 2025 that is weighing on the US Dollar – some of the USD7.5 trillion of debt requires refinancing this year, around 25% of total US treasuries.

Figure 2: USD Index v Gold Price (USD per ounce)

Source: Bloomberg; July 2025

Figure 3: US Debt Refinancing by Calendar Year

Source: US Treasury & Antares Equities; July 2025

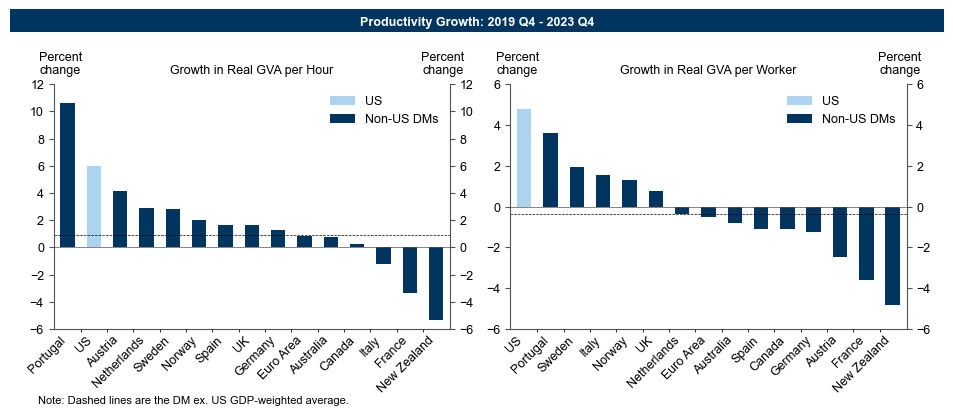

Was this evident from our discussions with various policy and markets people operating in the US itself? The answer is generally “no” but it is nuanced given the polemic nature of certain policy debates in the United States. We met several very senior bankers who made clear their disdain for the administration suggesting that this was a definite trend amongst global asset allocators. Yet when we discussed this with more market facing and trading staff, their views were that the US equity market exceptionalism was likely to continue, supported by strong personal income growth and high levels of inferred savings from the S&P 500’s five year bull market. Further, no country matches the US in its multifactor productivity (Figure 4).

Figure 4: US Productivity as Real GDP per capita and compared to OECD Countries

Source: Goldman Sachs; July 2025

Note: Gross Value Added (GVA) - measures the contribution of a producer, industry, sector, or region to an economy. It GVA provides a dollar value for the amount of goods and services that have been produced in a country, minus the cost of all inputs, raw materials, and intermediate consumption that are directly attributable to that production.

We also note that much of the US dollar weakness is likely associated with an over supply of US dollars given the Federal Reserve is continuing to shrink its balance sheet, and that 30% of US Treasuries mature in the next 12 months. That is a lot of supply for the world to accommodate.

Finally, there is the TINA argument (There is no alternative) ie the depth and liquidity of US markets means there is no alternative for major asset allocations. For example, the US accounts for over 65% of the world’s equity market and 45% of the world’s sovereign bond market. In contrast, even at recently elevated levels, the world’s stock of gold is much smaller and represents approximately 40% of the value of the US Treasury market. We argue there is insufficient depth for a major central bank to buy gold on any more than a peripheral allocation instead of US treasuries for their reserves. Any move to allocate away from the US would see the risk of significant bubbles developing in those assets, that are not backed by US multifactor productivity.

Will Artificial Intelligence (AI) deliver?

This was an interesting follow up to our trip last year which examined the potential of AI and its capabilities. At that time, most companies were wrestling with “use cases” and what it might do, in theory.

That has clearly changed in the US.

The aforementioned TMT conference in Boston highlighted that US corporates are now deploying AI into multiple facets of their business. The rise of “agentic AI”, which is akin to a Chat Bot, has led to real life use cases. Agentic AI utilises AI as an agent of the owner to take action on the owner’s behalf. While this is still strictly limited in scope, the sheer cadence of product release flagged in our meetings suggests this will spread quickly. In contrast, Australian management seems still to be at the “use case” stage.

By way of example, Agentic AI can do your shopping. You charge the agent with locating and purchasing a particular item and your appointed “agent” will do this on your behalf.

This expanded adoption of AI supports further investment into power sources, nuclear especially, and connective technologies given the need to link language learning models with inference models closer to the decision makers which will house their agents. Copper and selective telecommunications technology are attractive in this theme.

The state of the global consumer

We also attended the Deutsche Bank Global Consumer Conference in Paris. This is the largest of the global consumer conferences and we met with over 20 corporates in our three days. We came away with an underwhelming perspective of the global consumer, with isolated pockets of strength.

Travel is one such pocket. Meetings with Delta Airways, IHG Hotels Group and Accor reinforced our bullish perspective on global travel. The consumer continues to prioritise travel globally. We remain invested in Qantas with this tailwind assisting.

The Chinese consumer, in contrast, remains under pressure. Government action is mandating a more cautious consumer culture, while the Chinese shopper has become more discerning, eg they will travel to Japan to take advantage of currency arbitrage when contemplating significant purchases. While we remain invested in Treasury Wine Estates (TWE), we continue to watch it closely. And we struggle to understand the elevated A2 Milk share price given the weakness in Chinese consumer confidence which continues to erode marriage numbers - economics being a key plank of marriage in Chinese culture.

Finally, we asked all the companies we met one question, regardless of sector. ”If there was one additional dollar of capital available, into which market would you invest that dollar?” The answer in every case, without exception, was North America, specifically the US. This was a consumer conference and the US is the home of the strongest global consumers. But it was an interesting data point in the context of the asset management discussion pertaining to deallocating to the US. The world’s global consumer companies certainly didn’t share that view.

Important information and disclaimer

This communication is issued by Antares Capital Partners Limited (ACP) trading as Antares Equities in its capacity as an investment manager. ACP is part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).

The information and commentary provided in this communication is of a general nature only and does not relate to any specific fund or product issued by an Insignia Financial Group entity. The information does not take into account any particular investor’s personal circumstances and reliance should not be placed by anyone on the information in this communication as the basis for making any investment decision relating to the purchase of a fund or product issued by an Insignia Financial Group entity or any other financial product including stocks mentioned. Before acting on the information, you should consider the appropriateness of it having regard to your personal objectives, financial situation and needs. You should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD), available from the applicable Insignia Financial Group website or by calling us, before deciding to acquire or hold an interest in a financial product issued by an entity within the Insignia Financial Group.

Any opinions expressed constitute our judgement at the time of issue and are subject to change without notice. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of compilation. However, no warranty is made as to their accuracy or reliability or in respect of other information contained in this communication. Any projection or forward-looking statement (Projection) in this communication is provided for information purposes only. No representation is made as to the accuracy or reasonableness of any such Projection or that it will be met. Actual events may vary materially.

This communication is directed to and prepared for Australian residents only.