MLC Real Return

Targeting returns above inflation while managing market uncertainty

The MLC Real Return trusts are actively-managed funds that aim to deliver returns above inflation over a particular period, through different investment environments. This gives investors more certainty they’ll get the returns they need to help achieve their financial goals.

On 30 November 2023, the MLC Wholesale Inflation Plus - Moderate Portfolio and MLC Wholesale Inflation Plus - Assertive Portfolio were renamed the MLC Real Return Moderate and MLC Real Return Assertive trusts respectively. The MLC Wholesale Inflation Plus - Conservative Portfolio retains its name.

Download adviser flyer (PDF)

Download investor flyer (PDF)

Focus on preserving and growing wealth

We aim to preserve and grow our funds, helping smooth the bumps in your client’s investment journey.

More confidence in investment outcomes

We manage risk differently, providing more certainty around your clients’ investment outcomes – especially important when they’re close to or in retirement.

Experience and track record

MLC is a pioneer of multi-manager investing in Australia, with over 35 years investing over multiple market cycles. The investment options are designed and managed using MLC’s market-leading investment approach, leveraging MLC’s experience in helping investors achieve their financial goals.

MLC Real Return at a glance

MLC Real Return trusts target returns above inflation subject to limiting the risk of negative returns.

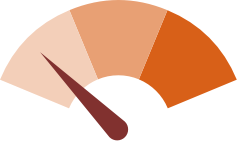

MLC Wholesale Inflation Plus Conservative Portfolio

Risk profile

May suit your clients if they:

- want to achieve a 2% p.a. return above inflation (after management costs) subject to limiting the risk of negative returns over 3 year periods

- want a smoother pattern of returns than a traditionally managed fund

- understand that the minimum suggested time to invest in the trust is 3 years

- are comfortable knowing that the trust has an estimated number of negative annual returns of between 2 to 3 years in 20 years

- are comfortable with the trust’s asset allocation changing significantly over time

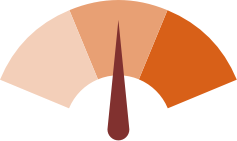

MLC Real Return Moderate

Risk profile

May suit your clients if they:

- want to achieve 3.5% p.a. return above inflation (after management costs) subject to limiting the risk of negative returns over 5 year periods

- want a smoother pattern of returns than a traditionally managed fund

- understand that the minimum suggested time to invest in the trust is 5 years

- are comfortable knowing that the trust has an estimated number of negative annual returns of approximately 5 years in 20 years

- are comfortable with the trust’s asset allocation changing significantly over time

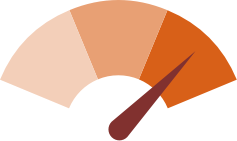

MLC Real Return Assertive

Risk profile

May suit your clients if they:

- want to achieve 4.5% p.a. return above inflation (after management costs) subject to limiting the risk of negative returns over 7 year periods

- want a smoother pattern of returns than a traditionally managed fund

- understand that the minimum suggested time to invest in the portfolio is 7years

- are comfortable knowing that the trust has an estimated number of negative annual returns of between 5 to 6 years in 20 years

- are comfortable with the trust’s asset allocation changing significantly over time

- understand the risks of investing in a geared trust and are comfortable with our investment experts flexibly managing the gearing level up to 25%

Research house ratings

The MLC Real Return trusts are rated by Lonsec and Zenith. For further information, please contact one of our Business Development Managers.

Access to Investment Central, your powerful client engagement tool

Investment Central is your perfect client engagement partner to MLC Real Return funds.

Investment Central will provide you with essential tools and support for selecting multi-asset solutions that align with your client’s investment needs.

- Ensure full transparency: Bring your clients’ portfolios to life with full transparency across their investment portfolios – deep dive into the underlying managers, asset classes, top holdings, and performance.

- Generate personalised reports: Create client-friendly investment reports in your practice’s branding.

- Create tailored portfolios: It’s a simple way to choose an MLC fund, SMA or create a blended portfolio that best suits your client and their risk profile.

Access more information on MLC Real Return on Investment Central

How to invest

Direct investors

Accessing the MLC Real Return trust is easy*. You can invest directly via the relevant application form which can be found here under MLC Trusts, or through your financial adviser.

*minimum investment and holding amounts may apply, refer to the relevant Product Disclosure Statement for more information

Advisers

For more information on available platforms please speak with your MLC Representative.

Invest through a platform - super or pension account

Invest through a platform – investment outside super or pension

Find out more

Find and download a range of reports and brochures.

Meet the MLC investment team and portfolio specialists.

Recent commentary and information on performance, asset allocation and investment managers.